Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve each problem using Excel. Show both the solution and the formula you used by putting an apostrophe in front of the equals sign.

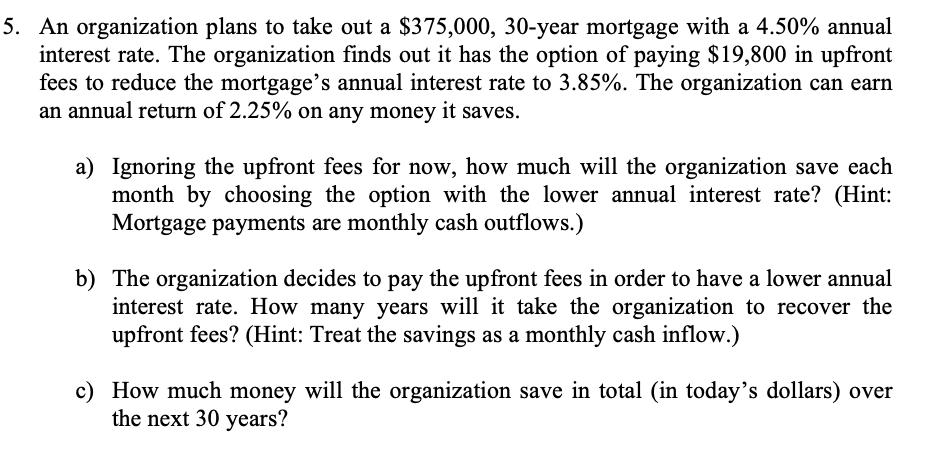

Solve each problem using Excel. Show both the solution and the formula you used by putting an apostrophe in front of the equals sign. (Note: There is no template for this assignment. This assignment does not require that you understand the mechanics of the investment instruments. We will discuss investments later in the semester.) 5. An organization plans to take out a $375,000, 30-year mortgage with a 4.50% annual interest rate. The organization finds out it has the option of paying $19,800 in upfront fees to reduce the mortgage's annual interest rate to 3.85%. The organization can earn an annual return of 2.25% on any money it saves. a) Ignoring the upfront fees for now, how much will the organization save each month by choosing the option with the lower annual interest rate? (Hint: Mortgage payments are monthly cash outflows.) b) The organization decides to pay the upfront fees in order to have a lower annual interest rate. How many years will it take the organization to recover the upfront fees? (Hint: Treat the savings as a monthly cash inflow.) c) How much money will the organization save in total (in today's dollars) over the next 30 years?

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER AND EXPLANATION your reasoning for each part a Ignoring the upfront fees fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started