Answered step by step

Verified Expert Solution

Question

1 Approved Answer

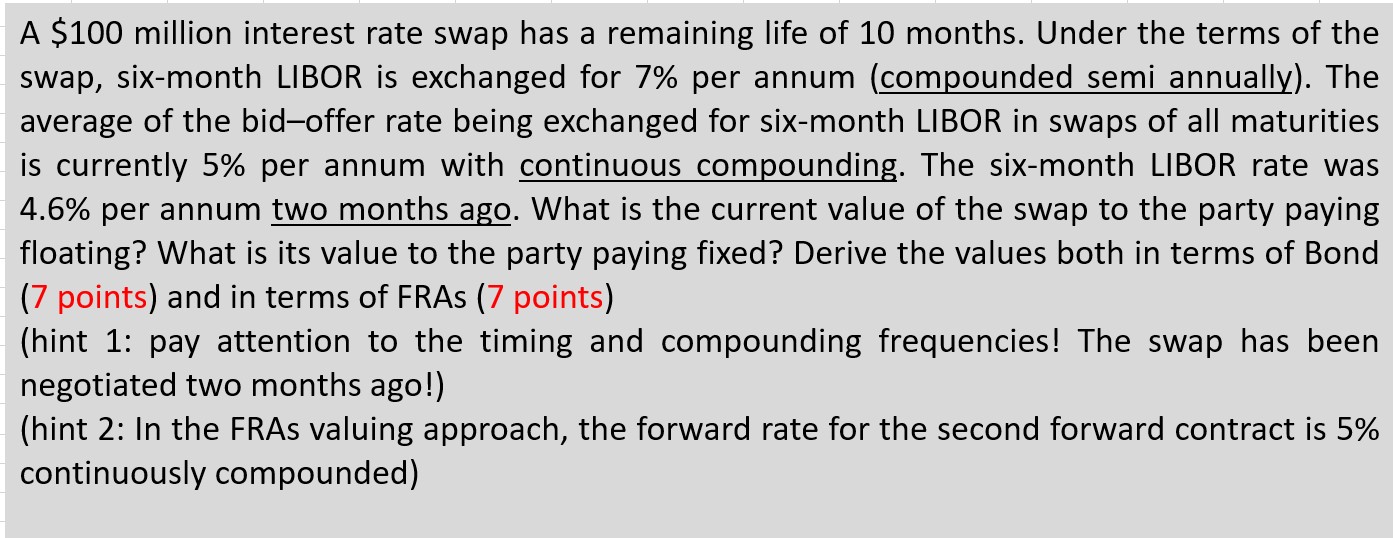

Solve it in excel. A $ 1 0 0 million interest rate swap has a remaining life of 1 0 months. Under the terms of

Solve it in excel. A $ million interest rate swap has a remaining life of months. Under the terms of the swap, sixmonth LIBOR is exchanged for per annum compounded semi annually The average of the bidoffer rate being exchanged for sixmonth LIBOR in swaps of all maturities is currently per annum with continuous compounding. The sixmonth LIBOR rate was per annum two months ago. What is the current value of the swap to the party paying floating? What is its value to the party paying fixed? Derive the values both in terms of Bond points and in terms of FRAs points A $ million interest rate swap has a remaining life of months. Under the terms of the

swap, sixmonth LIBOR is exchanged for per annum compounded semi annually The

average of the bidoffer rate being exchanged for sixmonth LIBOR in swaps of all maturities

is currently per annum with continuous compounding. The sixmonth LIBOR rate was

per annum two months ago. What is the current value of the swap to the party paying

floating? What is its value to the party paying fixed? Derive the values both in terms of Bond

points and in terms of FRAs points

hint : pay attention to the timing and compounding frequencies! The swap has been

negotiated two months ago!

hint : In the FRAs valuing approach, the forward rate for the second forward contract is

continuously compounded

hint : pay attention to the timing and compounding frequencies! The swap has been negotiated two months ago!

hint : In the FRAs valuing approach, the forward rate for the second forward contract is continuously compounded I have to solve it in excel. plese help me with it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started