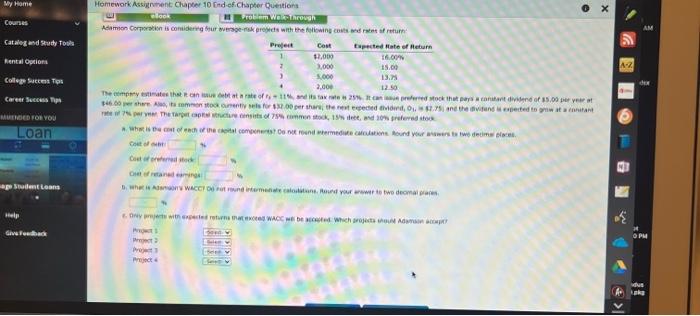

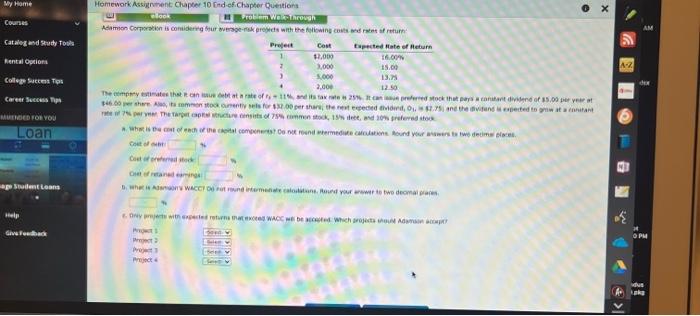

My Home Courses Catalog and Study Tools Rental Options College Success Tips Career Success Tips MMENDED FOR YOU Loan age Student Loans Help Give Feedback 0x Homework Assignment: Chapter 10 End-of-Chapter Questions Problem Walk-Through clook Adamson Corporation is considering four average-nsk projects with the following costs and rates of return Project Cost Expected Rate of Return 12,000 16.00% A-Z 3,000 15.00 5,000 13.75 2,000 12.50 The company estimates that it can issue debt at a rate of r, 11%, and its tax rate is 25%. It can issue preferred stock that pays a constant dividend of $5.00 per year at $46.00 per share Also, its common stock ourently sels for $32.00 per shars, the next expected vidend, O, is $2.75) and the dividend is expected to grow at a constant rate of 7% per year The Target capital structure consists of 75% common stock, 15% deet, and 10% preferred stock a. What is the cost of each of the capital components? Do not round antermediate calculations. Round your answers to two decimal places. Cost of Cost of refered stock Oset of retained eaming 5. What is A WACC? Do not round intermenate calculations. Round your answer to two decimal places . Dny projects with expected returns that exceed WACC will be accepted which projects should Adamson acc Pro Project 2 Projec Boek Project 0905 L G AM A OPM dus Ak ww G C BE 31 PA D d M. 0 1 M ***** 6 10000000 . MacBook Air Expe 1111 Spatid mo alam Proton We Thoma Qu ApK) KARAIN K Date CENA LATI Loan C 1 Normal C My Home Courses Catalog and Study Tools Rental Options College Success Tips Career Success Tips MMENDED FOR YOU Loan age Student Loans Help Give Feedback 0x Homework Assignment: Chapter 10 End-of-Chapter Questions Problem Walk-Through clook Adamson Corporation is considering four average-nsk projects with the following costs and rates of return Project Cost Expected Rate of Return 12,000 16.00% A-Z 3,000 15.00 5,000 13.75 2,000 12.50 The company estimates that it can issue debt at a rate of r, 11%, and its tax rate is 25%. It can issue preferred stock that pays a constant dividend of $5.00 per year at $46.00 per share Also, its common stock ourently sels for $32.00 per shars, the next expected vidend, O, is $2.75) and the dividend is expected to grow at a constant rate of 7% per year The Target capital structure consists of 75% common stock, 15% deet, and 10% preferred stock a. What is the cost of each of the capital components? Do not round antermediate calculations. Round your answers to two decimal places. Cost of Cost of refered stock Oset of retained eaming 5. What is A WACC? Do not round intermenate calculations. Round your answer to two decimal places . Dny projects with expected returns that exceed WACC will be accepted which projects should Adamson acc Pro Project 2 Projec Boek Project 0905 L G AM A OPM dus Ak ww G C BE 31 PA D d M. 0 1 M ***** 6 10000000 . MacBook Air Expe 1111 Spatid mo alam Proton We Thoma Qu ApK) KARAIN K Date CENA LATI Loan C 1 Normal C