Answered step by step

Verified Expert Solution

Question

1 Approved Answer

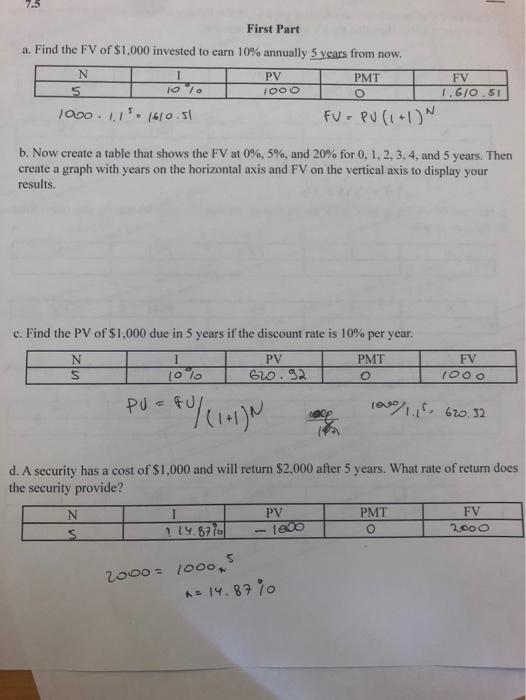

solve b, f,g,h a. Find the FV of $1,000 invested to earn 10% annually 5 years from now. 10001,15=161051 FV=PV(1+1)N b. Now create a table

solve b, f,g,h

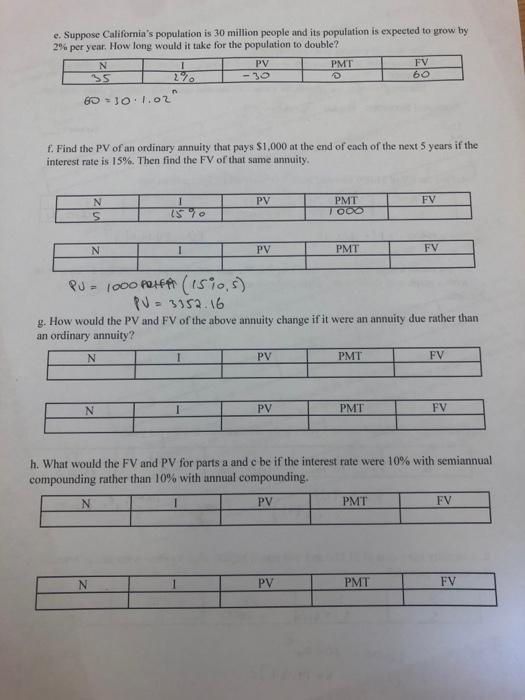

a. Find the FV of $1,000 invested to earn 10% annually 5 years from now. 10001,15=161051 FV=PV(1+1)N b. Now create a table that shows the FV at 0%,5%, and 20% for 0,1,2,3,4, and 5 years. Then create a graph with years on the horizontal axis and FV on the vertical axis to display your results. c. Find the PV of $1,000 due in 5 years if the discount rate is 10% per year. PU=FU/(1+1)N14log100/1.15=620.32 d. A security has a cost of $1,000 and will return $2,000 after 5 years. What rate of return does the security provide? 2000=1000x5x=14.87% e. Suppose California's population is 30 million people and its population is expected to grow by 2% per year. How long would it take for the population to double? 60=301.02n f. Find the PV of an ordinary annuity that pays $1,000 at the end of each of the next 5 years if the interest rate is 15%. Then find the FV of that same annuity. PU=1000petffi(15%,5)PV=3352.16 g. How would the PV and FV of the above annuity change if it were an annuity due rather than an ordinary annuity? h. What would the FV and PV for parts a and c be if the interest rate were 10% with semiannual compounding rather than 10% with annual compounding

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started