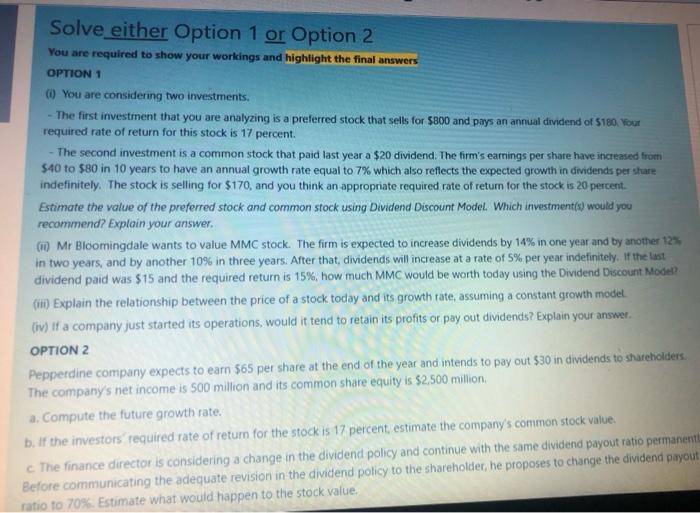

Solve either Option 1 or Option 2 You are required to show your workings and highlight the final answers OPTION 1 CO You are considering two investments. - The first investment that you are analyzing is a preferred stock that sells for $800 and pays an annual dividend of 5180. YOU required rate of return for this stock is 17 percent. The second investment is a common stock that paid last year a $20 dividend. The firm's earnings per share have increased from $40 to $80 in 10 years to have an annual growth rate equal to 7% which also reflects the expected growth in dividends per share indefinitely. The stock is selling for $170, and you think an appropriate required rate of return for the stock is 20 percent. Estimate the value of the preferred stock and common stock using Dividend Discount Model. Which investment(x) would you recommend? Explain your answer. Mr Bloomingdale wants to value MMC stock. The firm is expected to increase dividends by 14% in one year and by another 125 in two years, and by another 10% in three years. After that, dividends will increase at a rate of 5% per year indefinitely. If the last dividend paid was $15 and the required return is 15%, how much MMC would be worth today using the Dividend Discount Model? (18) Explain the relationship between the price of a stock today and its growth rate, assuming a constant growth model (iv) If a company just started its operations, would it tend to retain its profits or pay out dividends? Explain your answer. OPTION 2 Pepperdine company expects to earn $65 per share at the end of the year and intends to pay out $30 in dividends to shareholders The company's net income is 500 million and its common share equity is $2,500 million a. Compute the future growth rate. b. If the investors' required rate of return for the stock is 17 percent estimate the company's common stock value. The finance director is considering a change in the dividend policy and continue with the same dividend payout ratio permanent Before communicating the adequate revision in the dividend policy to the shareholder, he proposes to change the dividend payout ratio to 70%. Estimate what would happen to the stock value