Answered step by step

Verified Expert Solution

Question

1 Approved Answer

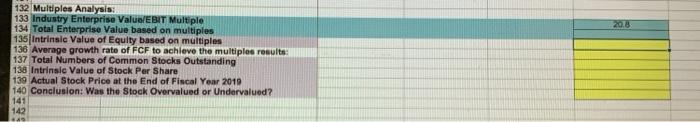

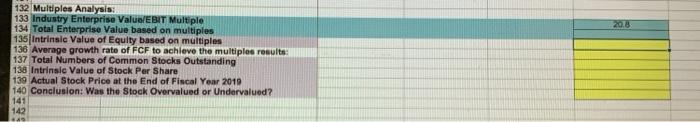

Solve multiple Analysis Information on second photo 203 132 Multiples Analysis: 133 Industry Enterprise Value/EBIT Multiple 134 Total Enterprise Value based on multiples 136 Intrinsic

Solve multiple Analysis

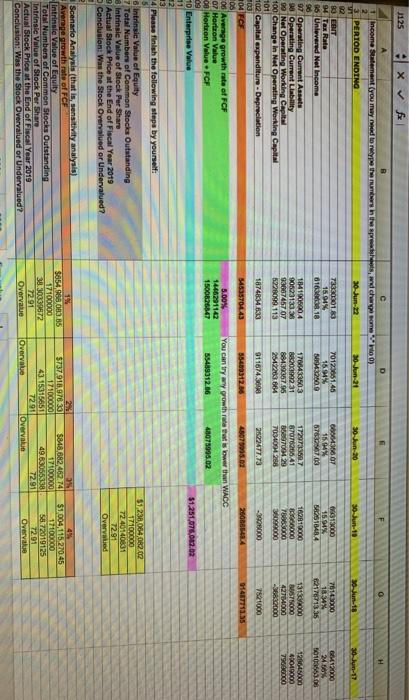

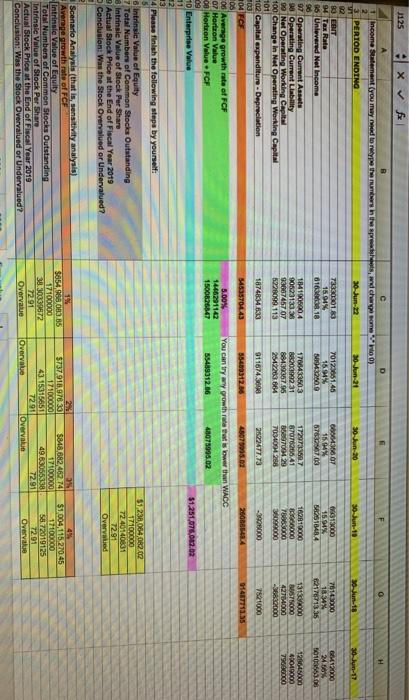

203 132 Multiples Analysis: 133 Industry Enterprise Value/EBIT Multiple 134 Total Enterprise Value based on multiples 136 Intrinsic Value of Equity based on multiples 136 Average growth rate of FCF to achieve the multiples results: 137 Total Numbers of Common Stocks Outstanding 138 Intrinsie Value of Stock Per Share 139 Actual Stock Price at the End of Fiscal Year 2010 140 Conclusion: Was the Stock Overvalued or Undervalued? 141 142 1.49 1125 xfx B D Income statement (you more the winter, charge amewo) 3 PERIOD ENDING 30 Jun-22 30-Jun-21 F 0 H 30-Jun-20 30-Jun-10 -Jun-18 30-Jun-17 733303013 15.94% 81618 701205146 16 % 589432009 13,000 15 94% 10484 7614300 18.34% 1217671335 12000 20 50103569705 1841905004 905231308 3067457 OZ 5228099,113 1766433503 820399231 88139357.95 3667 150 6763256700 1720733567 6707620541 B97004 20 7034002 83 EBIT 94 Tax Rate 16 Unlevered Net Income 97 Operating Current Assets 90 Operating Current Liability So Net Operating Working Capital 100 Change in Net Operating Working Capital 101 H02 Capital expenditure - Depreciation 03 104 FCF OS 06 Average growth rate of FCF 07 Horizon Value 0 Horton Value - FCF 182819000 0000 6.3000 38090000 1313000 ws 4271000 4352000 12145.00 41010000 79000000 1874634 633 7520000 5453570L45 H47711.35 911674.300 2522477.73 5540312 36 2GONA You can try my growth rate od slower than WACC 55489012.06 48075995.02 5.00% 1446291142 1500826847 $1.251.075.002.02 HD Enterprise Value 11 22 13 4 Please finish the following step by yourself 5 o intrinsic Value of Equity 7 Total Number of Common Stocks Outstanding 8 Intrinsie Value of Stock Per Share 9 Actual Stock Price at the End of Fiscal Year 2019 Conclusion: Was the Stock Overvalued or Undervalued? 557238,064,082.02 77100000 7240140831 7291 Overved Scenario Analysis that is sensitivity analysis Average growth rate of FCF intrinsic Value of Equity Total Numbers of Common Stocks Outstanding Intrinsic Value of Stock Per Share Actual Stock Price of the End of Fiscal Year 2019 Conclusion: Was the Stack Overvalued or Undervalued? 1% $854,03 85 17100000 38.30330872 7291 Overvalue 2 $737 91697839 $818,682462 74 17100000 17100000 431531651 49183055338 7291 7291 Overvale Overvalue $1004 115 270245 17100000 56.72019125 7201 Overvake 203 132 Multiples Analysis: 133 Industry Enterprise Value/EBIT Multiple 134 Total Enterprise Value based on multiples 136 Intrinsic Value of Equity based on multiples 136 Average growth rate of FCF to achieve the multiples results: 137 Total Numbers of Common Stocks Outstanding 138 Intrinsie Value of Stock Per Share 139 Actual Stock Price at the End of Fiscal Year 2010 140 Conclusion: Was the Stock Overvalued or Undervalued? 141 142 1.49 1125 xfx B D Income statement (you more the winter, charge amewo) 3 PERIOD ENDING 30 Jun-22 30-Jun-21 F 0 H 30-Jun-20 30-Jun-10 -Jun-18 30-Jun-17 733303013 15.94% 81618 701205146 16 % 589432009 13,000 15 94% 10484 7614300 18.34% 1217671335 12000 20 50103569705 1841905004 905231308 3067457 OZ 5228099,113 1766433503 820399231 88139357.95 3667 150 6763256700 1720733567 6707620541 B97004 20 7034002 83 EBIT 94 Tax Rate 16 Unlevered Net Income 97 Operating Current Assets 90 Operating Current Liability So Net Operating Working Capital 100 Change in Net Operating Working Capital 101 H02 Capital expenditure - Depreciation 03 104 FCF OS 06 Average growth rate of FCF 07 Horizon Value 0 Horton Value - FCF 182819000 0000 6.3000 38090000 1313000 ws 4271000 4352000 12145.00 41010000 79000000 1874634 633 7520000 5453570L45 H47711.35 911674.300 2522477.73 5540312 36 2GONA You can try my growth rate od slower than WACC 55489012.06 48075995.02 5.00% 1446291142 1500826847 $1.251.075.002.02 HD Enterprise Value 11 22 13 4 Please finish the following step by yourself 5 o intrinsic Value of Equity 7 Total Number of Common Stocks Outstanding 8 Intrinsie Value of Stock Per Share 9 Actual Stock Price at the End of Fiscal Year 2019 Conclusion: Was the Stock Overvalued or Undervalued? 557238,064,082.02 77100000 7240140831 7291 Overved Scenario Analysis that is sensitivity analysis Average growth rate of FCF intrinsic Value of Equity Total Numbers of Common Stocks Outstanding Intrinsic Value of Stock Per Share Actual Stock Price of the End of Fiscal Year 2019 Conclusion: Was the Stack Overvalued or Undervalued? 1% $854,03 85 17100000 38.30330872 7291 Overvalue 2 $737 91697839 $818,682462 74 17100000 17100000 431531651 49183055338 7291 7291 Overvale Overvalue $1004 115 270245 17100000 56.72019125 7201 Overvake Information on second photo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started