Solve multiple analysis with information provided. (See attached photo) Scroll to right to see full image

| Multiples Analysis: 20.8 |

| Industry Enterprise Value/EBIT Multiple |

| Total Enterprise Value based on multiples |

| Intrinsic Value of Equity based on multiples |

| Average growth rate of FCF to achieve the multiples results: |

| Total Numbers of Common Stocks Outstanding |

| Intrinsic Value of Stock Per Share |

| Actual Stock Price at the End of Fiscal Year 2019 |

| Conclusion: Was the Stock Overvalued or Undervalued? |

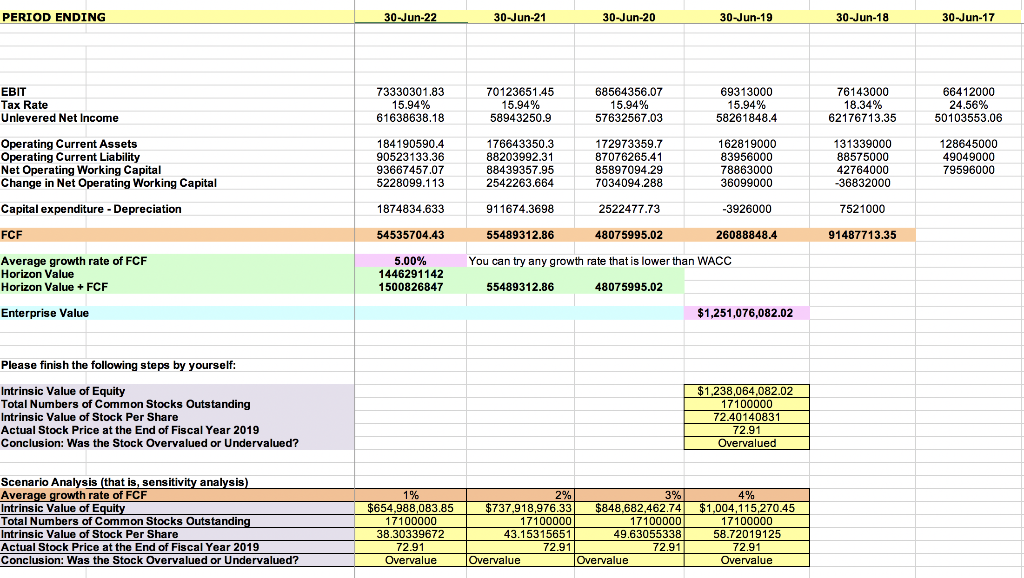

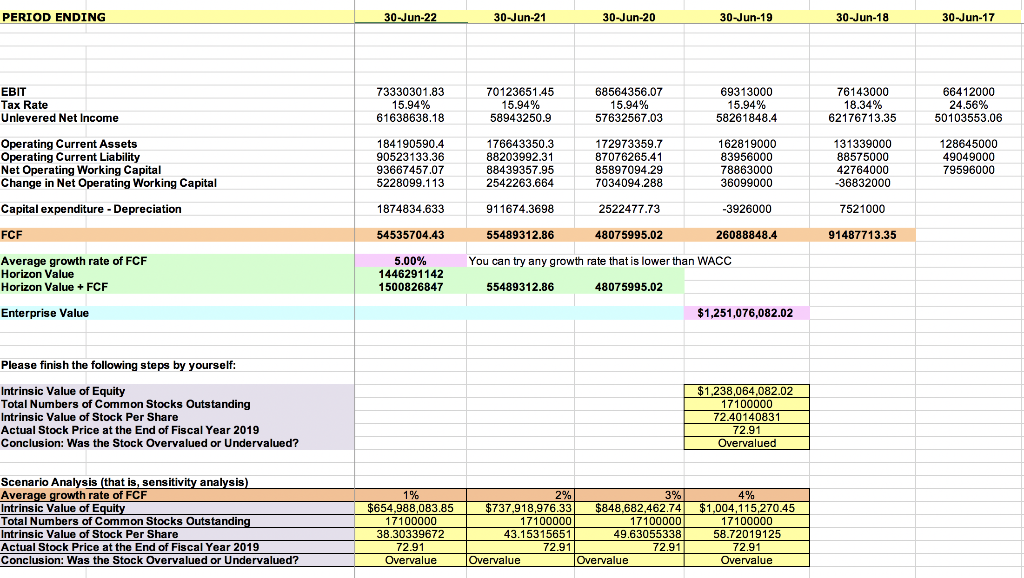

PERIOD ENDING 30-Jun-22 - 30-Jun-21 30-Jun-20 30-Jun-19 30-Jun-18 30-Jun-17 EBIT Tax Rate Unlevered Net Income 73330301.83 15.94% 61638638.18 70123651.45 15.94% 58943250.9 68564356.07 15.94% 57632567.03 69313000 15.94% 58261848.4 76143000 18.34% 62176713.35 66412000 24.56% 50103553.06 Operating Current Assets Operating Current Liability Net Operating Working Capital Change in Net Operating Working Capital Capital expenditure - Depreciation FCF 184190590.4 90523133.36 93667457.07 5228099.113 176643350.3 88203992.31 88439357.95 2542263.664 172973359.7 87076265.41 85897094.29 7034094.288 162819000 83956000 78863000 36099000 131339000 88575000 42764000 36832000 128645000 49049000 79596000 1874834.633 911674.3698 2522477.73 -3926000 7521000 54535704.43 55489312.86 48075995.02 26088848.4 91487713.35 You can try any growth rate that is lower than WACC Average growth rate of FCF Horizon Value Horizon Value + FCF 5.00% 1446291142 1500826847 55489312.86 48075995.02 Enterprise Value $1,251,076,082.02 Please finish the following steps by yourself: Intrinsic Value of Equity Total Numbers of Common Stocks Outstanding Intrinsic Value of Stock Per Share Actual Stock Price at the End of Fiscal Year 2019 Conclusion: Was the Stock Overvalued or Undervalued? $1,238,064.082.02 17100000 72.40140831 72.91 Overvalued Scenario Analysis (that is, sensitivity analysis) Average growth rate of FCF Intrinsic Value of Equity Total Numbers of Common Stocks Outstanding Intrinsic Value of Stock Per Share Actual Stock Price at the End of Fiscal Year 2019 Conclusion: Was the Stock Overvalued or Undervalued? 1% $654,988,083.85 17100000 38.30339672 72.91 Overvalue 2% 3% $737,918,976.33 $848,682,462.74 17100000 17100000 43.15315651 49.63055338 72.91 72.91 Overvalue Overvalue 4% $1,004,115,270.45 17100000 58.72019125 72.91 Overvalue PERIOD ENDING 30-Jun-22 - 30-Jun-21 30-Jun-20 30-Jun-19 30-Jun-18 30-Jun-17 EBIT Tax Rate Unlevered Net Income 73330301.83 15.94% 61638638.18 70123651.45 15.94% 58943250.9 68564356.07 15.94% 57632567.03 69313000 15.94% 58261848.4 76143000 18.34% 62176713.35 66412000 24.56% 50103553.06 Operating Current Assets Operating Current Liability Net Operating Working Capital Change in Net Operating Working Capital Capital expenditure - Depreciation FCF 184190590.4 90523133.36 93667457.07 5228099.113 176643350.3 88203992.31 88439357.95 2542263.664 172973359.7 87076265.41 85897094.29 7034094.288 162819000 83956000 78863000 36099000 131339000 88575000 42764000 36832000 128645000 49049000 79596000 1874834.633 911674.3698 2522477.73 -3926000 7521000 54535704.43 55489312.86 48075995.02 26088848.4 91487713.35 You can try any growth rate that is lower than WACC Average growth rate of FCF Horizon Value Horizon Value + FCF 5.00% 1446291142 1500826847 55489312.86 48075995.02 Enterprise Value $1,251,076,082.02 Please finish the following steps by yourself: Intrinsic Value of Equity Total Numbers of Common Stocks Outstanding Intrinsic Value of Stock Per Share Actual Stock Price at the End of Fiscal Year 2019 Conclusion: Was the Stock Overvalued or Undervalued? $1,238,064.082.02 17100000 72.40140831 72.91 Overvalued Scenario Analysis (that is, sensitivity analysis) Average growth rate of FCF Intrinsic Value of Equity Total Numbers of Common Stocks Outstanding Intrinsic Value of Stock Per Share Actual Stock Price at the End of Fiscal Year 2019 Conclusion: Was the Stock Overvalued or Undervalued? 1% $654,988,083.85 17100000 38.30339672 72.91 Overvalue 2% 3% $737,918,976.33 $848,682,462.74 17100000 17100000 43.15315651 49.63055338 72.91 72.91 Overvalue Overvalue 4% $1,004,115,270.45 17100000 58.72019125 72.91 Overvalue