Answered step by step

Verified Expert Solution

Question

1 Approved Answer

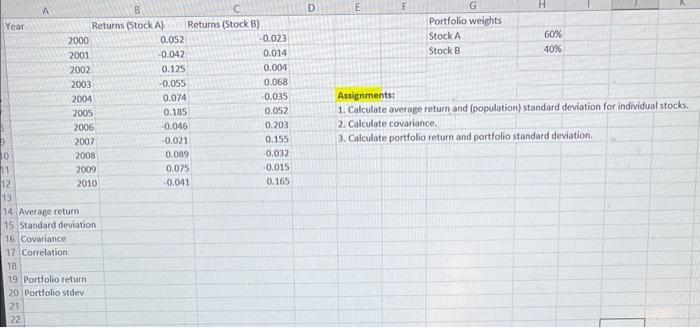

Solve in Excel and show formulas. Year A 16 Covariance 112212 17 Correlation 11 12 13 14 Average return 15 Standard deviation 18 2000 2001

Solve in Excel and show formulas.

Year A 16 Covariance 112212 17 Correlation 11 12 13 14 Average return 15 Standard deviation 18 2000 2001 2002 2003 2004 2005 B Returns (Stock A) 2006 2007 2008 2009 2010 19 Portfolio return. 20 Portfolio stdev Returns (Stock B) 0.052 -0.042 0.125 -0.055 0.074 0.185 -0.046 -0.021 0.089 0.075 -0.041 -0.023 0.014 0.004 0.068 -0.035 0.052 0.203 0.155) -0.032 -0.015 0.165 D G Portfolio weights Stock A Stock B H 60% 40% Assignments: 1. Calculate average return and (population) standard deviation for individual stocks. 2. Calculate covariance. 3. Calculate portfolio return and portfolio standard deviation.

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the average return and standard deviation for individual stocks as well as the covariance and portfolio return and standard deviation we can use the given data 1 Calculate average return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started