Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve Q13 in 40 mins i will give thumb up The graph above shows a hypothetical demand function for federal funds on a particular day.

solve Q13 in 40 mins i will give thumb up

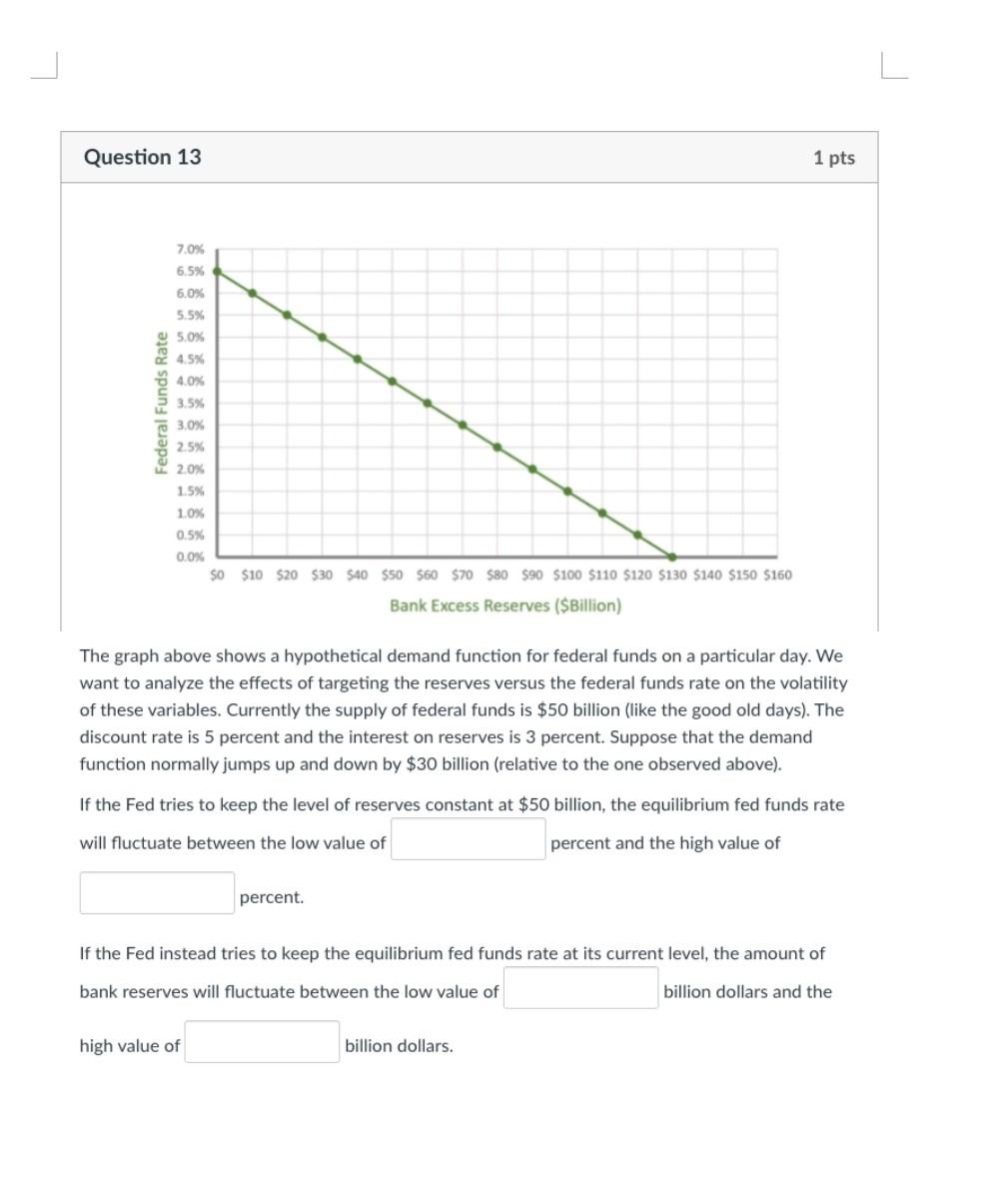

The graph above shows a hypothetical demand function for federal funds on a particular day. We want to analyze the effects of targeting the reserves versus the federal funds rate on the volatility of these variables. Currently the supply of federal funds is $50 billion (like the good old days). The discount rate is 5 percent and the interest on reserves is 3 percent. Suppose that the demand function normally jumps up and down by $30 billion (relative to the one observed above). If the Fed tries to keep the level of reserves constant at $50 billion, the equilibrium fed funds rate will fluctuate between the low value of percent and the high value of percent. If the Fed instead tries to keep the equilibrium fed funds rate at its current level, the amount of bank reserves will fluctuate between the low value of billion dollars and the high value of billion dollarsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started