Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve it please in this form : On November 30, 2019, Golden Eye company had a cash balance per books of $49,553. The bank statement

solve it please

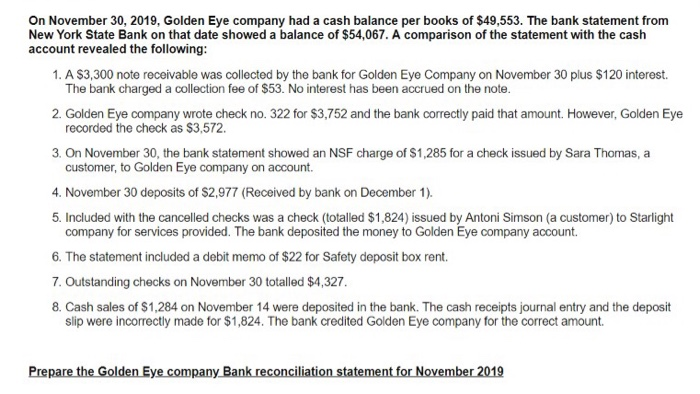

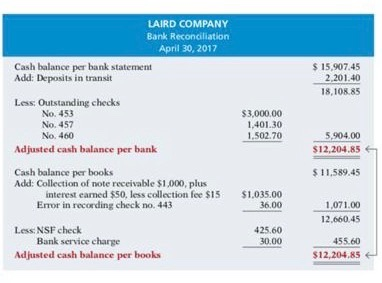

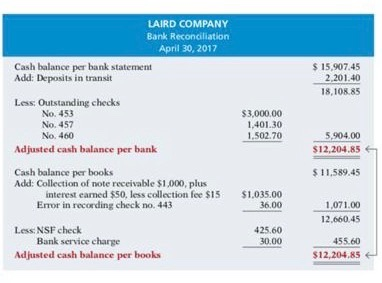

On November 30, 2019, Golden Eye company had a cash balance per books of $49,553. The bank statement from New York State Bank on that date showed a balance of $54,067. A comparison of the statement with the cash account revealed the following: 1. A $3,300 note receivable was collected by the bank for Golden Eye Company on November 30 plus $120 interest. The bank charged a collection fee of $53. No interest has been accrued on the note. 2. Golden Eye company wrote check no. 322 for $3,752 and the bank correctly paid that amount. However, Golden Eye recorded the check as $3,572. 3. On November 30, the bank statement showed an NSF charge of $1,285 for a check issued by Sara Thomas, a customer, to Golden Eye company on account. 4. November 30 deposits of $2,977 (Received by bank on December 1). 5. Included with the cancelled checks was a check (totalled $1,824) issued by Antoni Simson (a customer) to Starlight company for services provided. The bank deposited the money to Golden Eye company account. 6. The statement included a debit memo of $22 for Safety deposit box rent. 7. Outstanding checks on November 30 totalled $4,327 8. Cash sales of $1,284 on November 14 were deposited in the bank. The cash receipts journal entry and the deposit slip were incorrectly made for $1,824. The bank credited Golden Eye company for the correct amount. Prepare the Golden Eye company Bank reconciliation statement for November 2019 LAIRD COMPANY Bank Reconciliation April 30, 2017 Cash balance per bank statement Add: Deposits in transit $15.90745 2,201.40 18,108.85 Less: Outstanding checks No. 453 No. 457 No. 460 Adjusted cash balance per bank $3,000.00 1,401.30 1.502.70 5,904.00 $12,204.85 $ 11,589.45 Cash balance per books Add: Collection of note receivable $1,000, plus interest earned $50, less collection fee $15 Error in recording check no. 443 $1.035.00 36.00 1.071.00 12.660.45 Less: NSF check Bank service charge Adjusted cash balance per books 425.60 30.00 4550 SI2204.RS

in this form :

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started