Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve Dr. David Banner is researching different bonds in which he could invest some of his savings. He is having difficulty making his choice. He

solve

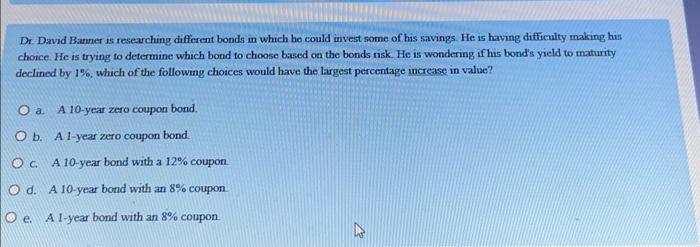

Dr. David Banner is researching different bonds in which he could invest some of his savings. He is having difficulty making his choice. He is trying to determine which bond to choose based on the bonds risk. He is wondering if his bond's yicld to maturity declined by 1%, which of the following choices would have the largest percentage increase in value? a. A 10-year zero coupon bond. b. A 1-year zero coupon bond. C. A 10-year bond with a 12% coupon d. A 10-year bond with an 8% coupon. e. A 1-year bond with an 8% coupon

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started