Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve in 2 hours. if you give wrong or incomplete solution i will dislike a) At what value noncash assets should be recorded in a

Solve in 2 hours.

if you give wrong or incomplete solution i will dislike

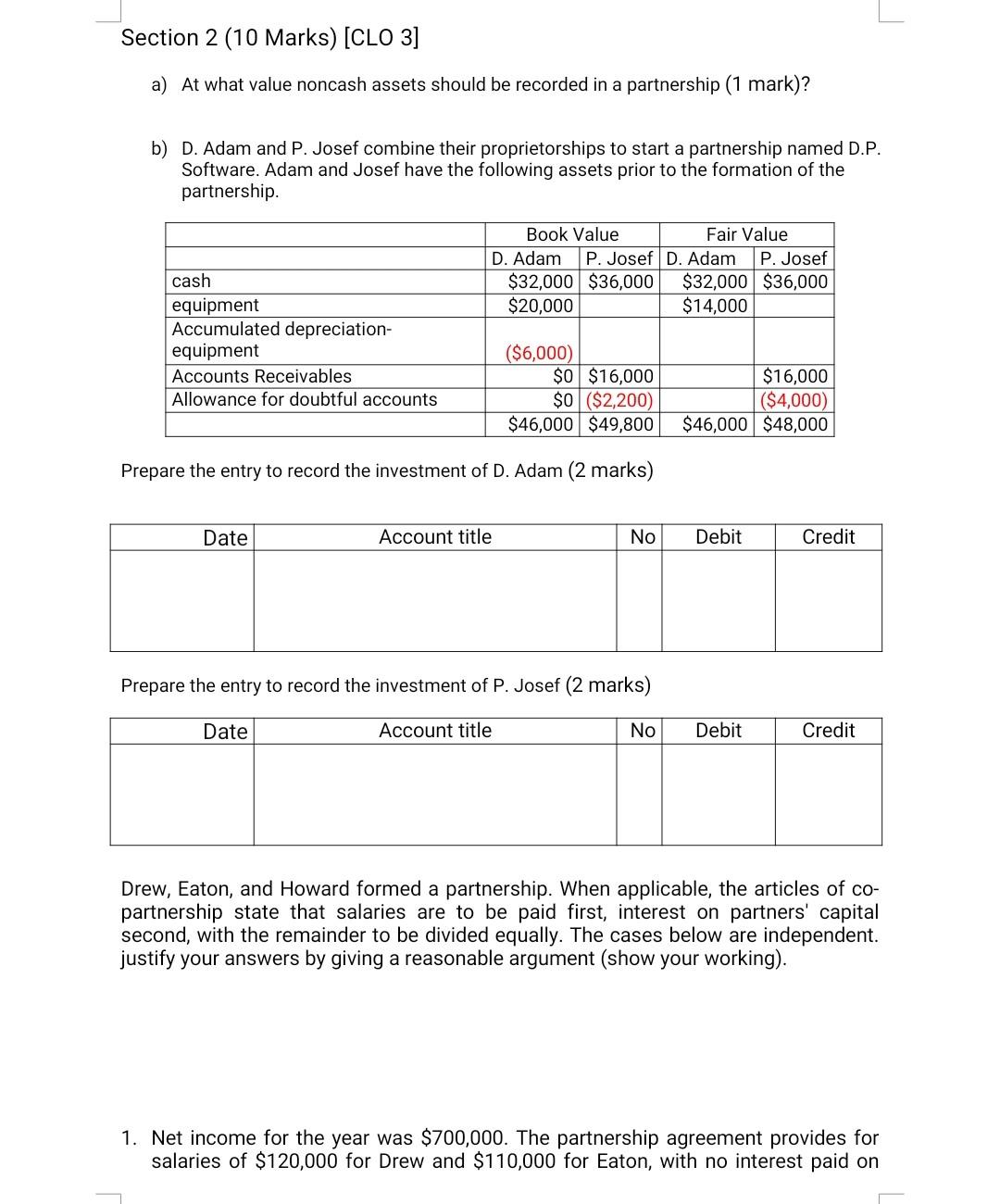

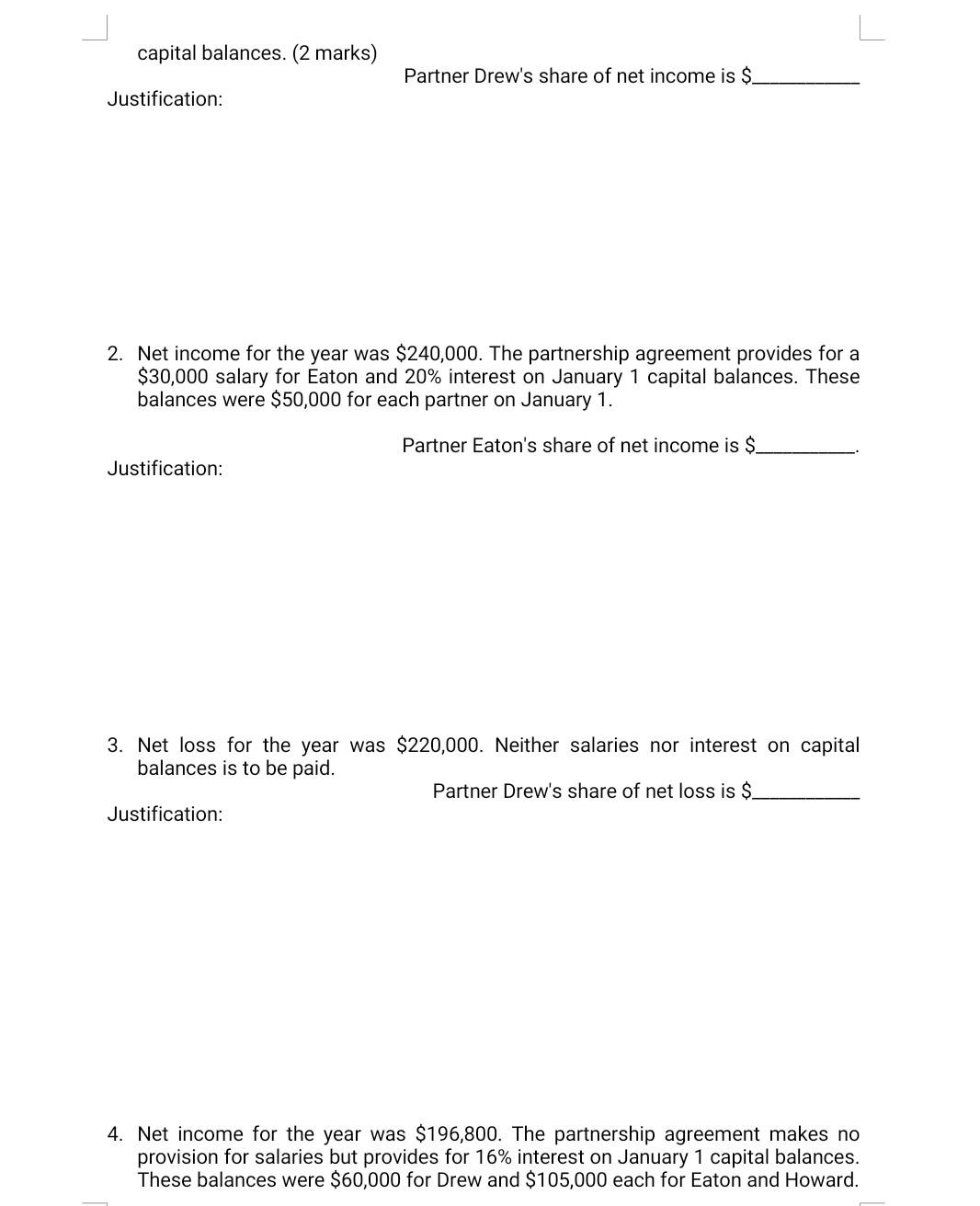

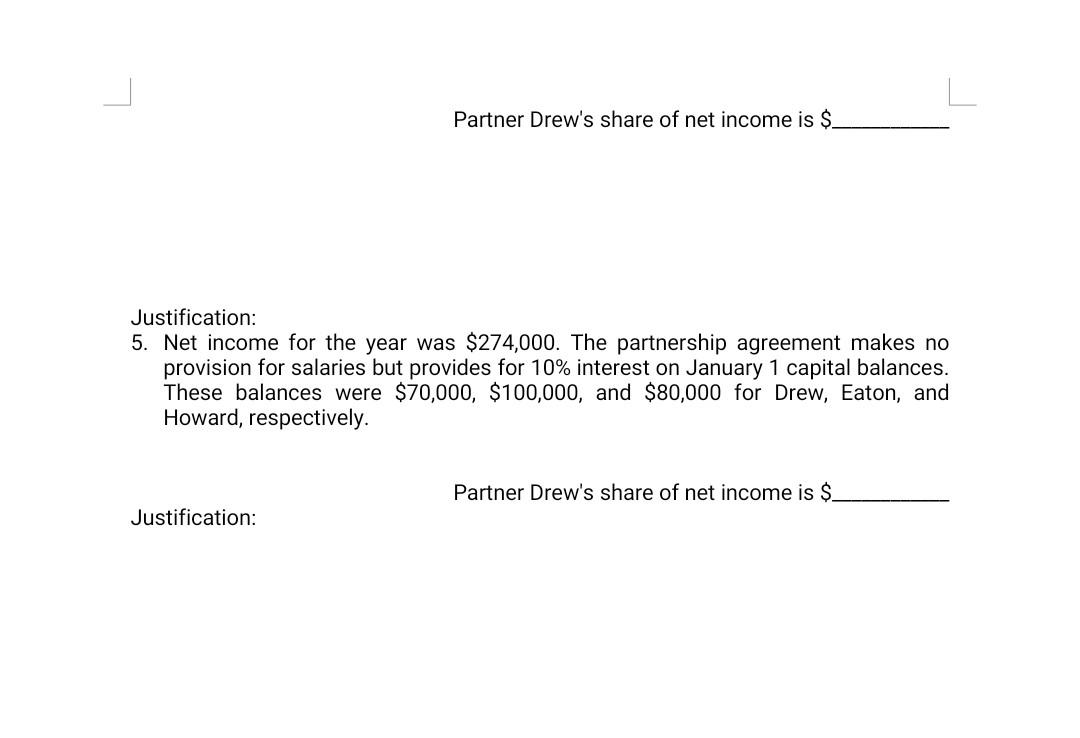

a) At what value noncash assets should be recorded in a partnership (1 mark)? b) D. Adam and P. Josef combine their proprietorships to start a partnership named D.P. Software. Adam and Josef have the following assets prior to the formation of the partnership. Prepare the entry to record the investment of D. Adam (2 marks) Prepare the entry to record the investment of P. Josef (2 marks) Drew, Eaton, and Howard formed a partnership. When applicable, the articles of copartnership state that salaries are to be paid first, interest on partners' capital second, with the remainder to be divided equally. The cases below are independent. justify your answers by giving a reasonable argument (show your working). 1. Net income for the year was $700,000. The partnership agreement provides for salaries of $120,000 for Drew and $110,000 for Eaton, with no interest paid on capital balances. (2 marks) Partner Drew's share of net income is $ Justification: 2. Net income for the year was $240,000. The partnership agreement provides for a $30,000 salary for Eaton and 20% interest on January 1 capital balances. These balances were $50,000 for each partner on January 1. Partner Eaton's share of net income is $ Justification: 3. Net loss for the year was $220,000. Neither salaries nor interest on capital balances is to be paid. Partner Drew's share of net loss is $ Justification: 4. Net income for the year was $196,800. The partnership agreement makes no provision for salaries but provides for 16% interest on January 1 capital balances. These balances were $60,000 for Drew and $105,000 each for Eaton and Howard. Partner Drew's share of net income is $ Justification: 5. Net income for the year was $274,000. The partnership agreement makes no provision for salaries but provides for 10% interest on January 1 capital balances. These balances were $70,000,$100,000, and $80,000 for Drew, Eaton, and Howard, respectively. Partner Drew's share of net income is $ JustificationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started