Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve it 3. Find the average loan rate that needs to be earned to get ROE -19% Suppose that a bank has equity of $470,

solve it

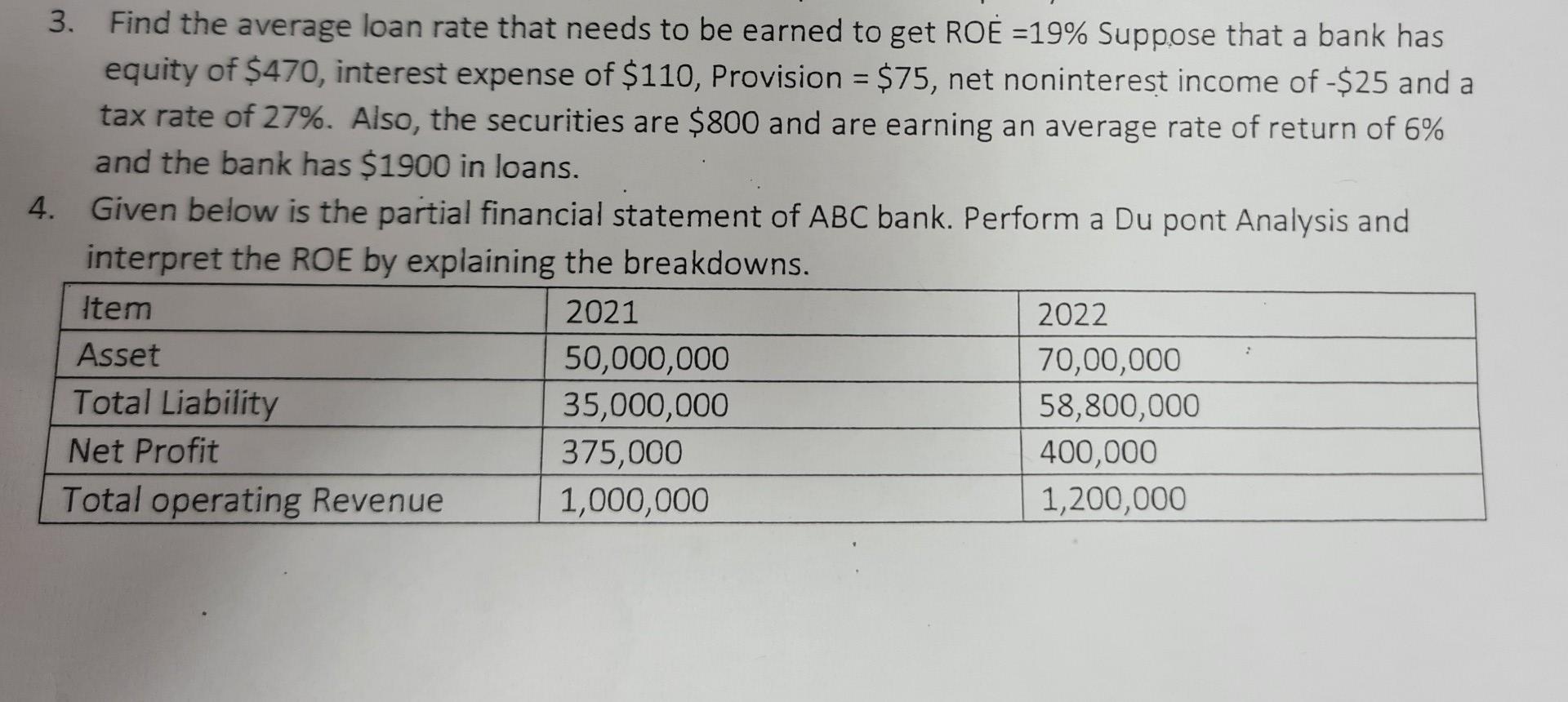

3. Find the average loan rate that needs to be earned to get ROE -19% Suppose that a bank has equity of $470, interest expense of $110, Provision = $75, net noninterest income of -$25 and a tax rate of 27%. Also, the securities are $800 and are earning an average rate of return of 6% and the bank has $1900 in loans. 4. Given below is the partial financial statement of ABC bank. Perform a Du pont Analysis and interpret the ROE by explaining the breakdowns. Item 2021 2022 Asset 50,000,000 70,00,000 Total Liability 35,000,000 58,800,000 Net Profit 375,000 400,000 Total operating Revenue 1,000,000 1,200,000 3. Find the average loan rate that needs to be earned to get ROE -19% Suppose that a bank has equity of $470, interest expense of $110, Provision = $75, net noninterest income of -$25 and a tax rate of 27%. Also, the securities are $800 and are earning an average rate of return of 6% and the bank has $1900 in loans. 4. Given below is the partial financial statement of ABC bank. Perform a Du pont Analysis and interpret the ROE by explaining the breakdowns. Item 2021 2022 Asset 50,000,000 70,00,000 Total Liability 35,000,000 58,800,000 Net Profit 375,000 400,000 Total operating Revenue 1,000,000 1,200,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started