Answered step by step

Verified Expert Solution

Question

1 Approved Answer

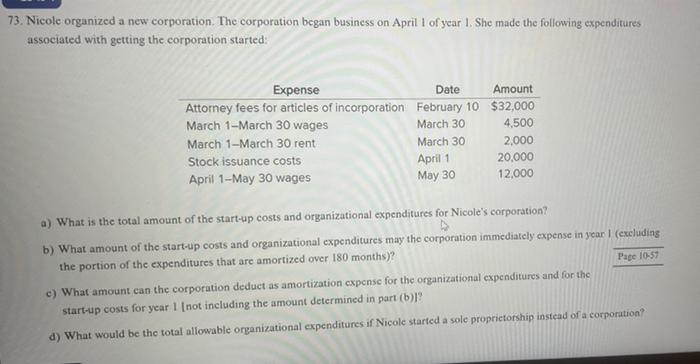

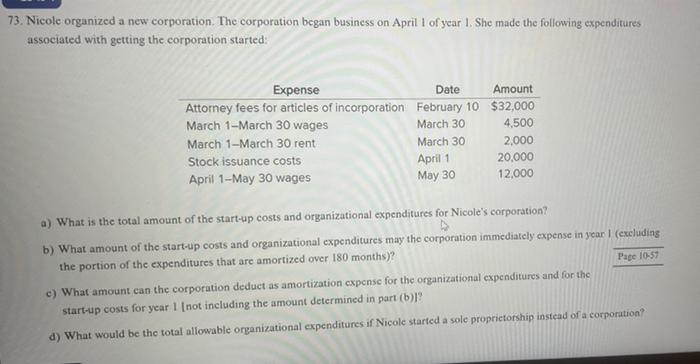

solve please 73. Nicole organized a new corporation. The corporation began business on April 1 of year I. She made the following expenditures associated with

solve please

73. Nicole organized a new corporation. The corporation began business on April 1 of year I. She made the following expenditures associated with getting the corporation started: Expense Date Amount Attorney fees for articles of incorporation February 10 $32,000 March 1-March 30 wages March 30 4,500 March 1-March 30 rent March 30 2,000 Stock issuance costs April 1 20.000 April 1-May 30 wages 12,000 May 30 a) What is the total amount of the start-up costs and organizational expenditures for Nicole's corporation? b) What amount of the start-up costs and organizational expenditures may the corporation immediately expense in year (excluding the portion of the expenditures that are amortized over 180 months)? Page 1057 c) What amount can the corporation deduct as amortization cxpense for the organizational expenditures and for the start-up costs for year 1 (not including the amount determined in part (b)l? d) What would be the total allowable organizational expenditures if Nicole started a sole proprietorship instead of a corporation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started