Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve Part 2. part 1 answers are included. updated 021119 COMPREHENSIVE BUDGFTING/VARIANCE PROBLEM TIDEWATER WRENCH COMPANY, LLC TRACKING COST VARIANCES & SALES VARIANCES INITIAL BUDGET

Solve Part 2. part 1 answers are included.

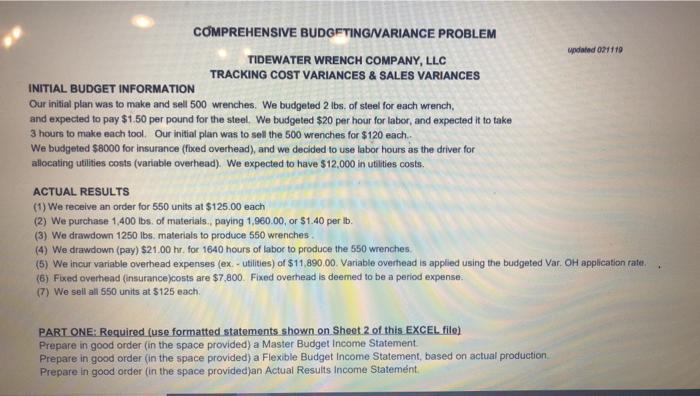

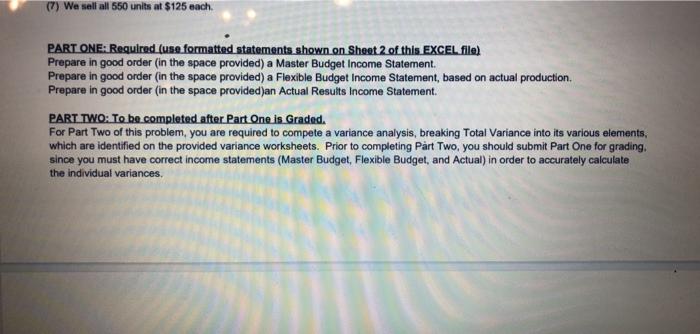

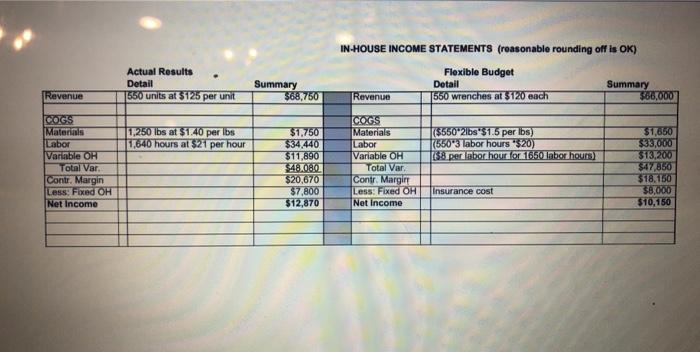

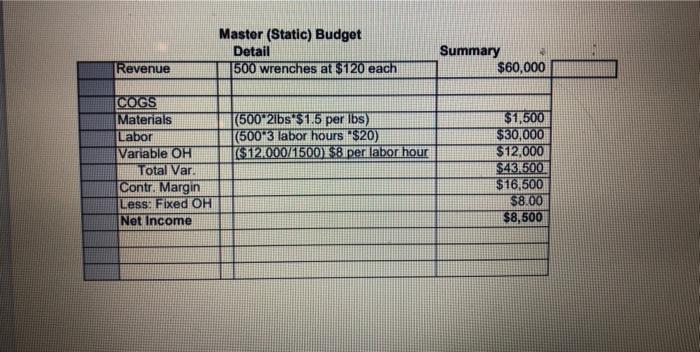

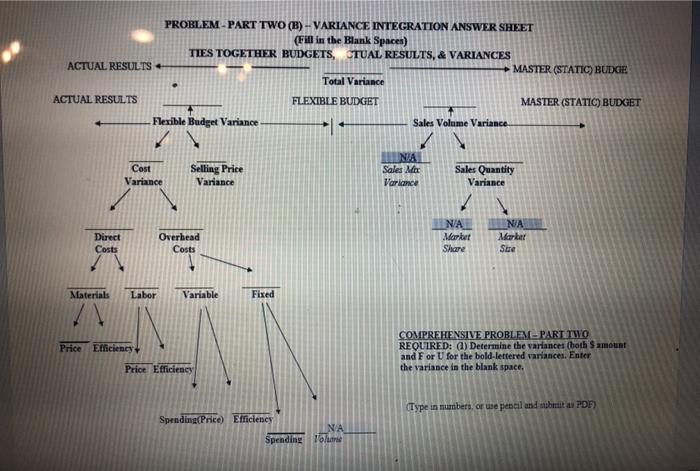

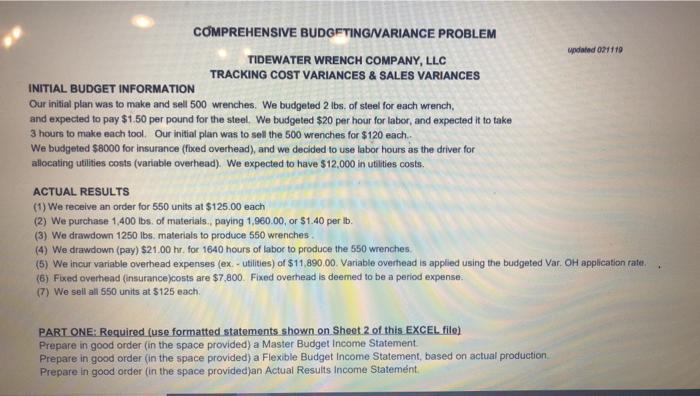

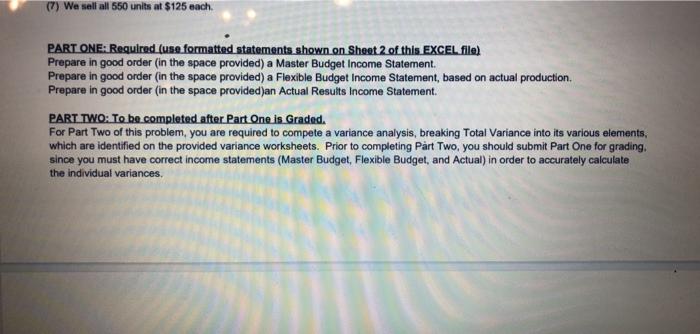

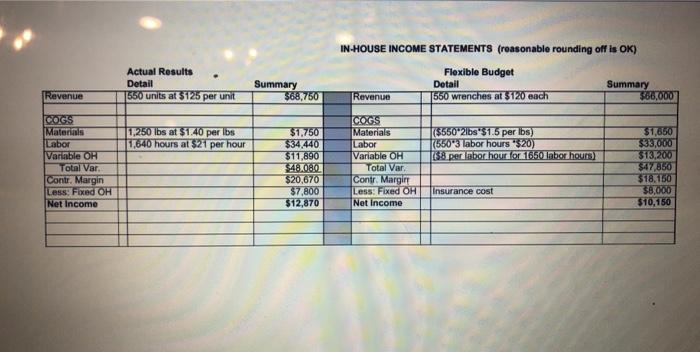

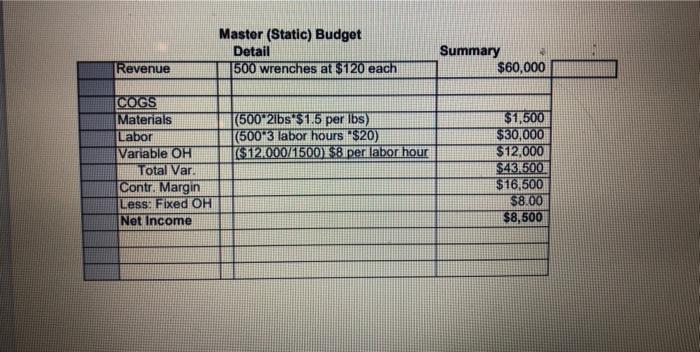

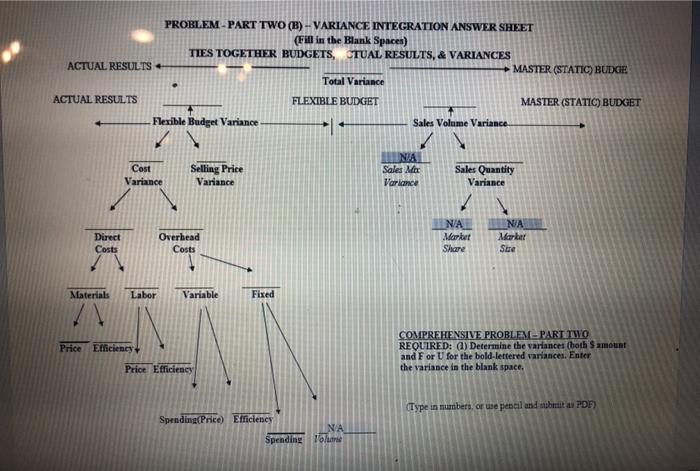

updated 021119 COMPREHENSIVE BUDGFTING/VARIANCE PROBLEM TIDEWATER WRENCH COMPANY, LLC TRACKING COST VARIANCES & SALES VARIANCES INITIAL BUDGET INFORMATION Our initial plan was to make and sell 500 wrenches. We budgeted 2 lbs. of steel for each wrench, and expected to pay $1.50 per pound for the steel. We budgeted $20 per hour for labor, and expected it to take 3 hours to make each tool. Our initial plan was to sell the 500 wrenches for $120 each. We budgeted $8000 for insurance (fixed overhead), and we decided to use labor hours as the driver for allocating utilities costs (variable overhead). We expected to have $12,000 in utilities costs. ACTUAL RESULTS (1) We receive an order for 550 units at $125.00 each (2) We purchase 1,400 lbs. of materials., paying 1,960.00, or $1.40 per b. (3) We drawdown 1250 lbs, materials to produce 550 wrenches (4) We drawdown (pay) $21.00 hr. for 1640 hours of labor to produce the 550 wrenches (5) We incur variable overhead expenses (ex- utilities) of $11,890,00. Variable overhead is applied using the budgeted Var. OH application rate. (6) Fixed overhead (insurance costs are $7,800. Fixed overhead is deemed to be a period expense. 1) We sell all 550 units at $125 each PART ONE: Required (use formatted statements shown on Sheet 2 of this EXCEL file) Prepare in good order (in the space provided) a Master Budget Income Statement Prepare in good order (in the space provided) a Flexible Budget Income Statement, based on actual production Prepare in good order (in the space provided)an Actual Results Income Statement (7) We sell all 550 units at $125 each. PART ONE: Required (use formatted statements shown on Shoot 2 of this EXCEL file) Prepare in good order (in the space provided) a Master Budget Income Statement Prepare in good order in the space provided) a Flexible Budget Income Statement, based on actual production. Prepare in good order (in the space provided)an Actual Results Income Statement. PART TWO: To be completed after Part One is Graded. For Part Two of this problem, you are required to compete a variance analysis, breaking Total Variance into its various elements, which are identified on the provided variance worksheets. Prior to completing Part Two, you should submit Part One for grading. since you must have correct income statements (Master Budget, Flexible Budget, and Actual) in order to accurately calculate the individual variances Actual Results Detail 1550 units at $125 per unit IN-HOUSE INCOME STATEMENTS (reasonable rounding off is OK) Flexible Budget Detail Summary Revenue 550 Wrenches at $120 each $66.000 Summary $68,750 Revenue 1.250 lbs at $1.40 per lbs 11.640 hours at $21 per hour COG'S Materials Labor Variable OH Total Var Contr. Margin Less Fixed OH Net Income ($550 2lbs $1.5 per lbs) (550'3 labor hours $20) {$8 per labor hour for 1650 labor hours) COGS Materials Labor Variable OH Total Var Contr. Margir Less: Fixed OH Net Income $1,750 $34.440 $11,890 $48.000 $20,670 $7,800 $12,870 $1,650 $35.000 $13,200 $47,850 318.150 $8,000 $10,150 Insurance cost Master (Static) Budget Detail 500 wrenches at $120 each Summary $60,000 Revenue |(500'21bs $1.5 per lbs) (500-3 labor hours $20) ($12.000/1500$iperlabor hour COGS Materials Labor Variable OH Total Var. Contr. Margin Less: Fixed OH Net Income $1,500 $30,000 $12,000 $43500 $16,500 $8.00 $8,500 PROBLEM - PART TWO (B) - VARIANCE INTEGRATION ANSWER SHEET (Fil in the Blank Spaces) TIES TOGETHER BUDGETS, STUAL RESULTS, & VARIANCES ACTUAL RESULTS MASTER (STATIC) BUDGE . Total Variance ACTUAL RESULTS FLEXIBLE BUDGET MASTER (STATIC) BUDGET Hexible Budget Variance + Sales Volume Variance Cost Variance Selling Price Variance NA Sales Mar Varicoce Sales Quantity Variance Direct Costs Overhead Costs NA Market Share NA Marker Stre Materials Labor Variable Fixed Price Efficiency COMPREHENSIVE PROBLEMPART TWO REQUIRED: a) Determine the variances (both S amount and For U for the bold-lettered variances Enter the variance in the blank space, Price Efficiency (Type in numbers, or use peal and submit au PDF) Spending Price) Efficiency NA Spending 1 updated 021119 COMPREHENSIVE BUDGFTING/VARIANCE PROBLEM TIDEWATER WRENCH COMPANY, LLC TRACKING COST VARIANCES & SALES VARIANCES INITIAL BUDGET INFORMATION Our initial plan was to make and sell 500 wrenches. We budgeted 2 lbs. of steel for each wrench, and expected to pay $1.50 per pound for the steel. We budgeted $20 per hour for labor, and expected it to take 3 hours to make each tool. Our initial plan was to sell the 500 wrenches for $120 each. We budgeted $8000 for insurance (fixed overhead), and we decided to use labor hours as the driver for allocating utilities costs (variable overhead). We expected to have $12,000 in utilities costs. ACTUAL RESULTS (1) We receive an order for 550 units at $125.00 each (2) We purchase 1,400 lbs. of materials., paying 1,960.00, or $1.40 per b. (3) We drawdown 1250 lbs, materials to produce 550 wrenches (4) We drawdown (pay) $21.00 hr. for 1640 hours of labor to produce the 550 wrenches (5) We incur variable overhead expenses (ex- utilities) of $11,890,00. Variable overhead is applied using the budgeted Var. OH application rate. (6) Fixed overhead (insurance costs are $7,800. Fixed overhead is deemed to be a period expense. 1) We sell all 550 units at $125 each PART ONE: Required (use formatted statements shown on Sheet 2 of this EXCEL file) Prepare in good order (in the space provided) a Master Budget Income Statement Prepare in good order (in the space provided) a Flexible Budget Income Statement, based on actual production Prepare in good order (in the space provided)an Actual Results Income Statement (7) We sell all 550 units at $125 each. PART ONE: Required (use formatted statements shown on Shoot 2 of this EXCEL file) Prepare in good order (in the space provided) a Master Budget Income Statement Prepare in good order in the space provided) a Flexible Budget Income Statement, based on actual production. Prepare in good order (in the space provided)an Actual Results Income Statement. PART TWO: To be completed after Part One is Graded. For Part Two of this problem, you are required to compete a variance analysis, breaking Total Variance into its various elements, which are identified on the provided variance worksheets. Prior to completing Part Two, you should submit Part One for grading. since you must have correct income statements (Master Budget, Flexible Budget, and Actual) in order to accurately calculate the individual variances Actual Results Detail 1550 units at $125 per unit IN-HOUSE INCOME STATEMENTS (reasonable rounding off is OK) Flexible Budget Detail Summary Revenue 550 Wrenches at $120 each $66.000 Summary $68,750 Revenue 1.250 lbs at $1.40 per lbs 11.640 hours at $21 per hour COG'S Materials Labor Variable OH Total Var Contr. Margin Less Fixed OH Net Income ($550 2lbs $1.5 per lbs) (550'3 labor hours $20) {$8 per labor hour for 1650 labor hours) COGS Materials Labor Variable OH Total Var Contr. Margir Less: Fixed OH Net Income $1,750 $34.440 $11,890 $48.000 $20,670 $7,800 $12,870 $1,650 $35.000 $13,200 $47,850 318.150 $8,000 $10,150 Insurance cost Master (Static) Budget Detail 500 wrenches at $120 each Summary $60,000 Revenue |(500'21bs $1.5 per lbs) (500-3 labor hours $20) ($12.000/1500$iperlabor hour COGS Materials Labor Variable OH Total Var. Contr. Margin Less: Fixed OH Net Income $1,500 $30,000 $12,000 $43500 $16,500 $8.00 $8,500 PROBLEM - PART TWO (B) - VARIANCE INTEGRATION ANSWER SHEET (Fil in the Blank Spaces) TIES TOGETHER BUDGETS, STUAL RESULTS, & VARIANCES ACTUAL RESULTS MASTER (STATIC) BUDGE . Total Variance ACTUAL RESULTS FLEXIBLE BUDGET MASTER (STATIC) BUDGET Hexible Budget Variance + Sales Volume Variance Cost Variance Selling Price Variance NA Sales Mar Varicoce Sales Quantity Variance Direct Costs Overhead Costs NA Market Share NA Marker Stre Materials Labor Variable Fixed Price Efficiency COMPREHENSIVE PROBLEMPART TWO REQUIRED: a) Determine the variances (both S amount and For U for the bold-lettered variances Enter the variance in the blank space, Price Efficiency (Type in numbers, or use peal and submit au PDF) Spending Price) Efficiency NA Spending 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started