Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve fast and Correct!!! Apps Gmall TOUTUBE Mdus DPP EDUUR Nedde Red Remaining Time: 1 hour, 03 minutes, 07 seconds. Question Completion Status: 1 2

solve fast and Correct!!!

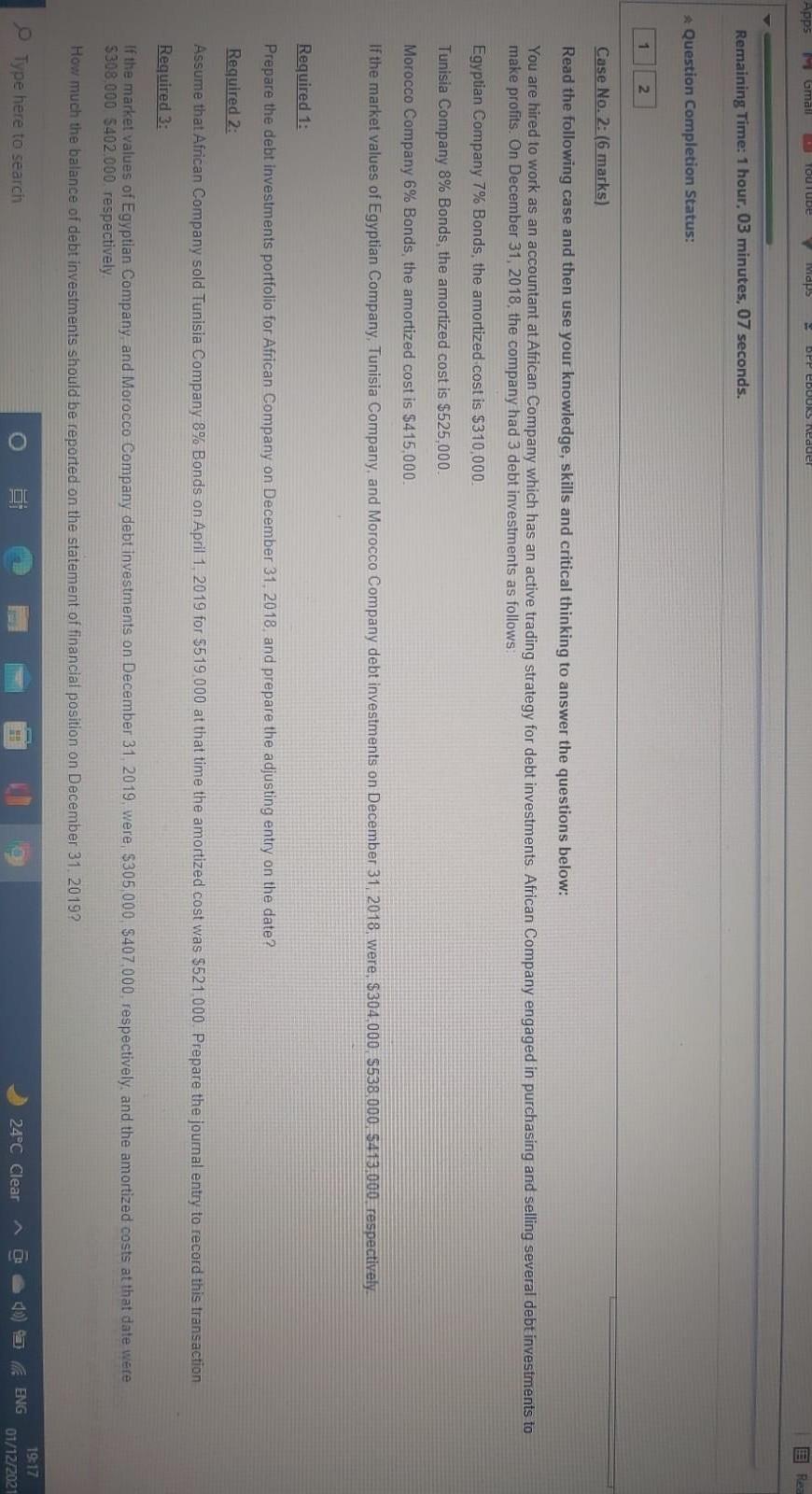

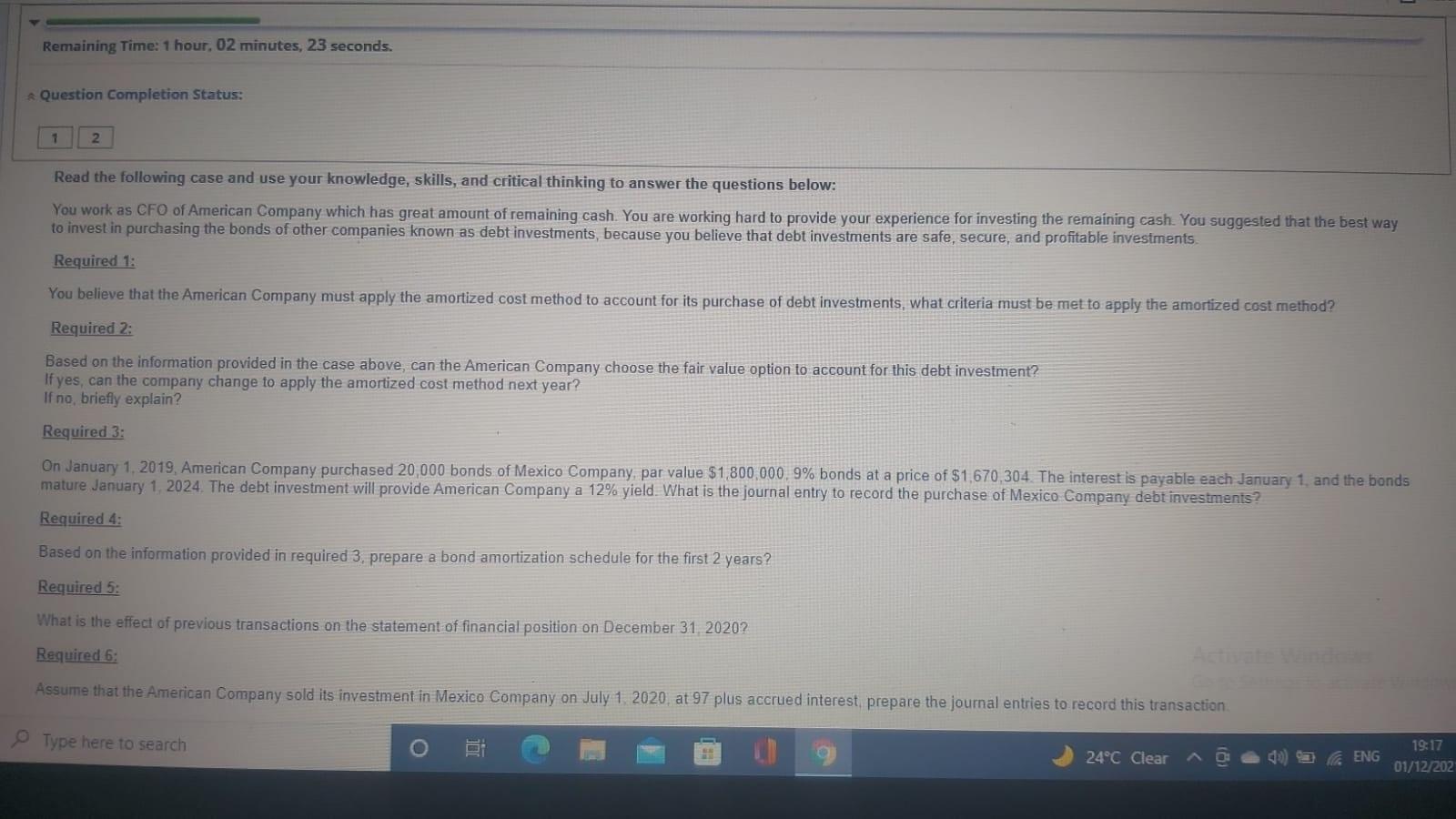

Apps Gmall TOUTUBE Mdus DPP EDUUR Nedde Red Remaining Time: 1 hour, 03 minutes, 07 seconds. Question Completion Status: 1 2 Case No. 2: (6 marks) Read the following case and then use your knowledge, skills and critical thinking to answer the questions below: You are hired to work as an accountant at African Company which has an active trading strategy for debt investments African Company engaged in purchasing and selling several debt investments to make profits. On December 31, 2018, the company had 3 debt investments as follows: Egyptian Company 7% Bonds, the amortized cost is $310,000 Tunisia Company 8% Bonds, the amortized cost is $525,000 Morocco Company 6% Bonds, the amortized cost is $415.000. If the market values of Egyptian Company, Tunisia Company, and Morocco Company debt investments on December 31, 2018, were, $304,000 $538 000. 5413.000, respectively Required 1: Prepare the debt investments portfolio for African Company on December 31, 2018 and prepare the adjusting entry on the date? Required 2: Assume that African Company sold Tunisia Company 8% Bonds on April 1, 2019 for $519.000 at that time the amortized cost was $521 000 Prepare the journal entry to record this transaction Required 3: If the market values of Egyptian Company and Morocco Company debt investments on December 31, 2019 were, $305 000 407.000 respectively, and the amortized costs at that date were $308.000 5402.000. respectively How much the balance of debt investments should be reported on the statement of financial position on December 31, 2019? Type here to search 24C Clear 50 als ENG 19:17 01/12/2021 Remaining Time: 1 hour, 02 minutes, 23 seconds. Question Completion Status: 1 2 Read the following case and use your knowledge, skills, and critical thinking to answer the questions below: You work as CFO of American Company which has great amount of remaining cash. You are working hard to provide your experience for investing the remaining cash. You suggested that the best way to invest in purchasing the bonds of other companies known as debt investments, because you believe that debt investments are safe, secure, and profitable investments Required 1: You believe that the American Company must apply the amortized cost method to account for its purchase of debt investments, what criteria must be met to apply the amortized cost method? Required 2: Based on the information provided in the case above, can the American Company choose the fair value option to account for this debt investment? If yes, can the company change to apply the amortized cost method next year? If no, briefly explain? Required 3: On January 1, 2019, American Company purchased 20,000 bonds of Mexico Company par value $1,800,000 9% bonds at a price of $1,670,304. The interest is payable each January 1, and the bonds mature January 1, 2024. The debt investment will provide American Company a 12% yield. What is the journal entry to record the purchase of Mexico Company debt investments? Required 4: Based on the information provided in required 3, prepare a bond amortization schedule for the first 2 years? Required 5: What is the effect of previous transactions on the statement of financial position on December 31, 2020? Required 6: Assume that the American Company sold its investment in Mexico Company on July 1 2020 at 97 plus accrued interest, prepare the journal entries to record this transaction Type here to search o i 24C Clear 29) ENG 19:17 01/12/202 Apps Gmall TOUTUBE Mdus DPP EDUUR Nedde Red Remaining Time: 1 hour, 03 minutes, 07 seconds. Question Completion Status: 1 2 Case No. 2: (6 marks) Read the following case and then use your knowledge, skills and critical thinking to answer the questions below: You are hired to work as an accountant at African Company which has an active trading strategy for debt investments African Company engaged in purchasing and selling several debt investments to make profits. On December 31, 2018, the company had 3 debt investments as follows: Egyptian Company 7% Bonds, the amortized cost is $310,000 Tunisia Company 8% Bonds, the amortized cost is $525,000 Morocco Company 6% Bonds, the amortized cost is $415.000. If the market values of Egyptian Company, Tunisia Company, and Morocco Company debt investments on December 31, 2018, were, $304,000 $538 000. 5413.000, respectively Required 1: Prepare the debt investments portfolio for African Company on December 31, 2018 and prepare the adjusting entry on the date? Required 2: Assume that African Company sold Tunisia Company 8% Bonds on April 1, 2019 for $519.000 at that time the amortized cost was $521 000 Prepare the journal entry to record this transaction Required 3: If the market values of Egyptian Company and Morocco Company debt investments on December 31, 2019 were, $305 000 407.000 respectively, and the amortized costs at that date were $308.000 5402.000. respectively How much the balance of debt investments should be reported on the statement of financial position on December 31, 2019? Type here to search 24C Clear 50 als ENG 19:17 01/12/2021 Remaining Time: 1 hour, 02 minutes, 23 seconds. Question Completion Status: 1 2 Read the following case and use your knowledge, skills, and critical thinking to answer the questions below: You work as CFO of American Company which has great amount of remaining cash. You are working hard to provide your experience for investing the remaining cash. You suggested that the best way to invest in purchasing the bonds of other companies known as debt investments, because you believe that debt investments are safe, secure, and profitable investments Required 1: You believe that the American Company must apply the amortized cost method to account for its purchase of debt investments, what criteria must be met to apply the amortized cost method? Required 2: Based on the information provided in the case above, can the American Company choose the fair value option to account for this debt investment? If yes, can the company change to apply the amortized cost method next year? If no, briefly explain? Required 3: On January 1, 2019, American Company purchased 20,000 bonds of Mexico Company par value $1,800,000 9% bonds at a price of $1,670,304. The interest is payable each January 1, and the bonds mature January 1, 2024. The debt investment will provide American Company a 12% yield. What is the journal entry to record the purchase of Mexico Company debt investments? Required 4: Based on the information provided in required 3, prepare a bond amortization schedule for the first 2 years? Required 5: What is the effect of previous transactions on the statement of financial position on December 31, 2020? Required 6: Assume that the American Company sold its investment in Mexico Company on July 1 2020 at 97 plus accrued interest, prepare the journal entries to record this transaction Type here to search o i 24C Clear 29) ENG 19:17 01/12/202

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started