Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve each part and show the solution step by steps every single calculation. C C MegaTron produces jet bridges for many domestic and international airports.

Solve each part and show the solution step by steps every single calculation.

Solve each part and show the solution step by steps every single calculation.

CC

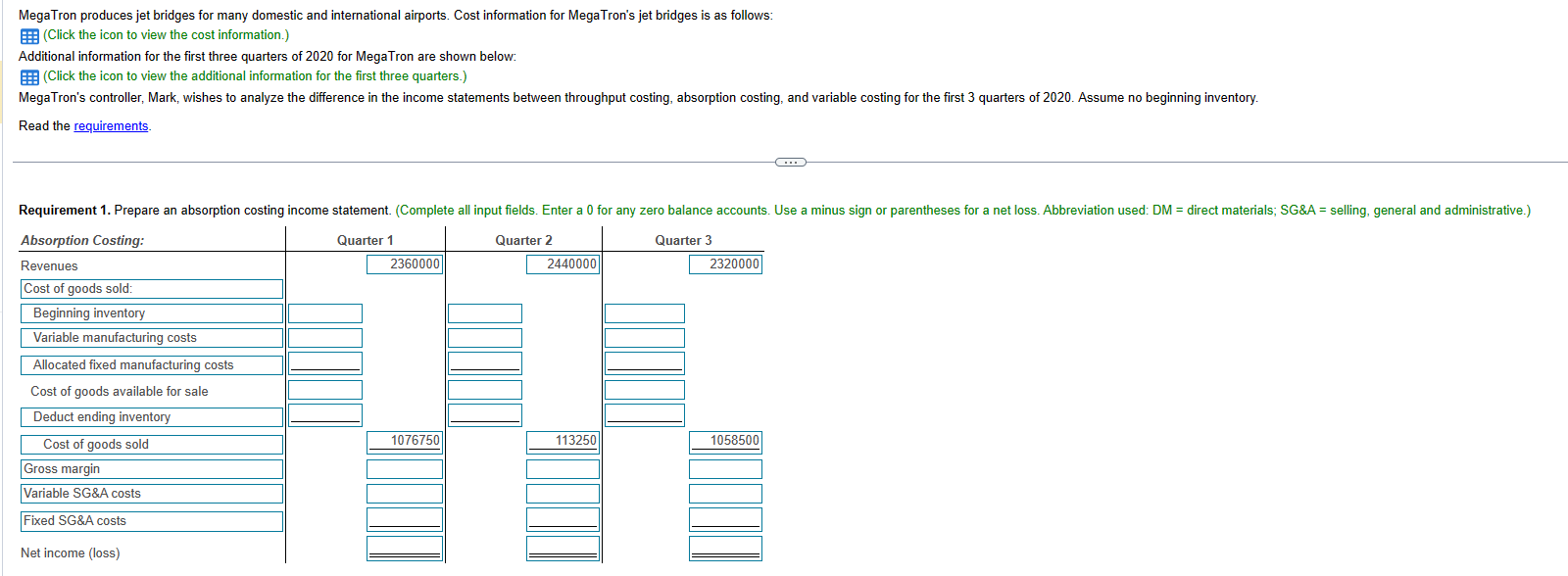

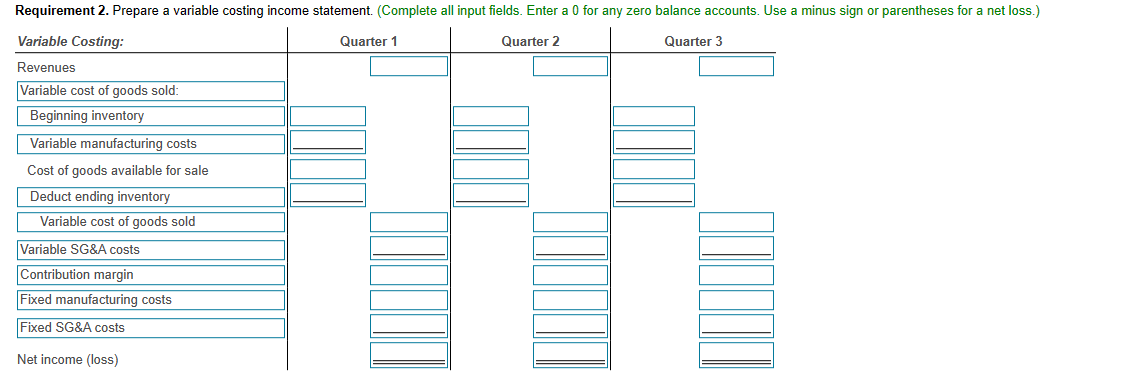

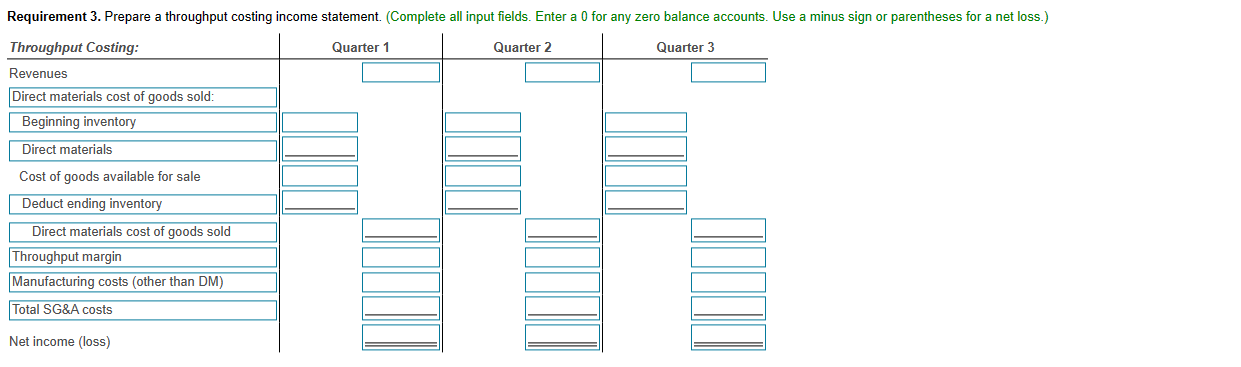

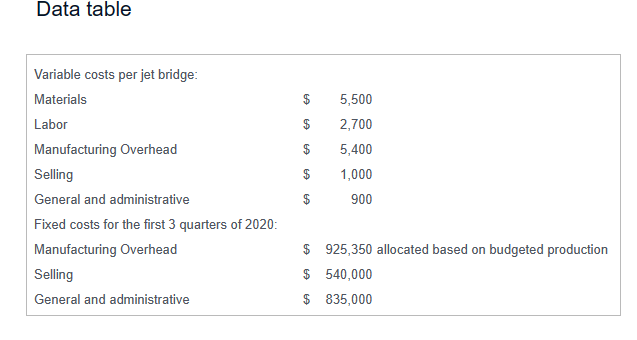

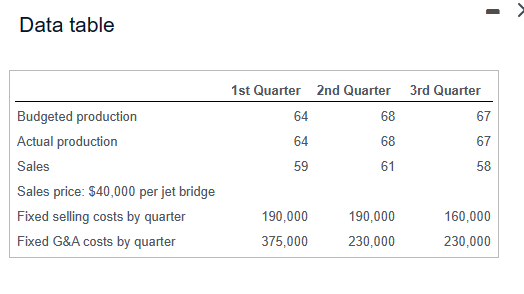

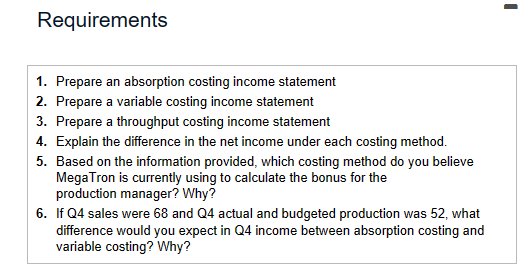

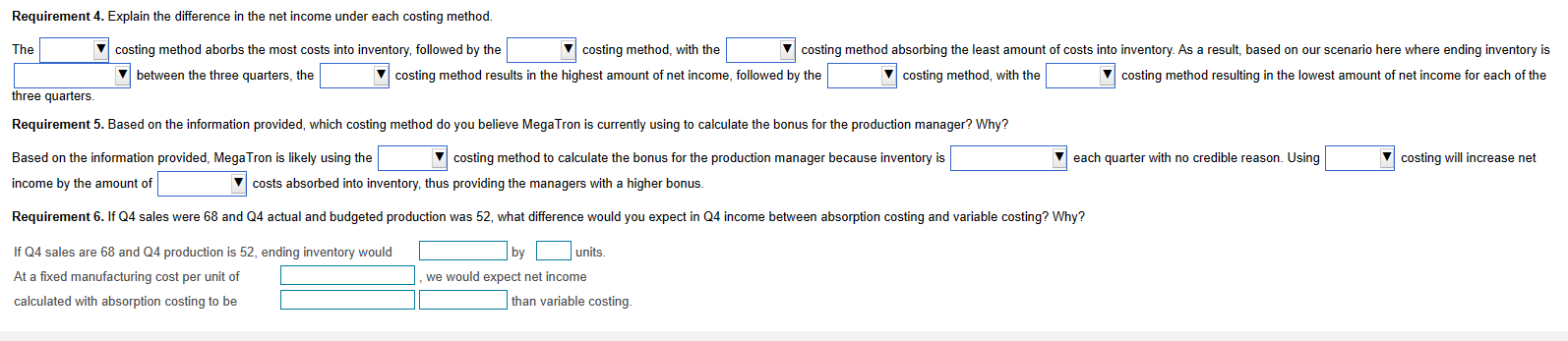

MegaTron produces jet bridges for many domestic and international airports. Cost information for MegaTron's jet bridges is as follows: (Click the icon to view the cost information.) Additional information for the first three quarters of 2020 for MegaTron are shown below: (Click the icon to view the additional information for the first three quarters.) Read the requirements. Requirement 2. Prepare a variable costing income statement. (Complete all input fields. Enter a 0 for any zero balance accounts. Use a minus sign or parentheses for a net loss.) \begin{tabular}{l} Variable Costing: \\ \hline Revenues \\ \hline Variable cost of goods sold: \\ \hline Beginning inventory \\ \hline Variable manufacturing costs \\ \hline Variable SG\&A costs \\ \hline Contribution margin \\ \hline Fixed manufacturing costs \\ \hline Fixed SG\&A costs \\ Net income (loss) \end{tabular} Requirement 3. Prepare a throughput costing income statement. (Complete all input fields. Enter a 0 for any zero balance accounts. Use a minus sign or parentheses for a net loss.) \begin{tabular}{l} Throughput Costing: \\ \hline Revenues \\ \hline Direct materials cost of goods sold: \\ \hline Beginning inventory \\ \hline Direct materials \\ Cost of goods available for sale \\ \hline Deduct ending inventory \\ \hline Direct materials cost of goods sold \\ \hline Manufacturing costs (other than DM) \\ \hline Total SG\&A costs \\ Net income (loss) \end{tabular} Data table Data table Requirements 1. Prepare an absorption costing income statement 2. Prepare a variable costing income statement 3. Prepare a throughput costing income statement 4. Explain the difference in the net income under each costing method. 5. Based on the information provided, which costing method do you believe MegaTron is currently using to calculate the bonus for the production manager? Why? 6. If Q4 sales were 68 and Q4 actual and budgeted production was 52 , what difference would you expect in Q4 income between absorption costing and variable costing? Why? Requirement 4. Explain the difference in the net income under each costing method. The costing method aborbs the most costs into inventory, followed by the costing method, with the costing method absorbing the least amount of costs into inventory. As a result, based on our scenario here where ending inventory is between the three quarters, the costing method results in the highest amount of net income, followed by the costing method, with the costing method resulting in the lowest amount of net income for each of the three quarters. Requirement 5 . Based on the information provided, which costing method do you believe MegaTron is currently using to calculate the bonus for the production manager? Why? Based on the information provided, MegaTron is likely using the costing method to calculate the bonus for the production manager because inventory is each quarter with no credible reason. Using costing will increase net income by the amount of costs absorbed into inventory, thus providing the managers with a higher bonus. If Q4 sales are 68 and Q4 production is 52 , ending inventory would by units. At a fixed manufacturing cost per unit of we would expect net income calculated with absorption costing to be than variable costingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started