Answered step by step

Verified Expert Solution

Question

1 Approved Answer

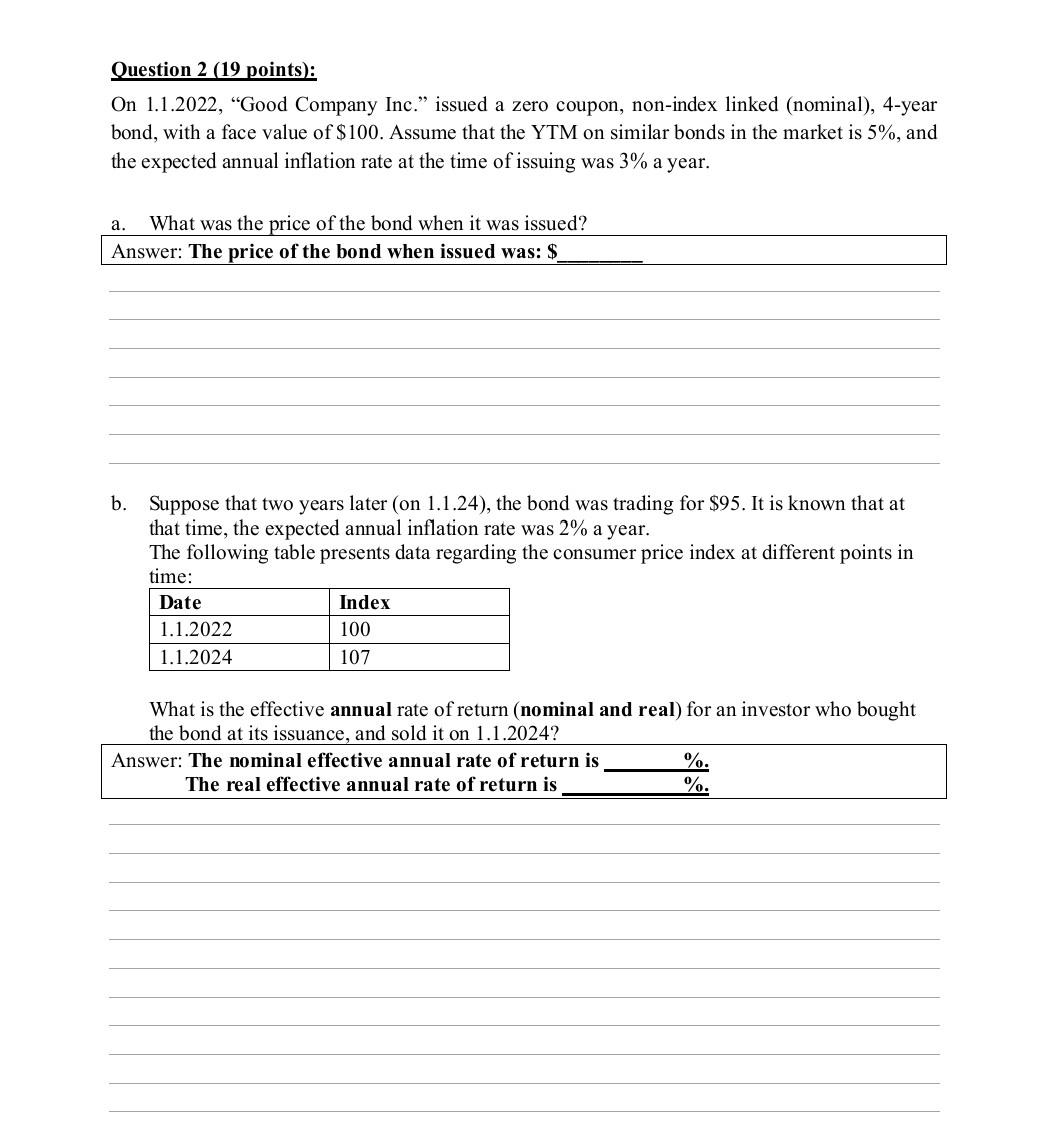

solve in 40 mins i will give upvote Question 2 (19 points): On 1.1.2022, Good Company Inc. issued a zero coupon, non-index linked (nominal), 4-year

solve in 40 mins i will give upvote

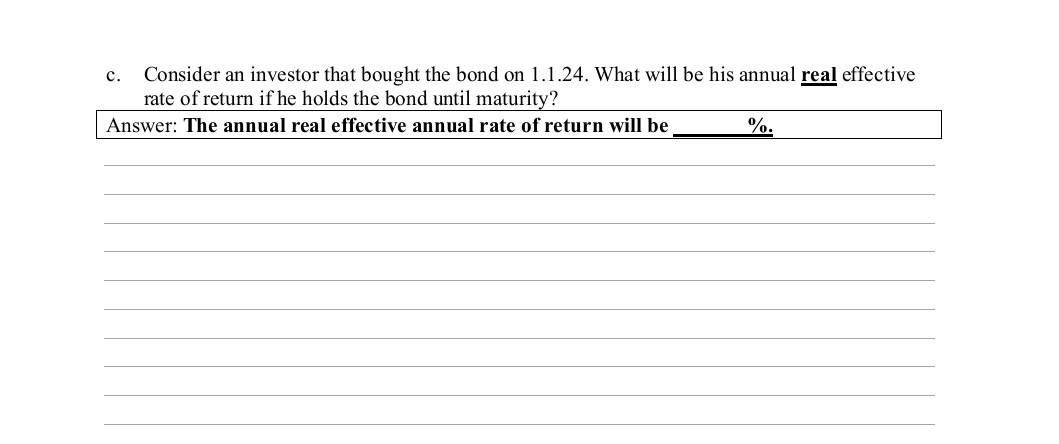

Question 2 (19 points): On 1.1.2022, "Good Company Inc." issued a zero coupon, non-index linked (nominal), 4-year bond, with a face value of $100. Assume that the YTM on similar bonds in the market is 5%, and the expected annual inflation rate at the time of issuing was 3% a year. b. Suppose that two years later (on 1.1.24), the bond was trading for $95. It is known that at that time, the expected annual inflation rate was 2% a year. The following table presents data regarding the consumer price index at different points in time: What is the effective annual rate of return (nominal and real) for an investor who bought the bond at its issuance, and sold it on 1.1.2024? c. Consider an investor that bought the bond on 1.1.24. What will be his annual real effective rate of return if he holds the bond until maturityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started