Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve I. It is September, and the NASDAQ 100 index is trading at 3,000. The dividend yield on the index is 4% p.a., and the

Solve

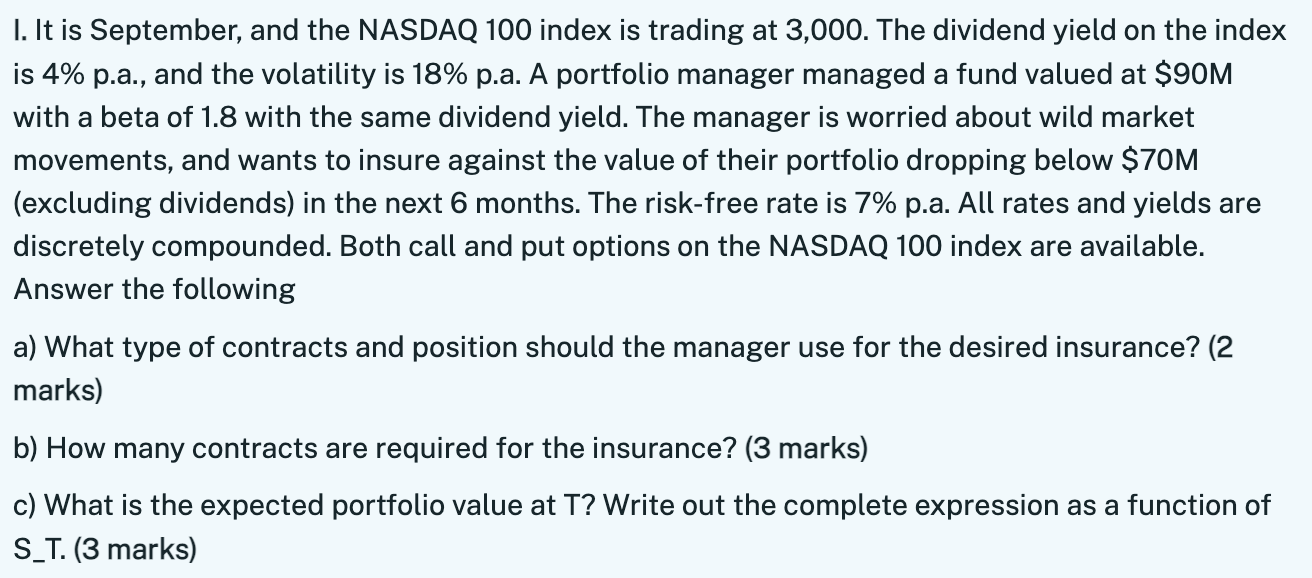

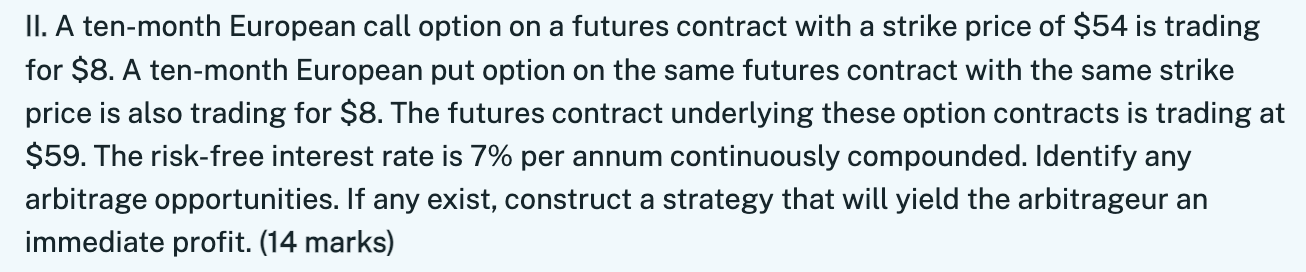

I. It is September, and the NASDAQ 100 index is trading at 3,000. The dividend yield on the index is 4% p.a., and the volatility is 18% p.a. A portfolio manager managed a fund valued at $90M with a beta of 1.8 with the same dividend yield. The manager is worried about wild market movements, and wants to insure against the value of their portfolio dropping below $70M (excluding dividends) in the next 6 months. The risk-free rate is 7% p.a. All rates and yields are discretely compounded. Both call and put options on the NASDAQ 100 index are available. Answer the following a) What type of contracts and position should the manager use for the desired insurance? (2 marks) b) How many contracts are required for the insurance? (3 marks) c) What is the expected portfolio value at T? Write out the complete expression as a function of S_T. (3 marks) II. A ten-month European call option on a futures contract with a strike price of $54 is trading for $8. A ten-month European put option on the same futures contract with the same strike price is also trading for $8. The futures contract underlying these option contracts is trading at \$59. The risk-free interest rate is 7% per annum continuously compounded. Identify any arbitrage opportunities. If any exist, construct a strategy that will yield the arbitrageur an immediate profit. (14 marks) I. It is September, and the NASDAQ 100 index is trading at 3,000. The dividend yield on the index is 4% p.a., and the volatility is 18% p.a. A portfolio manager managed a fund valued at $90M with a beta of 1.8 with the same dividend yield. The manager is worried about wild market movements, and wants to insure against the value of their portfolio dropping below $70M (excluding dividends) in the next 6 months. The risk-free rate is 7% p.a. All rates and yields are discretely compounded. Both call and put options on the NASDAQ 100 index are available. Answer the following a) What type of contracts and position should the manager use for the desired insurance? (2 marks) b) How many contracts are required for the insurance? (3 marks) c) What is the expected portfolio value at T? Write out the complete expression as a function of S_T. (3 marks) II. A ten-month European call option on a futures contract with a strike price of $54 is trading for $8. A ten-month European put option on the same futures contract with the same strike price is also trading for $8. The futures contract underlying these option contracts is trading at \$59. The risk-free interest rate is 7% per annum continuously compounded. Identify any arbitrage opportunities. If any exist, construct a strategy that will yield the arbitrageur an immediate profit. (14 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started