Answered step by step

Verified Expert Solution

Question

1 Approved Answer

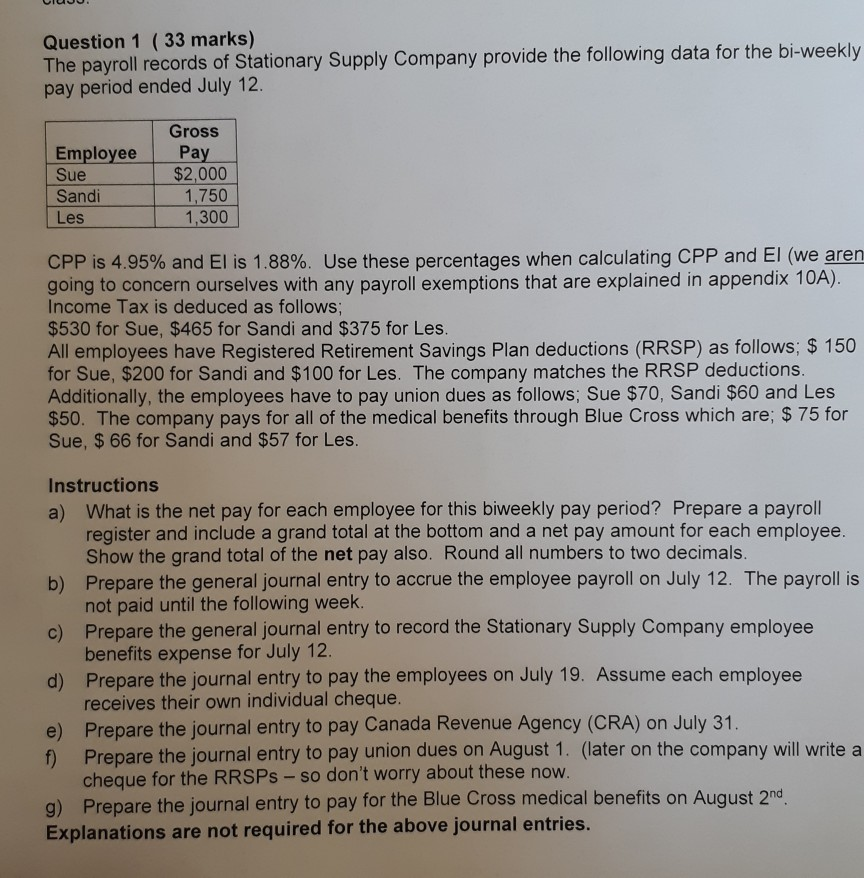

solve question 1 Question 1 (33 marks) The pareroll records of Stationary Supply Company provide the following data for the bi-weekly pay period ended July

solve question 1

Question 1 (33 marks) The pareroll records of Stationary Supply Company provide the following data for the bi-weekly pay period ended July 12 Gross Employee Pay Sue Sandi Les $2,000 1,750 1,300 CPP is 4.95% and El is 1.88%. Use these percentages when calculating CPP and EI (we aren going to concern ourselves with any payroll exemptions that are explained in appendix 10A) Income Tax is deduced as follows $530 for Sue, $465 for Sandi and $375 for Les. All employees have Registered Retirement Savings Plan deductions (RRSP) as follows; $ 150 for Sue, $200 for Sandi and $100 for Les. The company matches the RRSP deductions Additionally, the employees have to pay union dues as follows; Sue $70, Sandi $60 and Les $50. The company pays for all of the medical benefits through Blue Cross which are; $ 75 for Sue, $66 for Sandi and $57 for Les Instructions a) What is the net pay for each employee for this biweekly pay period? Prepare a payroll b) c) d) e) register and include a grand total at the bottom and a net pay amount for each employee. Show the grand total of the net pay also. Round all numbers to two decimals. Prepare the general journal entry to accrue the employee payroll on July 12. The payroll is not paid until the following week. Prepare the general journal entry to record the Stationary Supply Company employee benefits expense for July 12 Prepare the journal entry to pay the employees on July 19. Assume each employee receives their own individual cheque Prepare the journal entry to pay Canada Revenue Agency (CRA) on July 31 Prepare the journal entry to pay union dues on August 1. (later on the company will write a cheque for the RRSPs - so don't worry about these now Prepare the journal entry to pay for the Blue Cross medical benefits on August 2nd f) g) Explanations are not required for the above journal entries. Question 1 (33 marks) The pareroll records of Stationary Supply Company provide the following data for the bi-weekly pay period ended July 12 Gross Employee Pay Sue Sandi Les $2,000 1,750 1,300 CPP is 4.95% and El is 1.88%. Use these percentages when calculating CPP and EI (we aren going to concern ourselves with any payroll exemptions that are explained in appendix 10A) Income Tax is deduced as follows $530 for Sue, $465 for Sandi and $375 for Les. All employees have Registered Retirement Savings Plan deductions (RRSP) as follows; $ 150 for Sue, $200 for Sandi and $100 for Les. The company matches the RRSP deductions Additionally, the employees have to pay union dues as follows; Sue $70, Sandi $60 and Les $50. The company pays for all of the medical benefits through Blue Cross which are; $ 75 for Sue, $66 for Sandi and $57 for Les Instructions a) What is the net pay for each employee for this biweekly pay period? Prepare a payroll b) c) d) e) register and include a grand total at the bottom and a net pay amount for each employee. Show the grand total of the net pay also. Round all numbers to two decimals. Prepare the general journal entry to accrue the employee payroll on July 12. The payroll is not paid until the following week. Prepare the general journal entry to record the Stationary Supply Company employee benefits expense for July 12 Prepare the journal entry to pay the employees on July 19. Assume each employee receives their own individual cheque Prepare the journal entry to pay Canada Revenue Agency (CRA) on July 31 Prepare the journal entry to pay union dues on August 1. (later on the company will write a cheque for the RRSPs - so don't worry about these now Prepare the journal entry to pay for the Blue Cross medical benefits on August 2nd f) g) Explanations are not required for the above journal entriesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started