Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve it with excel Don Harrison's current salary is $60,000 per year, and he is planning retirement 35 years from now. He anticipates that his

Solve it with excel

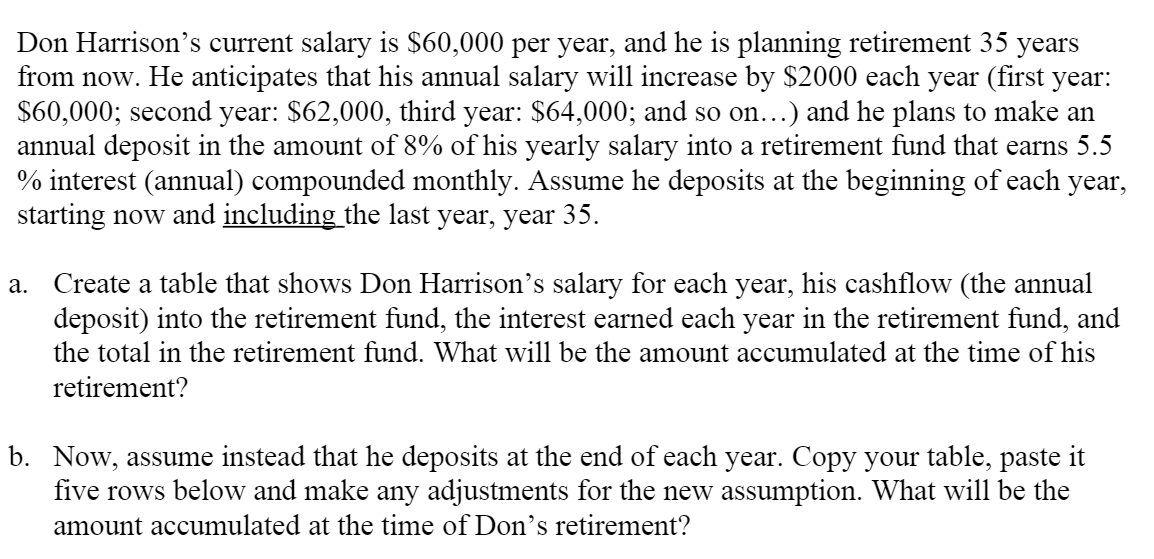

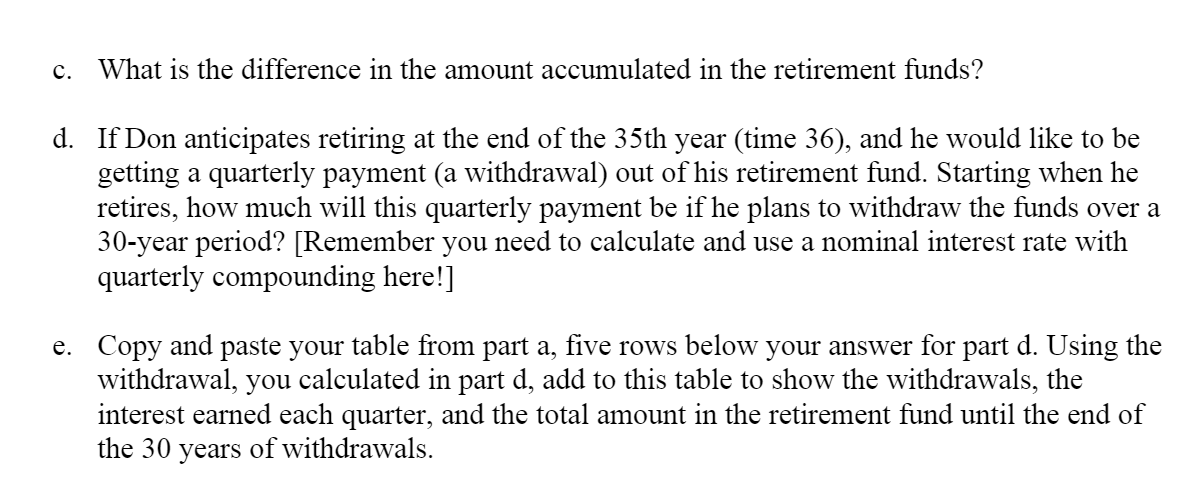

Don Harrison's current salary is $60,000 per year, and he is planning retirement 35 years from now. He anticipates that his annual salary will increase by $2000 each year (first year: $60,000; second year: $62,000, third year: $64,000; and so on...) and he plans to make an annual deposit in the amount of 8% of his yearly salary into a retirement fund that earns 5.5 % interest (annual) compounded monthly. Assume he deposits at the beginning of each year, starting now and including the last year, year 35. a. Create a table that shows Don Harrison's salary for each year, his cashflow (the annual deposit) into the retirement fund, the interest earned each year in the retirement fund, and the total in the retirement fund. What will be the amount accumulated at the time of his retirement? b. Now, assume instead that he deposits at the end of each year. Copy your table, paste it five rows below and make any adjustments for the new assumption. What will be the amount accumulated at the time of Don's retirement? c. What is the difference in the amount accumulated in the retirement funds? d. If Don anticipates retiring at the end of the 35th year (time 36), and he would like to be getting a quarterly payment (a withdrawal) out of his retirement fund. Starting when he retires, how much will this quarterly payment be if he plans to withdraw the funds over a 30-year period? [Remember you need to calculate and use a nominal interest rate with quarterly compounding here!] e. Copy and paste your table from part a, five rows below your answer for part d. Using the withdrawal, you calculated in part d, add to this table to show the withdrawals, the interest earned each quarter, and the total amount in the retirement fund until the end of the 30 years of withdrawals. Don Harrison's current salary is $60,000 per year, and he is planning retirement 35 years from now. He anticipates that his annual salary will increase by $2000 each year (first year: $60,000; second year: $62,000, third year: $64,000; and so on...) and he plans to make an annual deposit in the amount of 8% of his yearly salary into a retirement fund that earns 5.5 % interest (annual) compounded monthly. Assume he deposits at the beginning of each year, starting now and including the last year, year 35. a. Create a table that shows Don Harrison's salary for each year, his cashflow (the annual deposit) into the retirement fund, the interest earned each year in the retirement fund, and the total in the retirement fund. What will be the amount accumulated at the time of his retirement? b. Now, assume instead that he deposits at the end of each year. Copy your table, paste it five rows below and make any adjustments for the new assumption. What will be the amount accumulated at the time of Don's retirement? c. What is the difference in the amount accumulated in the retirement funds? d. If Don anticipates retiring at the end of the 35th year (time 36), and he would like to be getting a quarterly payment (a withdrawal) out of his retirement fund. Starting when he retires, how much will this quarterly payment be if he plans to withdraw the funds over a 30-year period? [Remember you need to calculate and use a nominal interest rate with quarterly compounding here!] e. Copy and paste your table from part a, five rows below your answer for part d. Using the withdrawal, you calculated in part d, add to this table to show the withdrawals, the interest earned each quarter, and the total amount in the retirement fund until the end of the 30 years of withdrawalsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started