Answered step by step

Verified Expert Solution

Question

1 Approved Answer

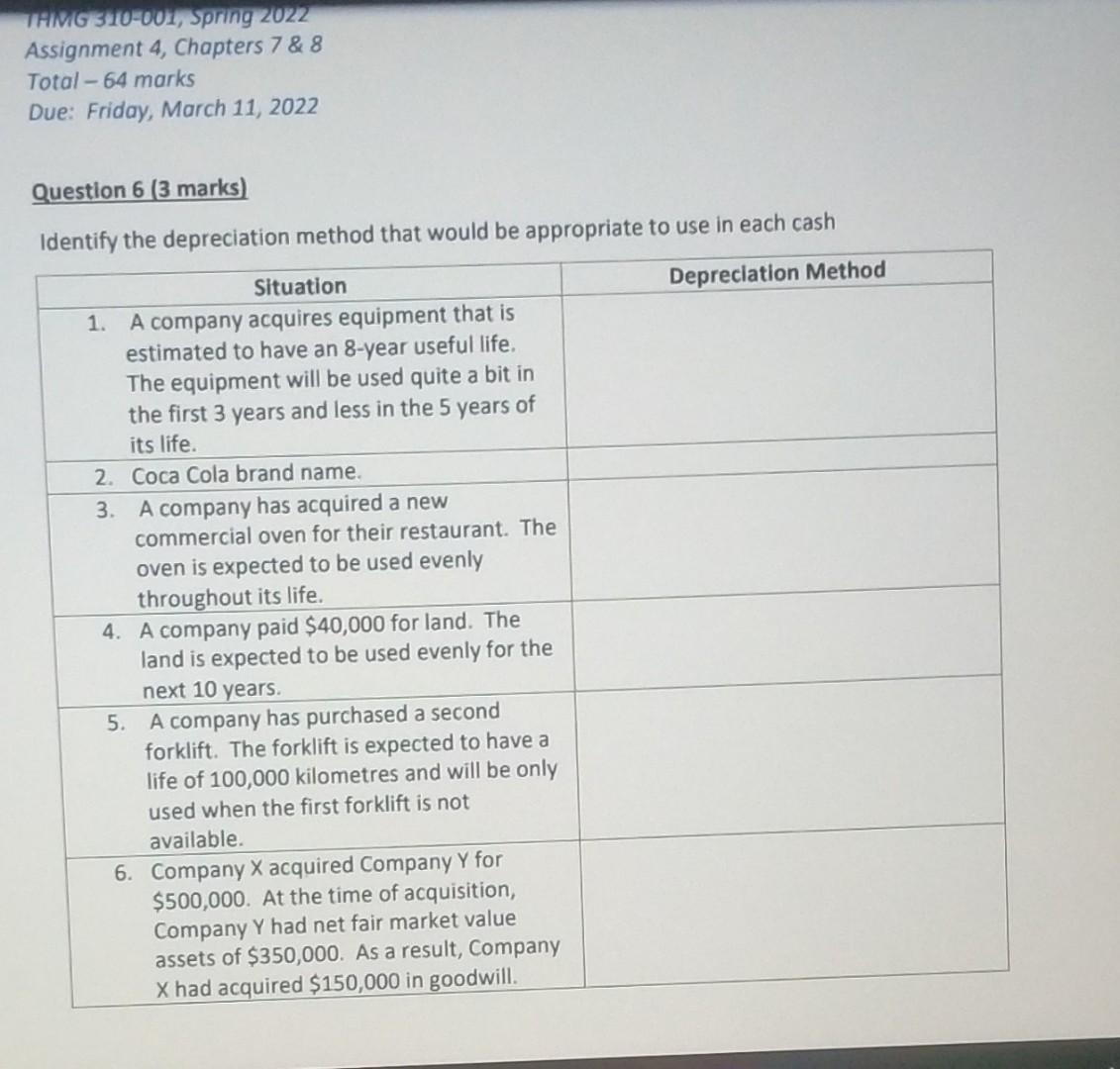

solve properly THMG 310-001, Spring 2022 Assignment 4, Chapters 7 & 8 Total - 64 marks Due: Friday, March 11, 2022 Question 6 (3 marks)

solve properly

THMG 310-001, Spring 2022 Assignment 4, Chapters 7 & 8 Total - 64 marks Due: Friday, March 11, 2022 Question 6 (3 marks) Identify the depreciation method that would be appropriate to use in each cash Depreciation Method Situation 1. A company acquires equipment that is estimated to have an 8-year useful life. The equipment will be used quite a bit in the first 3 years and less in the 5 years of its life. 2. Coca Cola brand name. 3. A company has acquired a new commercial oven for their restaurant. The oven is expected to be used evenly throughout its life. 4. A company paid $40,000 for land. The land is expected to be used evenly for the next 10 years. 5. A company has purchased a second forklift. The forklift is expected to have a life of 100,000 kilometres and will be only used when the first forklift is not available. 6. Company X acquired Company Y for $500,000. At the time of acquisition, Company Y had net fair market value assets of $350,000. As a result, Company X had acquired $150,000 in goodwillStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started