Answered step by step

Verified Expert Solution

Question

1 Approved Answer

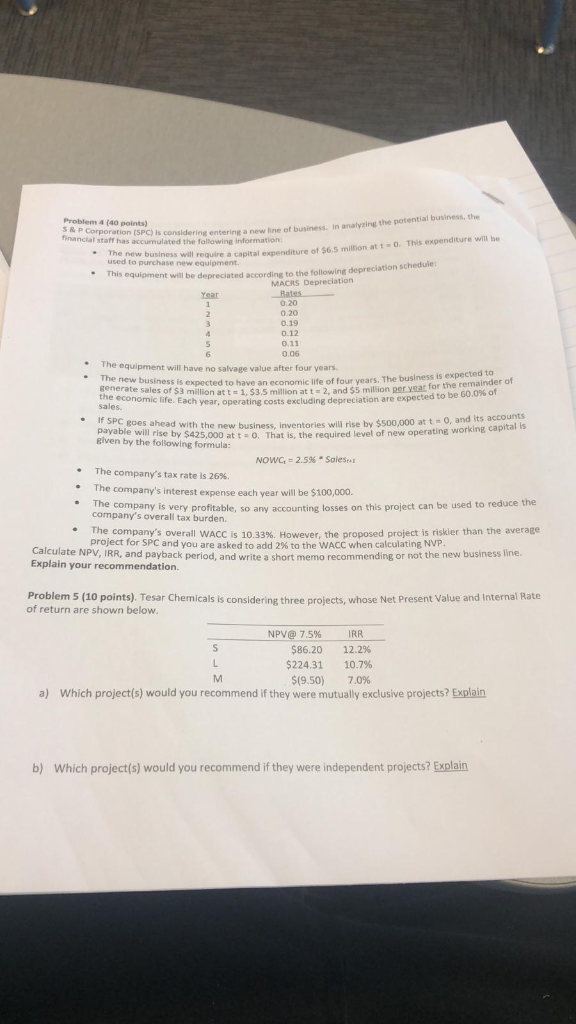

solve number 4 only thank you Problem 4 (40 points) s&P Corporation (SPC) is considering entering a new line of business. in analyzing the potential

solve number 4 only thank you

Problem 4 (40 points) s&P Corporation (SPC) is considering entering a new line of business. in analyzing the potential business, the The new huriess will require a capital expenditure of $6.5 million at t 0, This expenditure will be used to purchase new equipment o the following depreciation schedule: Depreciation This equipment will be depreciated accordins Year 0.20 0.12 0.11 0.06 The equipment will have salvage value r years The new business is expected to have an economic life of four years. The business is expected to , $3.5 million at t Each year, operating costs excluding depreciatio er of 2, and 55 milion pa Y to be 6o.0 % of t sales of $3 million at t sales. unts .canital is r SPC goes ahead with the new business, inventories will rise by $500,000 at t 0, d the required level of new operat 00 at t= 0, That given by the followl NOWC, 2.5 %6 Sales The company's tax rate is 26%. The company's interest ex each year will be $100,000. reduce the The company is very profitabl company's overall tax burden. o any accounting losses on this project can be used The company's overall WACC is 10.33%. However, the proposed project is riskier than the average Calculate NPV, IRR. and naub are asked to add 2% to the WACC when calculatig6 new business line. period, and write short memo recommending Explain your recommendation. Problem 5 (10 points). Tesar Chemicals is considering three projects, whose Net Present Value and Internal Rate of return are shown below. NPV@ 7.5 % IRR 12.2 % $86.20 $224.31 10.7 % M $(9.50) 7.0% Which project(s) would you recommend if they were mutually exclusive projects? Explain a) Which project(s) would you recommend if they were independent projects? Explain b)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started