,, solve please

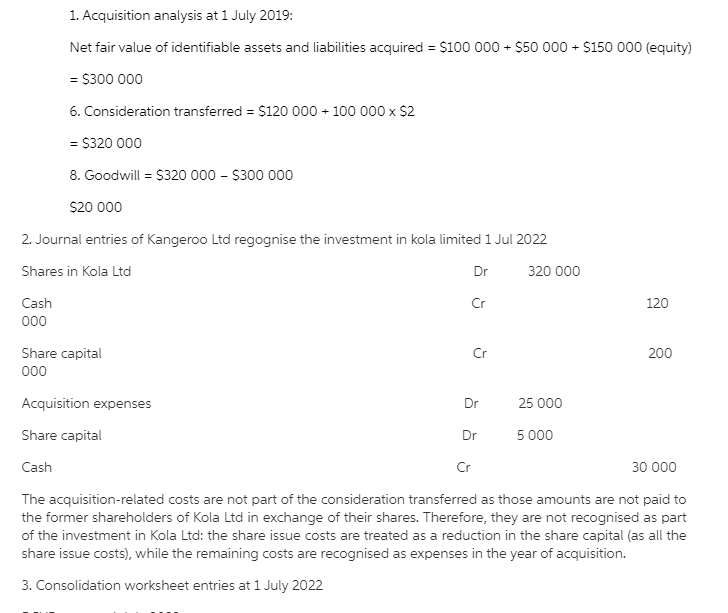

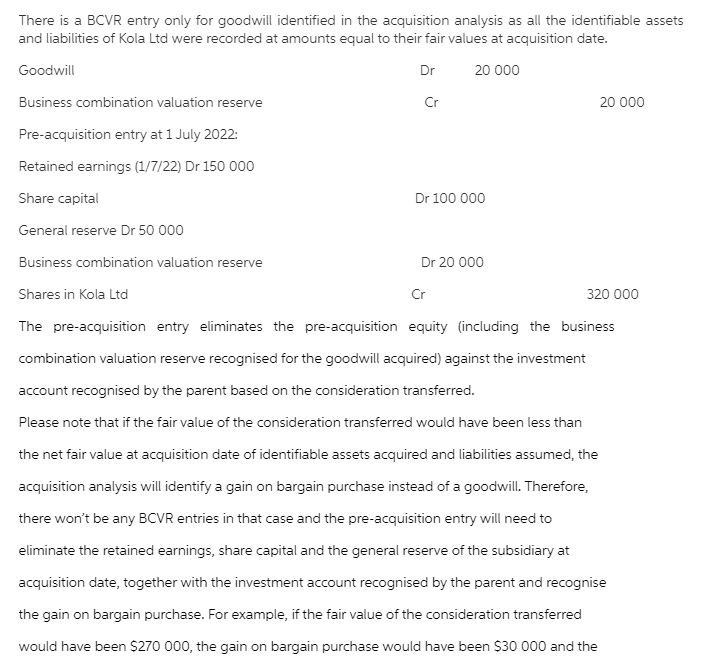

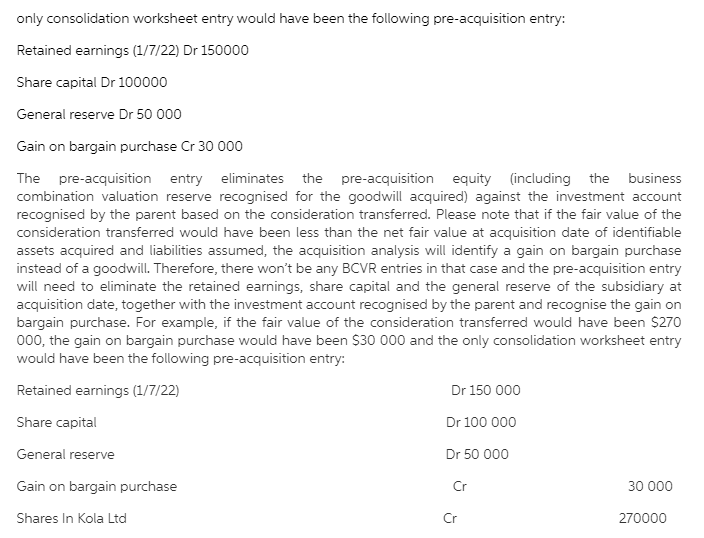

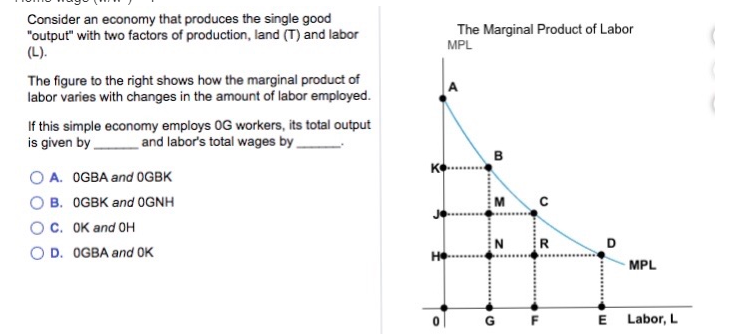

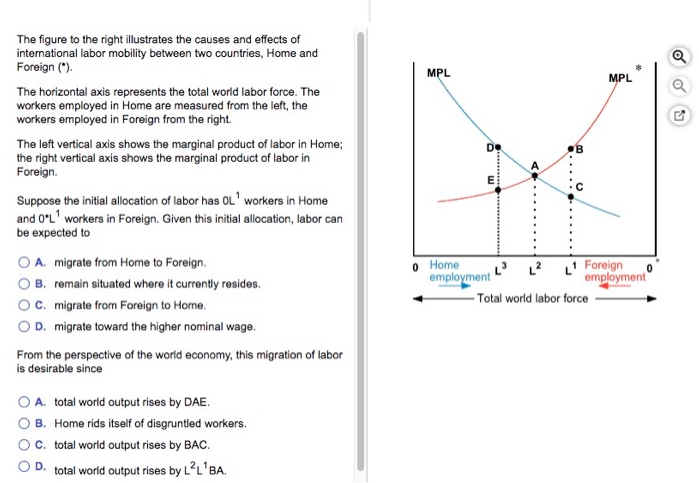

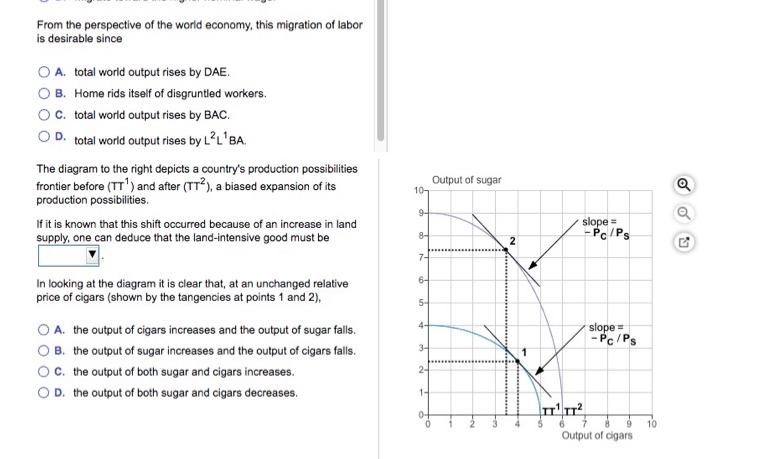

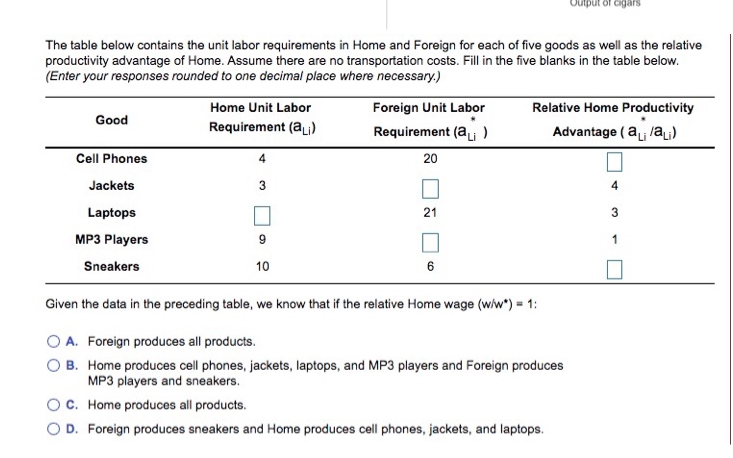

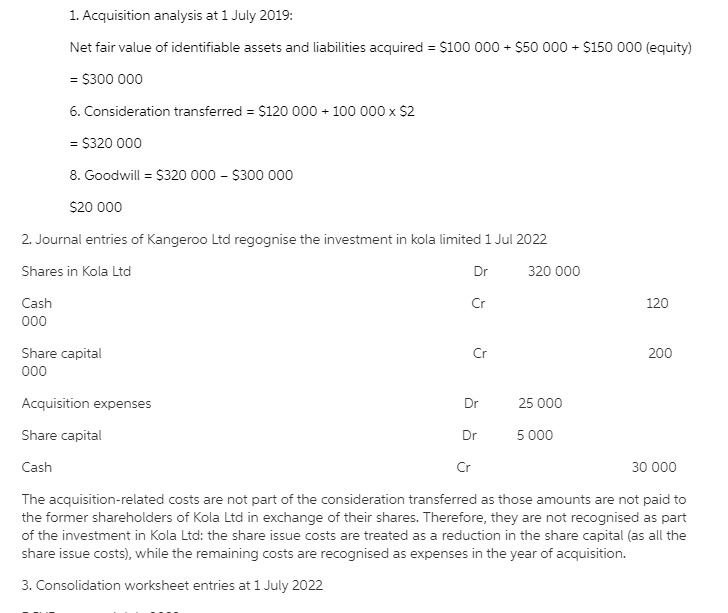

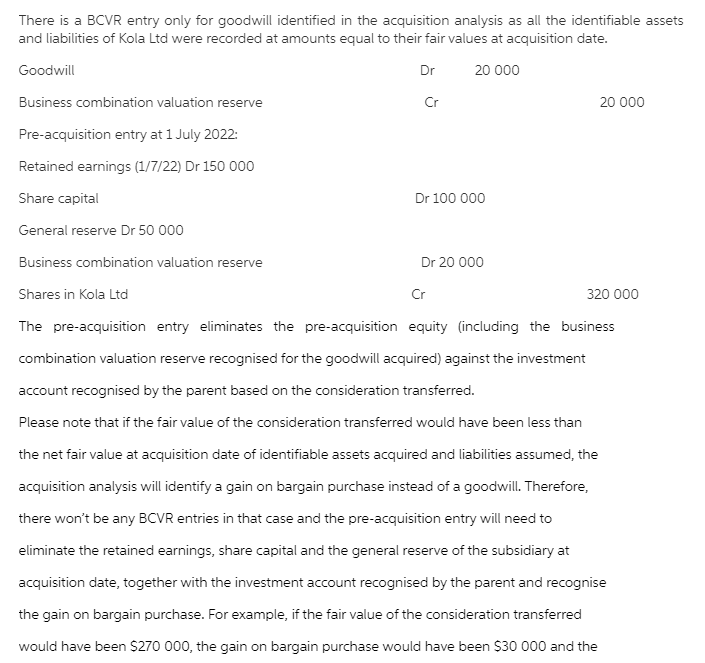

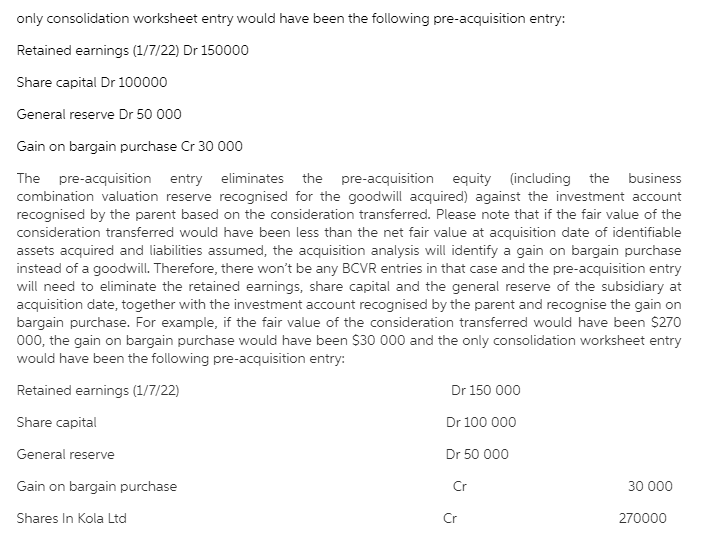

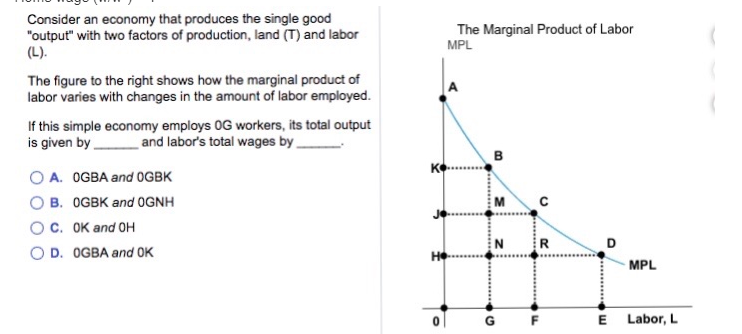

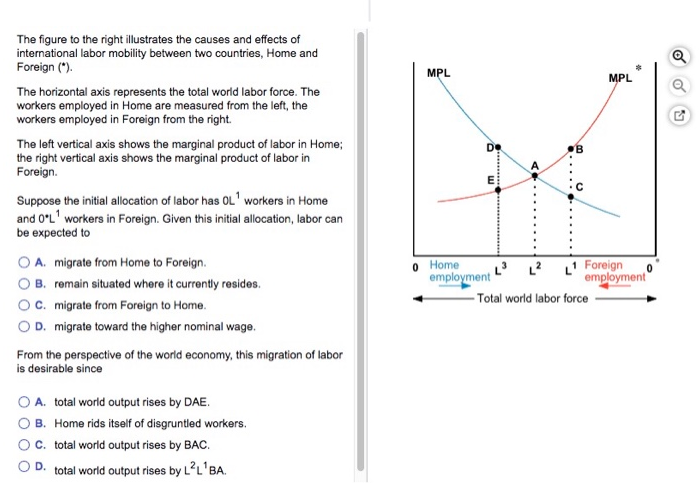

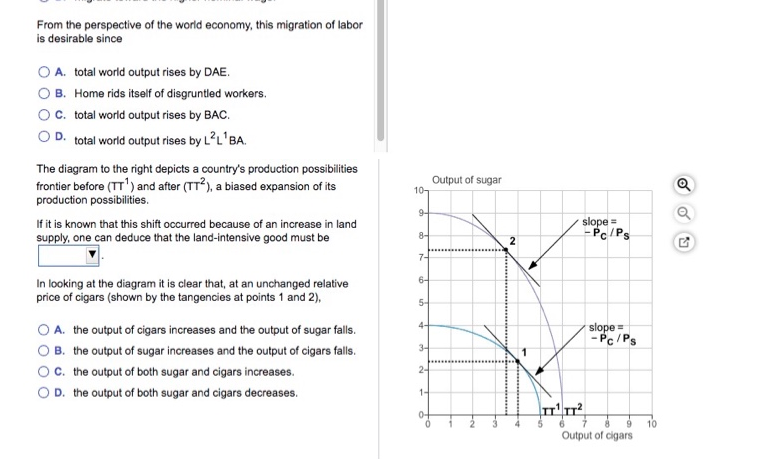

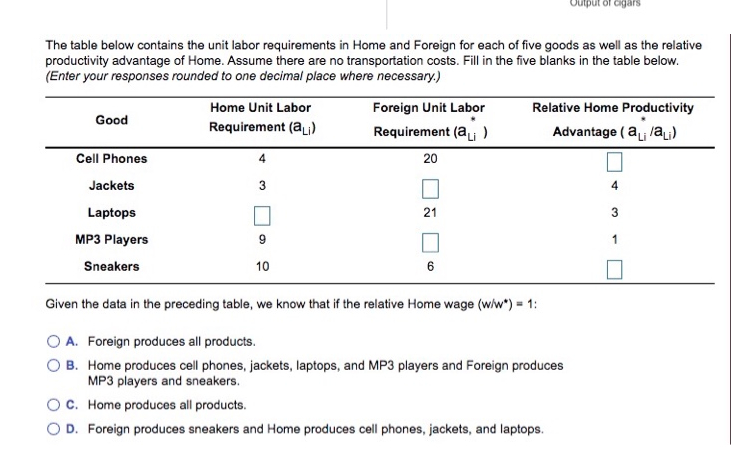

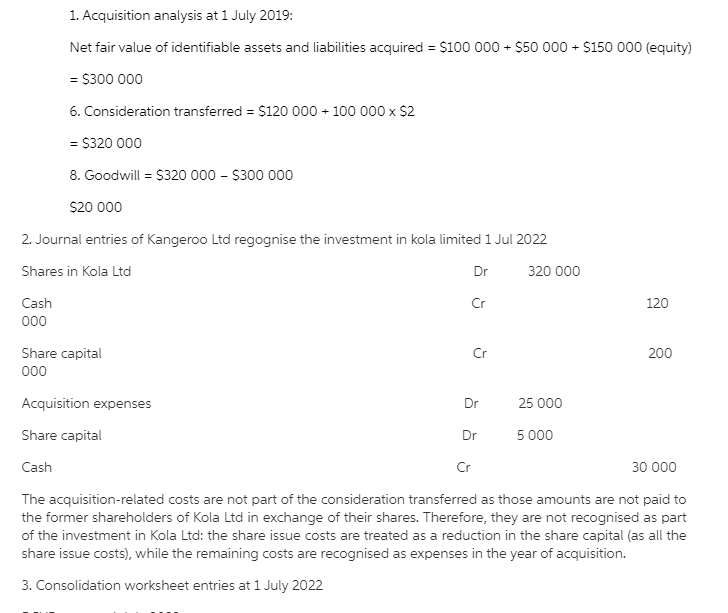

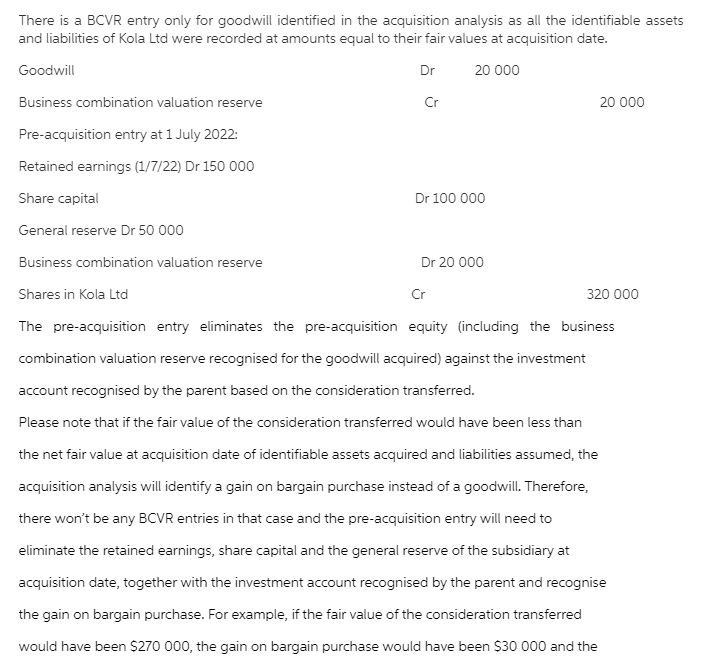

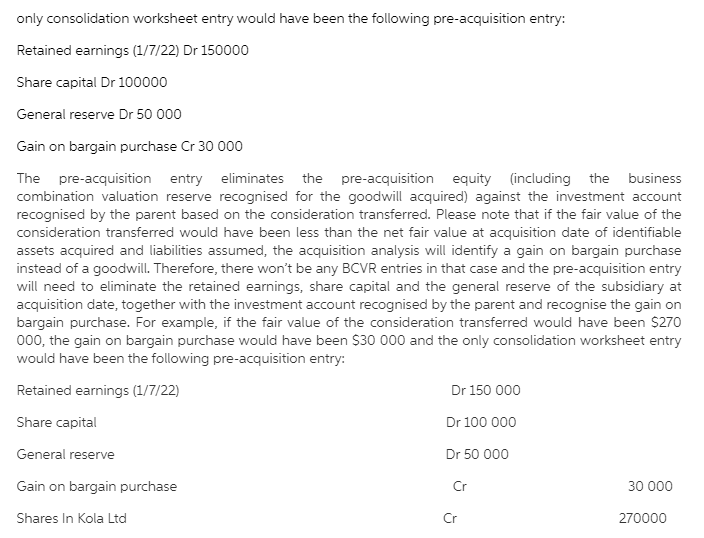

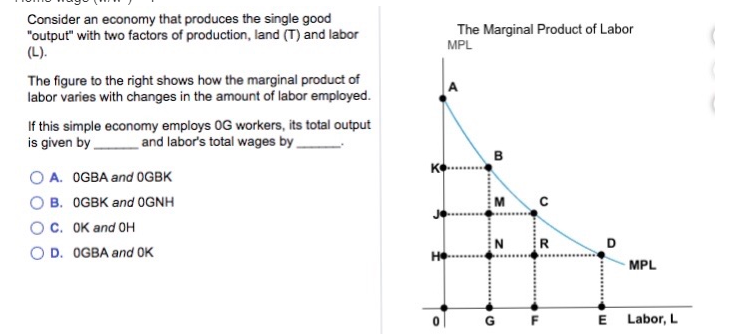

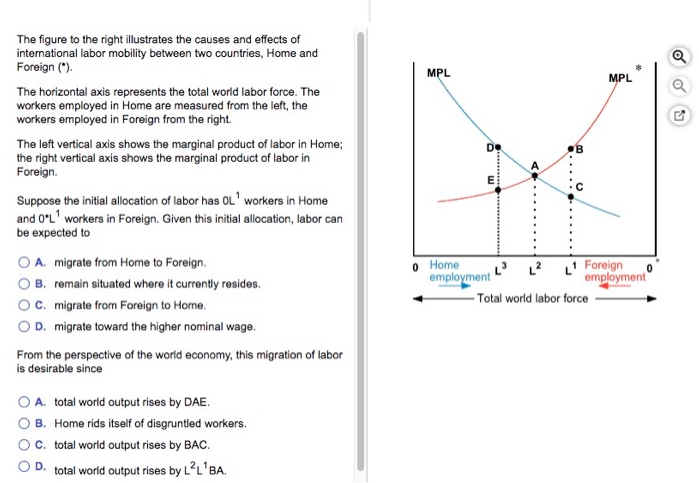

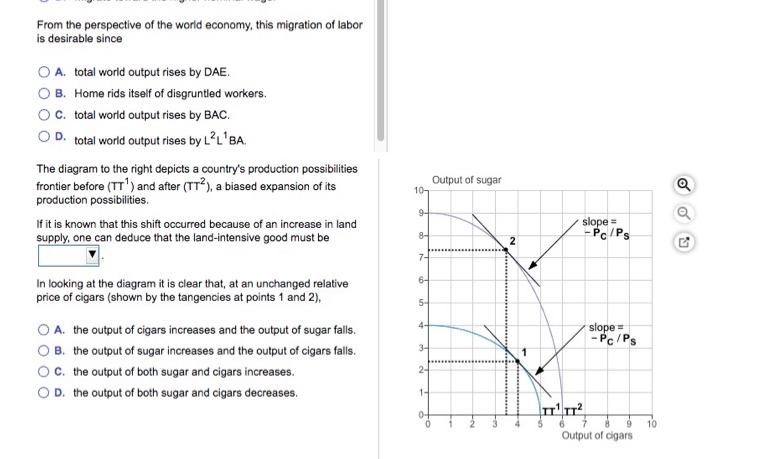

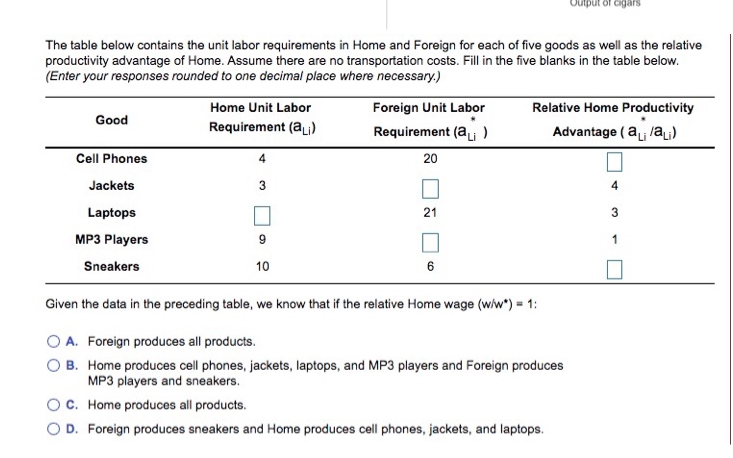

1. Acquisition analysis at 1 July 2019: Net fair value of identifiable assets and liabilities acquired = $100 000 + $50 000 + $150 000 (equity) = $300 000 6. Consideration transferred = $120 000 + 100 000 x $2 = $320 000 8. Goodwill = $320 000 - $300 000 $20 000 2. Journal entries of Kangeroo Lid regognise the investment in kola limited 1 Jul 2022 Shares in Kola Ltd Dr 320 000 Cash Cr 120 000 Share capital Cr 200 000 Acquisition expenses Dr 25 000 Share capital Dr 5 000 Cash Cr 30 000 The acquisition-related costs are not part of the consideration transferred as those amounts are not paid to the former shareholders of Kola Lid in exchange of their shares. Therefore, they are not recognised as part of the investment in Kola Lid: the share issue costs are treated as a reduction in the share capital (as all the share issue costs), while the remaining costs are recognised as expenses in the year of acquisition. 3. Consolidation worksheet entries at 1 July 2022There is a BCVR entry only for goodwill identified in the acquisition analysis as all the identifiable assets and liabilities of Kola Lid were recorded at amounts equal to their fair values at acquisition date. Goodwill Dr 20 000 Business combination valuation reserve Cr 20 000 Pre-acquisition entry at 1 July 2022: Retained earnings (1/7/22) Dr 150 000 Share capital Dr 100 000 General reserve Dr 50 000 Business combination valuation reserve Dr 20 000 Shares in Kola Ltd Cr 320 000 The pre-acquisition entry eliminates the pre-acquisition equity (including the business combination valuation reserve recognised for the goodwill acquired) against the investment account recognised by the parent based on the consideration transferred. Please note that if the fair value of the consideration transferred would have been less than the net fair value at acquisition date of identifiable assets acquired and liabilities assumed, the acquisition analysis will identify a gain on bargain purchase instead of a goodwill. Therefore, there won't be any BCVR entries in that case and the pre-acquisition entry will need to eliminate the retained earnings, share capital and the general reserve of the subsidiary at acquisition date, together with the investment account recognised by the parent and recognise the gain on bargain purchase. For example, if the fair value of the consideration transferred would have been $270 000, the gain on bargain purchase would have been $30 000 and theonly consolidation worksheet entry would have been the following pre-acquisition entry: Retained earnings (1/7/22) Dr 150000 Share capital Dr 100000 General reserve Dr 50 000 Gain on bargain purchase Cr 30 000 The pre-acquisition entry eliminates the pre-acquisition equity (including the business combination valuation reserve recognised for the goodwill acquired) against the investment account recognised by the parent based on the consideration transferred. Please note that if the fair value of the consideration transferred would have been less than the net fair value at acquisition date of identifiable assets acquired and liabilities assumed, the acquisition analysis will identify a gain on bargain purchase instead of a goodwill. Therefore, there won't be any BCVR entries in that case and the pre-acquisition entry will need to eliminate the retained earnings, share capital and the general reserve of the subsidiary at acquisition date, together with the investment account recognised by the parent and recognise the gain on bargain purchase. For example, if the fair value of the consideration transferred would have been $270 000, the gain on bargain purchase would have been $30 000 and the only consolidation worksheet entry would have been the following pre-acquisition entry: Retained earnings (1/7/22) Dr 150 000 Share capital Dr 100 000 General reserve Dr 50 000 Gain on bargain purchase Cr 30 000 Shares In Kola Ltd Cr 2700001. 1. Consider an economy that produces the single good"output" with two factors of production, land {T} and labor (L). The gure to the n'ght shows how the marginal product of labor varies with changes in the amount of labor employed. If this simple economy employs O G womers, its total output is given by and labor's total wages by 2. The gure to the right illustrates the causes and effects of international labor mobility between two countries, Home and Foreign {*1 The horizontal axis represents the total wond labor force. The workers employed in Home are measured from the left. the workers employed in Foreign from the right. The left vertical axis shows the marginal product of labor in Home; the right vertical axis shows the marginal product of labor in Foreign. Suppose the initial allocation of labor has [II L1 workers in Home and 0*L'l workers in Foreign. Given this initial allocation, labor can be expected to 3. The diagram to the n'ght depicts a country's production possibilities frontier before {TH} and after ('II'E}, a biased expansion of its production possibilities. If it is known that this shi occurred because of an increase in land supply, one can deduce that the landintensive good must be 4. The table below contains the unit labor requirements in Home and Foreign for each of ve goods as well as the relative productivity advantage of Home. Assume there are no transportation costs. Fill in the ve blanks in the table below. {Enter your responses rounded to one decimal place where necessary.) Given the data in the preceding table, we know that 'rfthe relative Home wage (wiv) = 1