Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve in 25 mins i will give thumb up. also write final answers at end of solution separately Let's see how bad risks drive good

solve in 25 mins i will give thumb up. also write final answers at end of solution separately

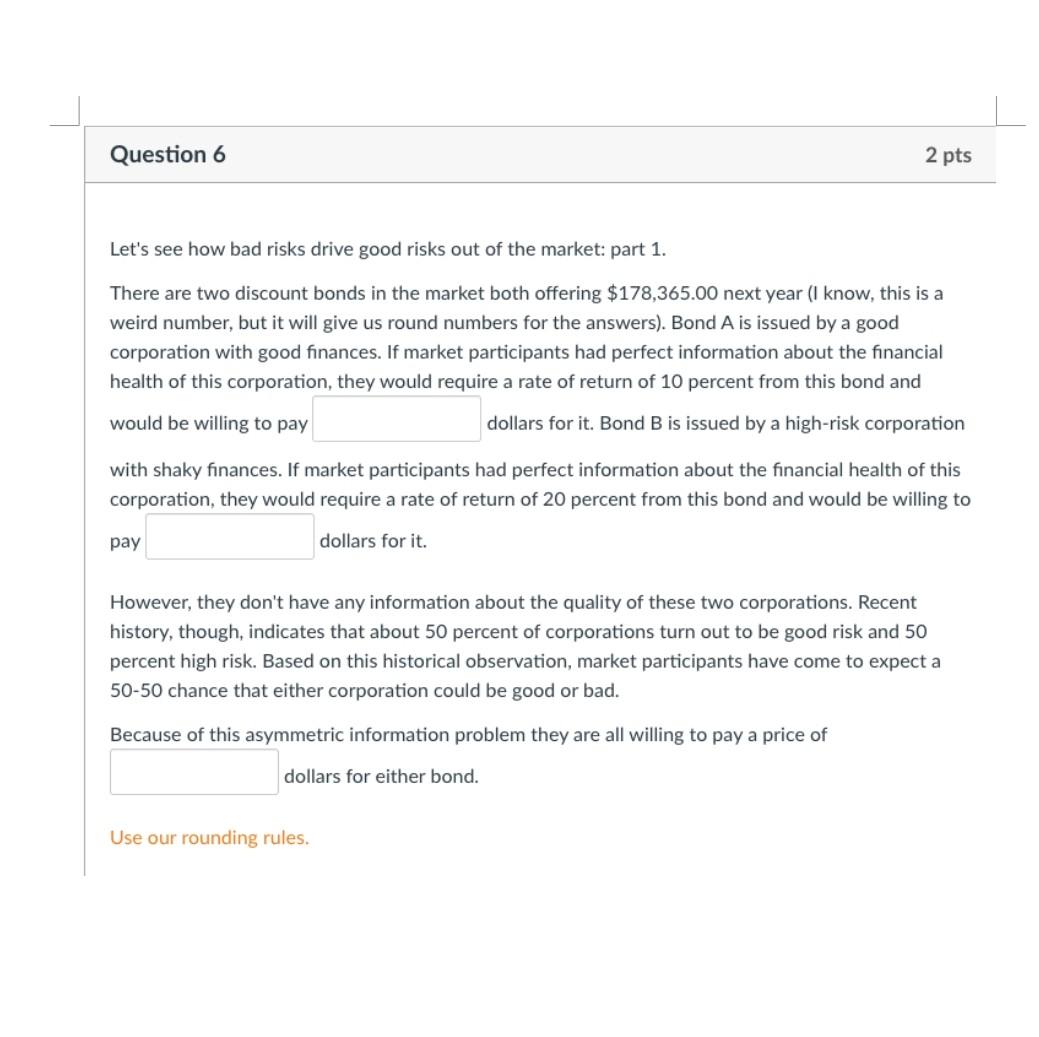

Let's see how bad risks drive good risks out of the market: part 1. There are two discount bonds in the market both offering $178,365.00 next year (I know, this is a weird number, but it will give us round numbers for the answers). Bond A is issued by a good corporation with good finances. If market participants had perfect information about the financial health of this corporation, they would require a rate of return of 10 percent from this bond and would be willing to pay dollars for it. Bond B is issued by a high-risk corporation with shaky finances. If market participants had perfect information about the financial health of this corporation, they would require a rate of return of 20 percent from this bond and would be willing to pay dollars for it. However, they don't have any information about the quality of these two corporations. Recent history, though, indicates that about 50 percent of corporations turn out to be good risk and 50 percent high risk. Based on this historical observation, market participants have come to expect a 50-50 chance that either corporation could be good or bad. Because of this asymmetric information problem they are all willing to pay a price of dollars for either bond. Use our rounding rulesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started