Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve please Entries for HTM Debt Securities: Effective Interest Method On fuly 1 of Yeac 1. West Company purchased for cash, eight $10,000 bonds of

solve please

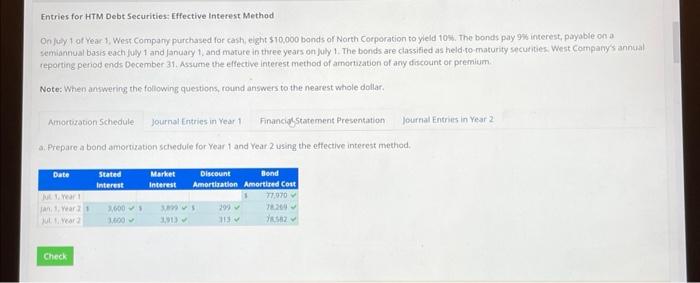

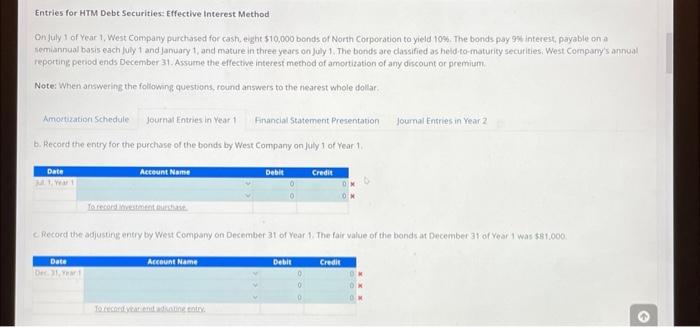

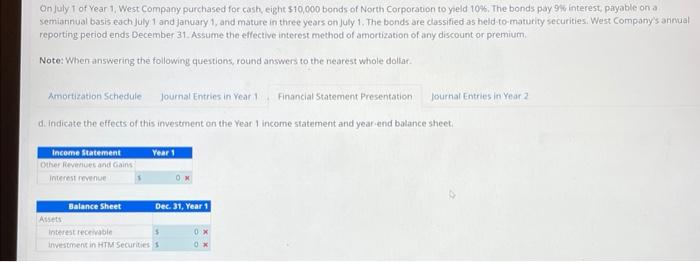

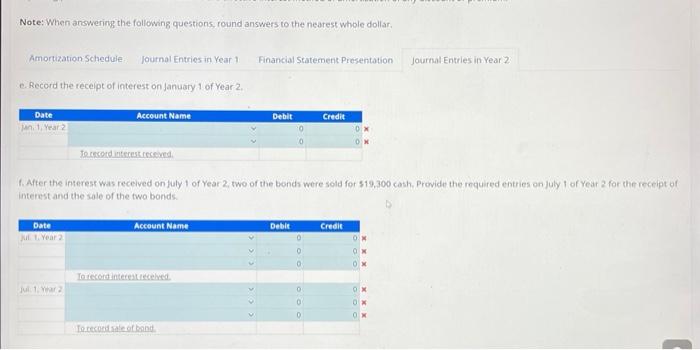

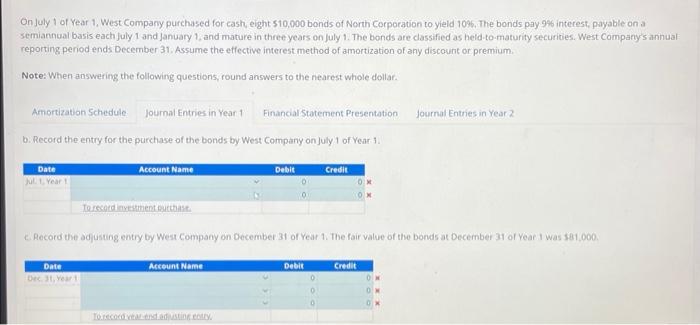

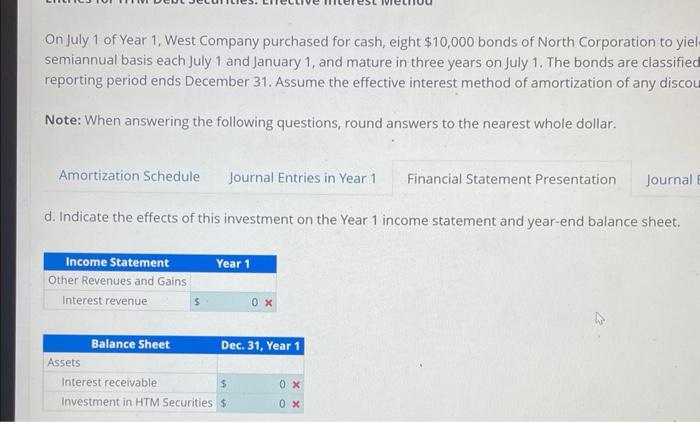

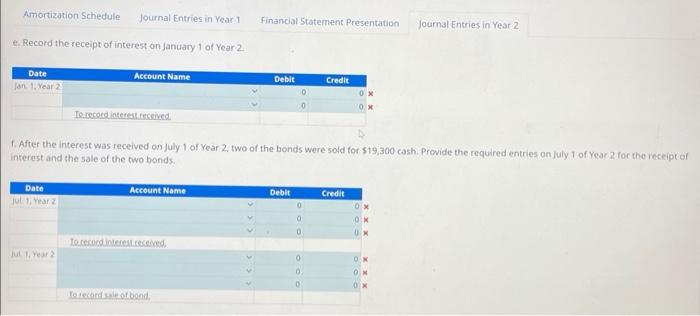

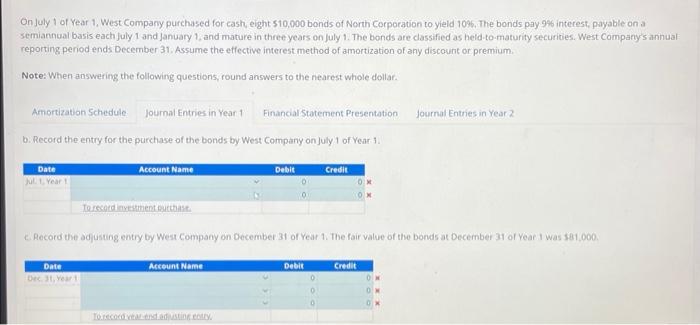

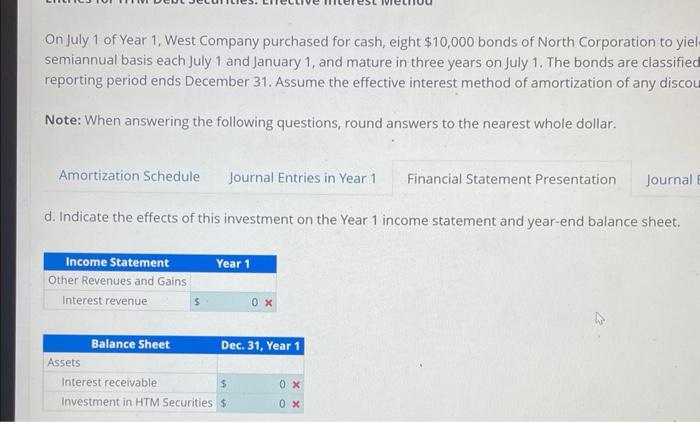

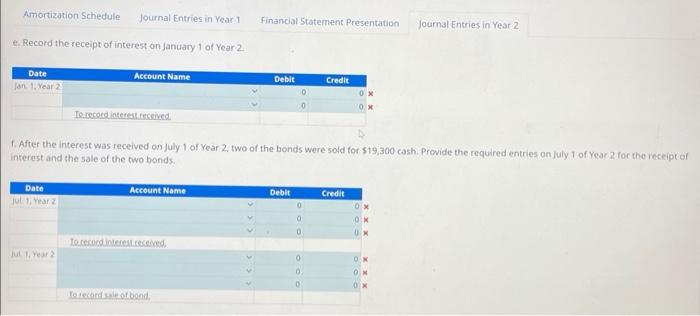

Entries for HTM Debt Securities: Effective Interest Method On fuly 1 of Yeac 1. West Company purchased for cash, eight $10,000 bonds of North Corporation to yield 105. . The bonds pay 95 interest, paysbie on a semiannual basis each july 1 and january 1 . and marure in theree years on july 1 . The bonds are ctassified as held-to-maturity secutities. West Compariy's annekal reporting period ends December 31. Assume the effective interest method of amortization of any ditcount of premium. Note: When answering the following questions, round answers to the nearest whole dollar: a. Prepare a bond amortiabion schedule for Year.1 and Year 2 using the effective interest method. Entries for HTM Debt Securities: Effective Interest Method Ow july 1 of Year 1, West company purctused for cash, eight 510,000 bonds of North Corporation to yield 105 . The bonds pay 95 interest, payable on a nemiannual basis each july 1 and january 1 , and mature in three years on July 1 . The bonds are classified as heid-to-maturity secufitiesi West cornpary's annoal reporting period ends December 31. Assuine the effective interest method of amortization of any discount or premium. Note: When answering the following questions, round answers to the nearest whole dollaf. b. Record the entry for the purchase of the bonds by West Company on july 1 of Year 1 , c. Recocd the adjusting entry by West Company on Desember 31 of Year 1 . The fair value of the bonds at December 31 of Year 1 was $31000. On july 1 of Year 1. West Company purchased for cash, eight $10,000 bonds of North Corporation to yeld 10%, The bonds pay 9 in interest, payable on a semiannual basis each july 1 and january 1 , and mature in three years on july 1 , The bonds are classified-as held-to-maturity securities. West Companys annual reporting period ends December 31. Assume the effective interest method of amortization of any discount or premium. Note: When answering the following questions, round answers to the nearest whole doliar. du indicate the effects of this investment on the Year 1 incorne statement and year eand balance sheet. e. Record the recelpt of interest on Januaty 1 of Year 2. f. After the interest was received onjuly 1 of Year 2 ; two of the bonds were sold for 519,300 cosh, Provide the required entries on july 1 of Year 2 for the receipt of interest and the sole of the fwo bonds. On July 1 of Year 1. West Company purehased for cash, eight 510,000 bonds of North Corporation to yield 1096, The bonds pay 9% interest, payable on a semiannual basis each july 1 and January 1 , and mature in three years on July 1 . The bonds are cassified as held-to-maturity securities. West Company's annual reporting period ends December 31 . Assume the effective interest method of amortization of any discount or premium. Note: When answering the following questions, round answers to the nearest whole dollar. b. Record the entry for the purchase of the bonds by West Compiny on July 1 of Year 1. c. Record the adjusting entry by West Company on December 31 of Year 1. The fair value of the bonds at December 31 of Year 1 was s si, ooe. On July 1 of Year 1. West Company purchased for cash, eight $10,000 bonds of North Corporation to yiel semiannual basis each July 1 and January 1 , and mature in three years on July 1 . The bonds are classifiec reporting period ends December 31 . Assume the effective interest method of amortization of any discou Note: When answering the following questions, round answers to the nearest whole dollar. d. Indicate the effects of this investment on the Year 1 income statement and year-end balance sheet. Record the receipt of interest on Januaty 1 of Year 2 1. After the interest was received on july 1 of Year 2 two of the bonds were sold for $19,300 cash. Previde the required entries on july 1 of Year 2 for the receipt of interest and the sale of the two bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started