solve for a-e all parts specify answers specifically

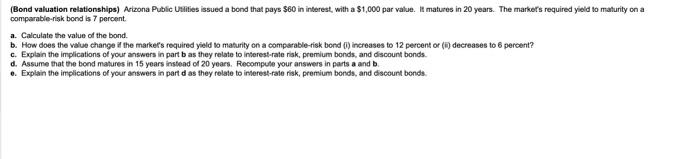

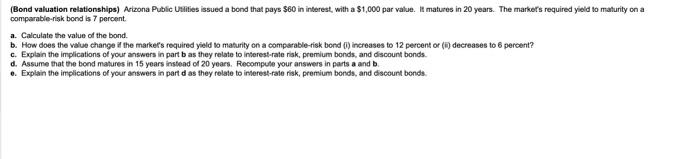

(Bond valuation relationships) Arizona Public Uwities issued a bond that pays $60 in interest, with a $1,000 par value. It matures in 20 years. The markers required yield to maturity on a pomparable-risk bond is 7 peroent. a. Calculate the value of the bond. b. How does the value change it the markefs required yeld to maturity on a comparable-risk bond (1) increases to 12 percent or (i) decreases to 6 percent? c. Explain the implications of your answers in part b as they relate to interest-rate riak, premium bonds, and discount bonds. d. Assume that the bond matures in 15 years instead of 20 years. Fecompule your answers in parts a and b. e. Explain the implications of your answers in part d as they relate to imerest-rale risk, premium bonds, and discount bonds. (Bond valuation relationships) Arizona Public Utilities issued a bond that pays $60 in interest, with a $1,000 par value. it matures in 20 years. The market's required yield to maturity on a comparable-risk bond is 7 percent. a. Calculate the value of the bond. b. How does the value change it the market's required yield to maturity on a comparable-risk bond (i) increases to 12 percent or (ii) decreases to 6 percent? c. Explain the implications of your answers in part b as they relate to interest-rate risk, premium bonds, and discount bonds. d. Assume that the bond matures in 15 years instead of 20 years. Recompule your answers in parts a and b. e. Explain the implications of your answers in part d as they reiate to interest-rate risk, premium bonds. and discount bonds. 3. What is the value of the bond if the marker's required yield to maturity on a comparable-risk bond is 7 percent? (Round to the nearest cent) (Bond valuation relationships) Arizona Public Uwities issued a bond that pays $60 in interest, with a $1,000 par value. It matures in 20 years. The markers required yield to maturity on a pomparable-risk bond is 7 peroent. a. Calculate the value of the bond. b. How does the value change it the markefs required yeld to maturity on a comparable-risk bond (1) increases to 12 percent or (i) decreases to 6 percent? c. Explain the implications of your answers in part b as they relate to interest-rate riak, premium bonds, and discount bonds. d. Assume that the bond matures in 15 years instead of 20 years. Fecompule your answers in parts a and b. e. Explain the implications of your answers in part d as they relate to imerest-rale risk, premium bonds, and discount bonds. (Bond valuation relationships) Arizona Public Utilities issued a bond that pays $60 in interest, with a $1,000 par value. it matures in 20 years. The market's required yield to maturity on a comparable-risk bond is 7 percent. a. Calculate the value of the bond. b. How does the value change it the market's required yield to maturity on a comparable-risk bond (i) increases to 12 percent or (ii) decreases to 6 percent? c. Explain the implications of your answers in part b as they relate to interest-rate risk, premium bonds, and discount bonds. d. Assume that the bond matures in 15 years instead of 20 years. Recompule your answers in parts a and b. e. Explain the implications of your answers in part d as they reiate to interest-rate risk, premium bonds. and discount bonds. 3. What is the value of the bond if the marker's required yield to maturity on a comparable-risk bond is 7 percent? (Round to the nearest cent)