Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve IRR for each 2 option. (The answers should be 2.) A small manufacturing firm is planning to either purchase new machinery to add capacity

Solve IRR for each 2 option. (The answers should be 2.)

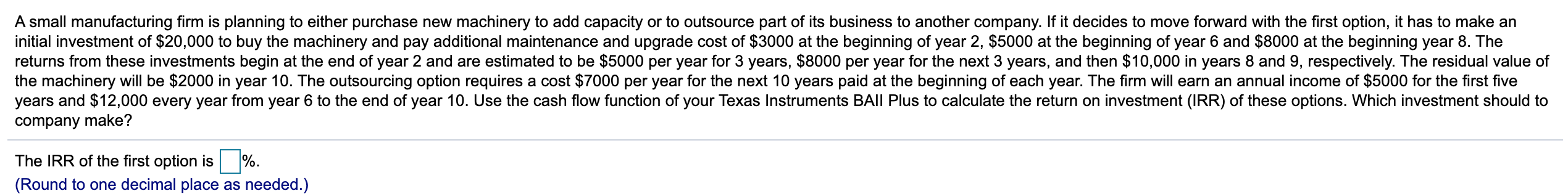

A small manufacturing firm is planning to either purchase new machinery to add capacity or to outsource part of its business to another company. If it decides to move forward with the first option, it has to make an initial investment of $20,000 to buy the machinery and pay additional maintenance and upgrade cost of $3000 at the beginning of year 2, $5000 at the beginning of year 6 and $8000 at the beginning year 8. The returns from these investments begin at the end of year 2 and are estimated to be $5000 per year for 3 years, $8000 per year for the next 3 years, and then $10,000 in years 8 and 9, respectively. The residual value of the machinery will be $2000 in year 10. The outsourcing option requires a cost $7000 per year for the next 10 years paid at the beginning of each year. The firm will earn an annual income of $5000 for the first five years and $12,000 every year from year 6 to the end of year 10. Use the cash flow function of your Texas Instruments BAll Plus to calculate the return on investment (IRR) of these options. Which investment should to company make? The IRR of the first option is %. (Round to one decimal place as needed.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started