Answered step by step

Verified Expert Solution

Question

1 Approved Answer

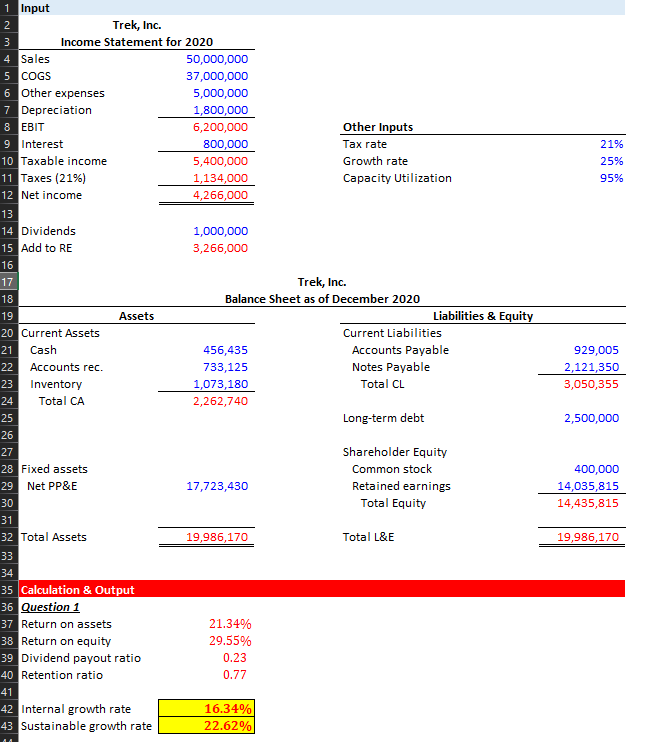

Solve for the missing items using the given data above. please show formulas thanks! I will upvote. :) 21% 25% 95% 1 Input 2 Trek,

Solve for the missing items using the given data above. please show formulas thanks! I will upvote. :)

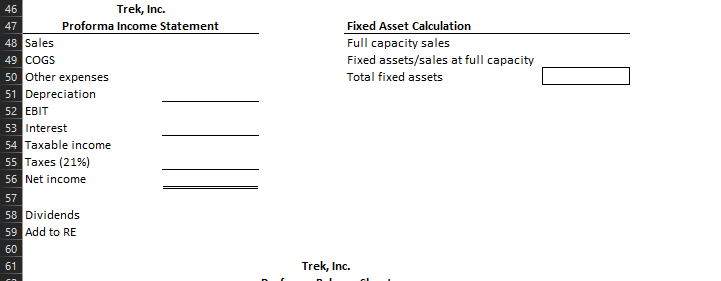

21% 25% 95% 1 Input 2 Trek, Inc. 3 Income Statement for 2020 4 Sales 50,000,000 5 COGS 37,000,000 6 Other expenses 5,000,000 7 Depreciation 1,800,000 8 EBIT 6,200,000 Other Inputs 9 Interest 800,000 Tax rate 10 Taxable income 5,400,000 Growth rate 11 Taxes (21%) 1,134,000 Capacity Utilization 12 Net income 4,266,000 13 14 Dividends 1,000,000 15 Add to RE 3,266,000 16 17 Trek, Inc. 18 Balance Sheet as of December 2020 19 Assets Liabilities & Equity 20 Current Assets Current Liabilities 21 Cash 456,435 Accounts Payable 22 Accounts rec. 733,125 Notes Payable 23 Inventory 1,073,180 Total CL 24 Total CA 2,262,740 25 Long-term debt 26 27 Shareholder Equity 28 Fixed assets Common stock 29 Net PP&E 17,723,430 Retained earnings 30 Total Equity 31 32 Total Assets 19,986,170 Total L&E 33 34 35 Calculation & Output 36 Question 1 37 Return on assets 21.34% 38 Return on equity 29.55% 39 Dividend payout ratio 0.23 40 Retention ratio 0.77 41 42 Internal growth rate 16.34% 43 Sustainable growth rate 22.62% 929,005 2,121,350 3,050,355 2,500,000 400,000 14,035,815 14,435,815 19,986,170 Fixed Asset Calculation Full capacity sales Fixed assets/sales at full capacity Total fixed assets 46 Trek, Inc. 47 Proforma Income Statement 48 Sales 49 COGS 50 Other expenses 51 Depreciation 52 EBIT 53 Interest 54 Taxable income 55 Taxes (21%) 56 Net income 57 58 Dividends 59 Add to RE 60 61 Trek, Inc. 21% 25% 95% 1 Input 2 Trek, Inc. 3 Income Statement for 2020 4 Sales 50,000,000 5 COGS 37,000,000 6 Other expenses 5,000,000 7 Depreciation 1,800,000 8 EBIT 6,200,000 Other Inputs 9 Interest 800,000 Tax rate 10 Taxable income 5,400,000 Growth rate 11 Taxes (21%) 1,134,000 Capacity Utilization 12 Net income 4,266,000 13 14 Dividends 1,000,000 15 Add to RE 3,266,000 16 17 Trek, Inc. 18 Balance Sheet as of December 2020 19 Assets Liabilities & Equity 20 Current Assets Current Liabilities 21 Cash 456,435 Accounts Payable 22 Accounts rec. 733,125 Notes Payable 23 Inventory 1,073,180 Total CL 24 Total CA 2,262,740 25 Long-term debt 26 27 Shareholder Equity 28 Fixed assets Common stock 29 Net PP&E 17,723,430 Retained earnings 30 Total Equity 31 32 Total Assets 19,986,170 Total L&E 33 34 35 Calculation & Output 36 Question 1 37 Return on assets 21.34% 38 Return on equity 29.55% 39 Dividend payout ratio 0.23 40 Retention ratio 0.77 41 42 Internal growth rate 16.34% 43 Sustainable growth rate 22.62% 929,005 2,121,350 3,050,355 2,500,000 400,000 14,035,815 14,435,815 19,986,170 Fixed Asset Calculation Full capacity sales Fixed assets/sales at full capacity Total fixed assets 46 Trek, Inc. 47 Proforma Income Statement 48 Sales 49 COGS 50 Other expenses 51 Depreciation 52 EBIT 53 Interest 54 Taxable income 55 Taxes (21%) 56 Net income 57 58 Dividends 59 Add to RE 60 61 Trek, IncStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started