Answered step by step

Verified Expert Solution

Question

1 Approved Answer

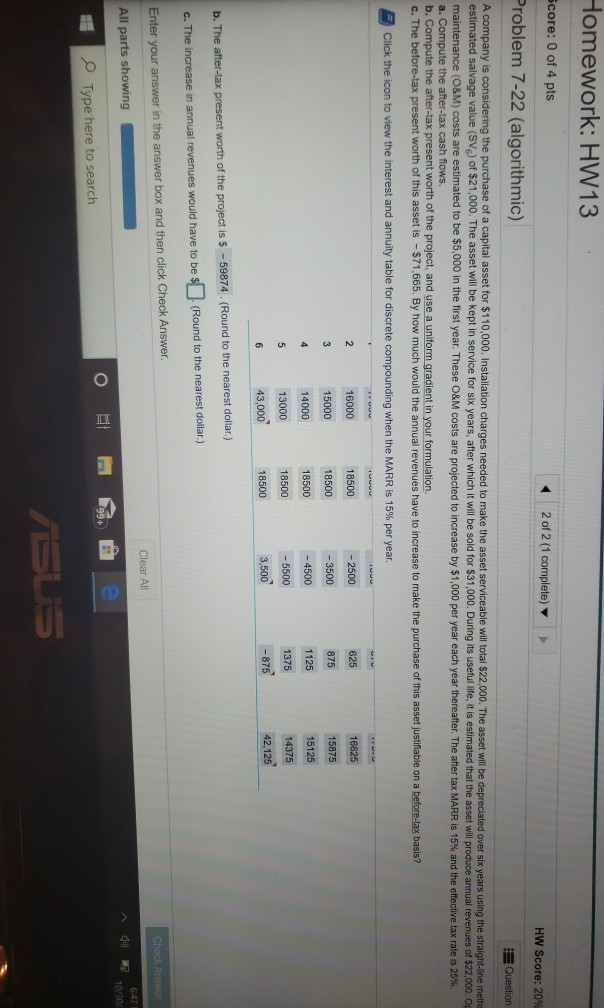

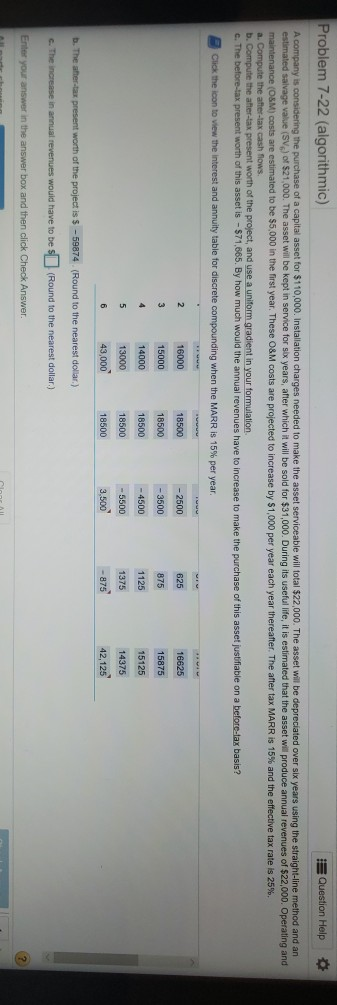

solve part C Homework: HW13 Score: 0 of 4 pts 2 of 2 (1 complete) HW Score: 20% Problem 7-22 (algorithmic) MQuestion A company is

solve part C

Homework: HW13 Score: 0 of 4 pts 2 of 2 (1 complete) HW Score: 20% Problem 7-22 (algorithmic) MQuestion A company is considering the purchase of a capital asset for $110,000. Installation charges needed to make the asset serviceable will total $22,000. The asset will be depreciated over six years using the straight-line meth estimated salvage value (SVe) of $21,000. The asset will be kept in service for six years, after which it will be sold for $31,000. During its useful life, it is estimated that the asset will produce annual revenues of $22,000. Op maintenance (O&M) costs are estimated to be $5,000 in the first year. These 0&M costs are projected to increase by $1,000 per year each year thereafter. The after tax MARR is 15 % and the effective tax rate is 25 %. a. Compute the after-tax cash flows. b. Compute the after-tax present worth of the project, and use a uniform gradient in your formulation. c. The before-tax present worth of this asset is -$71,665. By how much would the annual revenues have to increase to make the purchase of this asset justifiable on a before-tax basis? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15 % per year. wwww 2 16000 18500 -2500 625 16625 3 15000 18500 -3500 875 15875 4 14000 18500 -4500 1125 15125 5 13000 18500 -5500 1375 14375 43,000 18500 3,500 -875 42,125 6 b. The after-tax present worth of the project is $ -59874. (Round to the nearest dollar.) c. The increase in annual revenues would have to be S (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer Check Answer Clear All All parts showing 647 10/30/ Type here to search ASUS Problem 7-22 (algorithmic) EQuestion Help A company is considering the purchase of a capital asset for $110,000. Installation charges needed to make the asset serviceable will total $22,000. The asset will be depreciated over six years using the straight-line method and an estimated salvage value (SV) of $21,000. The asset will be kept in service for six years, after which it will be sold for $31,000. During its useful life, it is estimated that the asset wil produce annual revenues of $22,000. Operating and maintenance (O&M) costs are estimated to be $5,000 in the first year. These 0&M costs are projected to increase by $1,000 per year each year thereafter. The after tax MARR is 15 % and the effective tax rate is 25 % a. Compute the after-tax cash flows. b. Compute the after-tax present worth of the project, and use a uniform gradient in your formulation. c. The before-tax present worth of this asset is -$71,665. By how much would the annual revenues have to increase to make the purchase of this asset justifiable on a before-tax basis? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% per year wwww 16000 18500 -2500 625 16625 31 15000 18500 -3500 875 15875 4 14000 18500 -4500 1125 15125 5 13000 18500 -5500 1375 14375 43,000 3,500 -875 42,125 6 18500 b. The after-tax present worth of the project is $ -59874 (Round to the nearest dollar.) c. The increase in annual revenues would have to be S (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer. (? Homework: HW13 Score: 0 of 4 pts 2 of 2 (1 complete) HW Score: 20% Problem 7-22 (algorithmic) MQuestion A company is considering the purchase of a capital asset for $110,000. Installation charges needed to make the asset serviceable will total $22,000. The asset will be depreciated over six years using the straight-line meth estimated salvage value (SVe) of $21,000. The asset will be kept in service for six years, after which it will be sold for $31,000. During its useful life, it is estimated that the asset will produce annual revenues of $22,000. Op maintenance (O&M) costs are estimated to be $5,000 in the first year. These 0&M costs are projected to increase by $1,000 per year each year thereafter. The after tax MARR is 15 % and the effective tax rate is 25 %. a. Compute the after-tax cash flows. b. Compute the after-tax present worth of the project, and use a uniform gradient in your formulation. c. The before-tax present worth of this asset is -$71,665. By how much would the annual revenues have to increase to make the purchase of this asset justifiable on a before-tax basis? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15 % per year. wwww 2 16000 18500 -2500 625 16625 3 15000 18500 -3500 875 15875 4 14000 18500 -4500 1125 15125 5 13000 18500 -5500 1375 14375 43,000 18500 3,500 -875 42,125 6 b. The after-tax present worth of the project is $ -59874. (Round to the nearest dollar.) c. The increase in annual revenues would have to be S (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer Check Answer Clear All All parts showing 647 10/30/ Type here to search ASUS Problem 7-22 (algorithmic) EQuestion Help A company is considering the purchase of a capital asset for $110,000. Installation charges needed to make the asset serviceable will total $22,000. The asset will be depreciated over six years using the straight-line method and an estimated salvage value (SV) of $21,000. The asset will be kept in service for six years, after which it will be sold for $31,000. During its useful life, it is estimated that the asset wil produce annual revenues of $22,000. Operating and maintenance (O&M) costs are estimated to be $5,000 in the first year. These 0&M costs are projected to increase by $1,000 per year each year thereafter. The after tax MARR is 15 % and the effective tax rate is 25 % a. Compute the after-tax cash flows. b. Compute the after-tax present worth of the project, and use a uniform gradient in your formulation. c. The before-tax present worth of this asset is -$71,665. By how much would the annual revenues have to increase to make the purchase of this asset justifiable on a before-tax basis? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% per year wwww 16000 18500 -2500 625 16625 31 15000 18500 -3500 875 15875 4 14000 18500 -4500 1125 15125 5 13000 18500 -5500 1375 14375 43,000 3,500 -875 42,125 6 18500 b. The after-tax present worth of the project is $ -59874 (Round to the nearest dollar.) c. The increase in annual revenues would have to be S (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer. (Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started