Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve Q16 Q17 in 60 mins i will give thumb up Assume the following: Current Actual Inflation Rate =2% Potential Real GDP =100,000 Actual Real

solve Q16 Q17 in 60 mins i will give thumb up

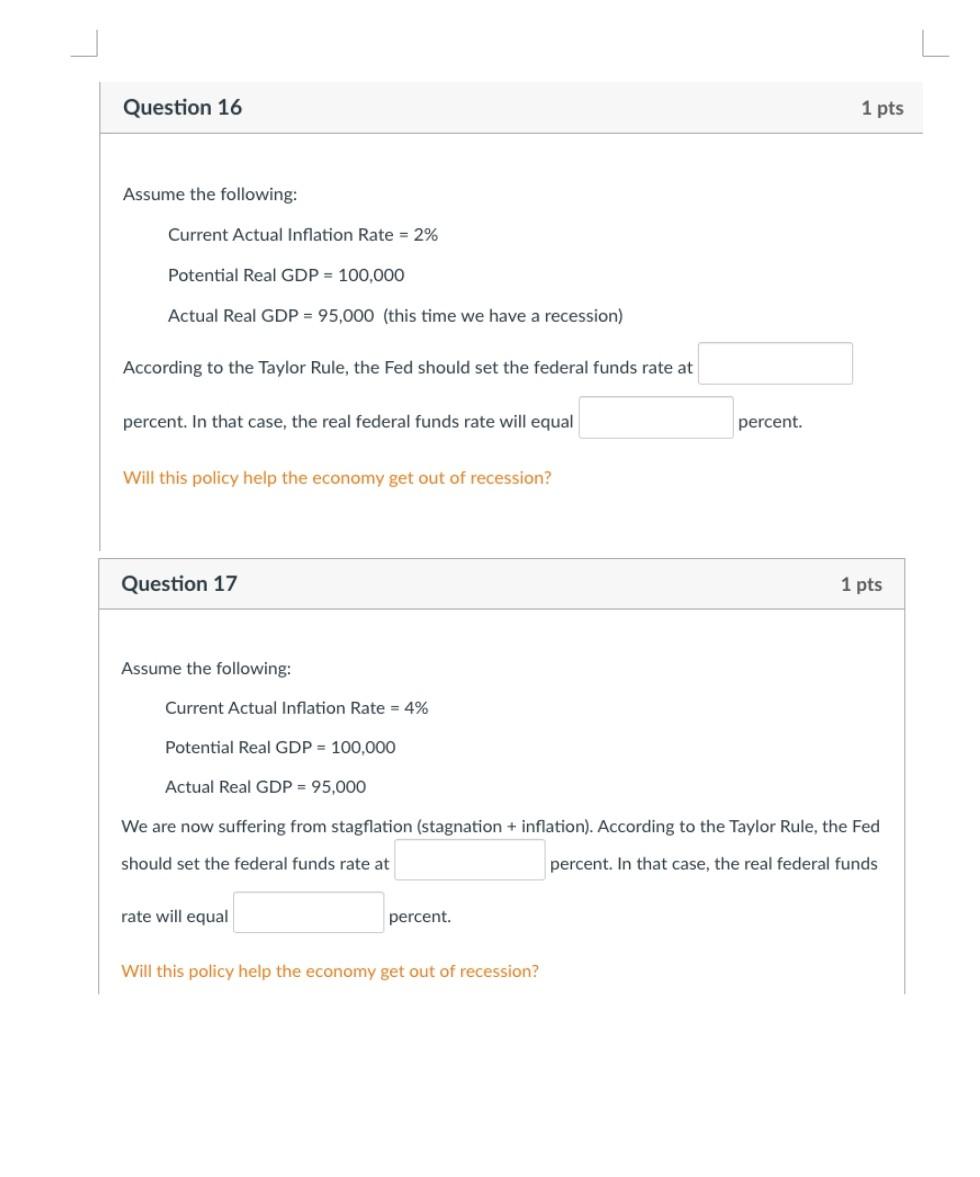

Assume the following: Current Actual Inflation Rate =2% Potential Real GDP =100,000 Actual Real GDP =95,000 (this time we have a recession) According to the Taylor Rule, the Fed should set the federal funds rate at percent. In that case, the real federal funds rate will equal percent. Will this policy help the economy get out of recession? Question 17 1 pts Assume the following: Current Actual Inflation Rate =4% Potential Real GDP =100,000 Actual Real GDP =95,000 We are now suffering from stagflation (stagnation + inflation). According to the Taylor Rule, the Fed should set the federal funds rate at percent. In that case, the real federal funds rate will equal percent. Will this policy help the economy get out of recession? Assume the following: Current Actual Inflation Rate =2% Potential Real GDP =100,000 Actual Real GDP =95,000 (this time we have a recession) According to the Taylor Rule, the Fed should set the federal funds rate at percent. In that case, the real federal funds rate will equal percent. Will this policy help the economy get out of recession? Question 17 1 pts Assume the following: Current Actual Inflation Rate =4% Potential Real GDP =100,000 Actual Real GDP =95,000 We are now suffering from stagflation (stagnation + inflation). According to the Taylor Rule, the Fed should set the federal funds rate at percent. In that case, the real federal funds rate will equal percent. Will this policy help the economy get out of recessionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started