Solve question 20 parts A-X, here is the problems and I need to input them into the attached excel format. Any help would be greatly appreciated.

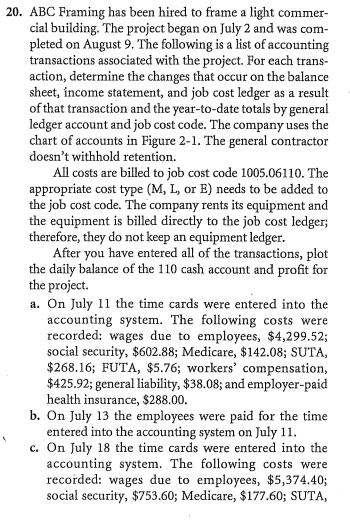

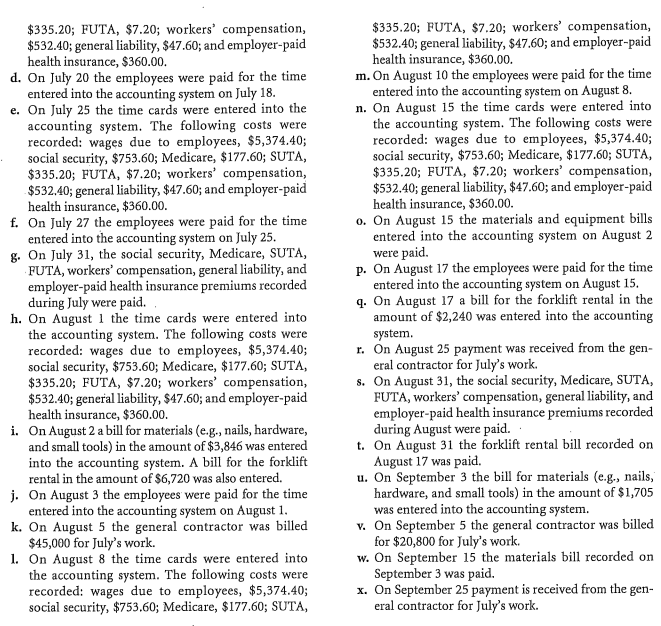

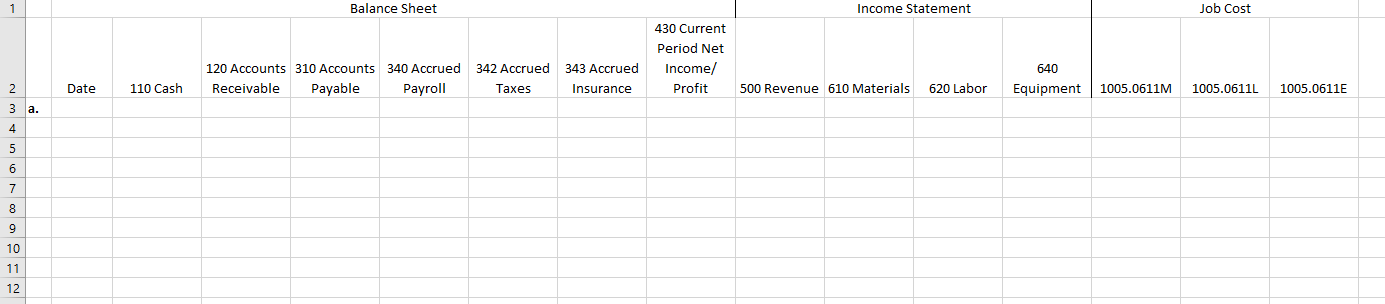

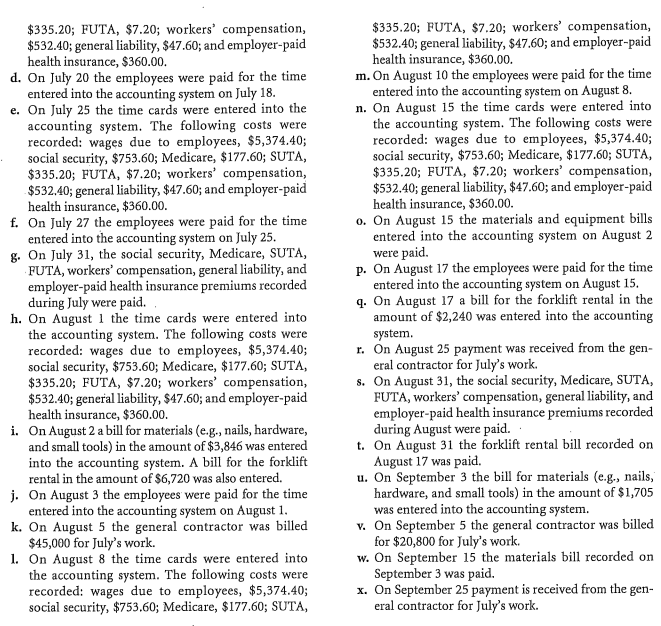

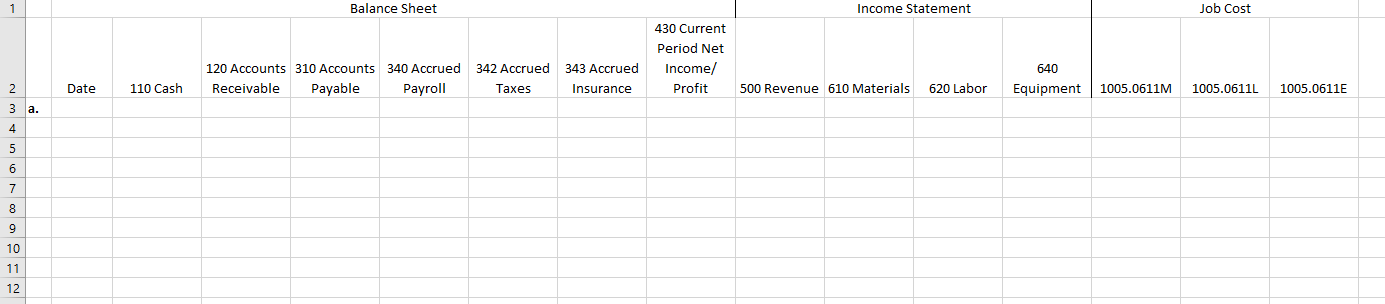

20. ABC Framing has been hired to frame a light commer- cial building. The project began on July 2 and was com pleted on August 9. The following is a list of accounting transactions associated with the project. For each trans- action, determine the changes that occur on the balance sheet, income statement, and job cost ledger as a result of that transaction and the year-to-date totals by general ledger account and job cost code. The company uses the chart of accounts in Figure 2-1. The general contractor doesn't withhold retention All costs are billed to job cost code 1005.06110. The appropriate cost type (M, L, or E) needs to be added to the job cost code. The company rents its equipment and the equipment is billed directly to the job cost ledger; therefore, they do not keep an equipment ledger After you have entered all of the transactions, plot the daily balance of the 110 cash account and profit for the project a. On July 11 the time cards were entered into the accounting system. The following costs were recorded: wages due to employees, $4,299.52; social security, $602.88; Medicare, $142.08; SUTA $268.16; FUTA, $5.76; workers' compensation, $425.92; general liability, $38.08; and employer-paid health insurance, $288.00 b. On July 13 the employees were paid for the time entered into the accounting system on July 11 c. On July 18 the time cards were entered into the accounting system. The following costs were recorded: wages due to employees, $5,374.40; social security, $753.60; Medicare, $177.60; SUTA, $335.20; FUTA, $7.20; workers' compensation, $532.40; general liability, $47.60; and employer-paid health insurance, $360.00 m. On August 10 the employees were paid for the time entered into the accounting system on August 8. n. On August 15 the time cards were entered into the accounting system. The following costs were recorded: wages due to employees, $5,374.40 social security, $753.60; Medicare, $177.60; SUTA $335.20; FUTA, $7.20; workers' compensation $532.40; general liability, $47.60; and employer-paid health insurance, $360.00 o. On August 15 the materials and equipment bills entered into the accounting system on August 2 were paid p. On August 17 the employees were paid for the time entered into the accounting system on August 15 q. On August 17 a bill for the forklift rental in the amount of $2,240 was entered into the accounting system r. On August 25 payment was received from the gen eral contractor for July's work. s. On August 31, the social security, Medicare, SUTA FUTA, workers' compensation, general liability, and employer-paid health insurance premiums recorded during August were paid t. On August 31 the forklift rental bill recorded on August 17 was paid u. On September 3 the bill for materials (e.g., nails, hardware, and small tools) in the amount of $1,705 was entered into the accounting system v. On September 5 the general contractor was billed for $20,800 for July's work. w. On September 15 the materials bill recorded on September 3 was paid. x. On September 25 payment is received from the eral contractor for July's work $335.20; FUTA, $7.20; workers' compensation, $532.40; general liability, $47.60; and employer-paid health insurance, $360.00. d. On July 20 the employees were paid for the time entered into the accounting system on July 18. e. On July 25 the time cards were entered into the accounting system. The following costs were recorded: wages due to employees, $5,374.40; social security, $753.60; Medicare, $177.60; SUTA, $335.20; FUTA, $7.20; workers' compensation, $532.40; general liability, $47.60; and employer-paid health insurance, $360.00. f. On July 27 the employees were paid for the time entered into the accounting system on July 25 g. On July 31, the social security, Medicare, SUTA, FUTA, workers' compensation, general liability, and employer-paid health insurance premiums recorded during July were paid. h. On August 1 the time cards were entered into the accounting system. The following costs were recorded: wages due to employees, $5,374.40; social security, $753.60; Medicare, $177.60; SUTA $335.20; FUTA, $7.20; workers' compensation, $532.40; general liability, $47.60; and employer-paid health insurance, $360.00. i. On August 2 a bill for materials (e.g., nails, hardware, and small tools) in the amount of $3,846 was entered into the accounting system. A bill for the forklift rental in the amount of $6,720 was also entered. j. On August 3 the employees were paid for the time entered into the accounting system on August 1 k. On August 5 the general contractor was billed $45,000 for July's work 1. On August 8 the time cards were entered into the accounting system. The following costs were recorded: wages due to employees, $5,374.40 social security, $753.60; Medicare, $177.60; SUTA gen- Balance Sheet Job Cost Income Statement 430 Current Period Net 120 Accounts 340 Accrued 342 Accrued Income/ 310 Accounts 343 Accrued 640 620 Labor 1005.0611L 110 Cash Receivable Payable Payroll Profit 500 Revenue 610 Materials 1005.0611E 2 Date xes Insurance Equipment 1005.0611M 4 6 7 10 11 12 20. ABC Framing has been hired to frame a light commer- cial building. The project began on July 2 and was com pleted on August 9. The following is a list of accounting transactions associated with the project. For each trans- action, determine the changes that occur on the balance sheet, income statement, and job cost ledger as a result of that transaction and the year-to-date totals by general ledger account and job cost code. The company uses the chart of accounts in Figure 2-1. The general contractor doesn't withhold retention All costs are billed to job cost code 1005.06110. The appropriate cost type (M, L, or E) needs to be added to the job cost code. The company rents its equipment and the equipment is billed directly to the job cost ledger; therefore, they do not keep an equipment ledger After you have entered all of the transactions, plot the daily balance of the 110 cash account and profit for the project a. On July 11 the time cards were entered into the accounting system. The following costs were recorded: wages due to employees, $4,299.52; social security, $602.88; Medicare, $142.08; SUTA $268.16; FUTA, $5.76; workers' compensation, $425.92; general liability, $38.08; and employer-paid health insurance, $288.00 b. On July 13 the employees were paid for the time entered into the accounting system on July 11 c. On July 18 the time cards were entered into the accounting system. The following costs were recorded: wages due to employees, $5,374.40; social security, $753.60; Medicare, $177.60; SUTA, $335.20; FUTA, $7.20; workers' compensation, $532.40; general liability, $47.60; and employer-paid health insurance, $360.00 m. On August 10 the employees were paid for the time entered into the accounting system on August 8. n. On August 15 the time cards were entered into the accounting system. The following costs were recorded: wages due to employees, $5,374.40 social security, $753.60; Medicare, $177.60; SUTA $335.20; FUTA, $7.20; workers' compensation $532.40; general liability, $47.60; and employer-paid health insurance, $360.00 o. On August 15 the materials and equipment bills entered into the accounting system on August 2 were paid p. On August 17 the employees were paid for the time entered into the accounting system on August 15 q. On August 17 a bill for the forklift rental in the amount of $2,240 was entered into the accounting system r. On August 25 payment was received from the gen eral contractor for July's work. s. On August 31, the social security, Medicare, SUTA FUTA, workers' compensation, general liability, and employer-paid health insurance premiums recorded during August were paid t. On August 31 the forklift rental bill recorded on August 17 was paid u. On September 3 the bill for materials (e.g., nails, hardware, and small tools) in the amount of $1,705 was entered into the accounting system v. On September 5 the general contractor was billed for $20,800 for July's work. w. On September 15 the materials bill recorded on September 3 was paid. x. On September 25 payment is received from the eral contractor for July's work $335.20; FUTA, $7.20; workers' compensation, $532.40; general liability, $47.60; and employer-paid health insurance, $360.00. d. On July 20 the employees were paid for the time entered into the accounting system on July 18. e. On July 25 the time cards were entered into the accounting system. The following costs were recorded: wages due to employees, $5,374.40; social security, $753.60; Medicare, $177.60; SUTA, $335.20; FUTA, $7.20; workers' compensation, $532.40; general liability, $47.60; and employer-paid health insurance, $360.00. f. On July 27 the employees were paid for the time entered into the accounting system on July 25 g. On July 31, the social security, Medicare, SUTA, FUTA, workers' compensation, general liability, and employer-paid health insurance premiums recorded during July were paid. h. On August 1 the time cards were entered into the accounting system. The following costs were recorded: wages due to employees, $5,374.40; social security, $753.60; Medicare, $177.60; SUTA $335.20; FUTA, $7.20; workers' compensation, $532.40; general liability, $47.60; and employer-paid health insurance, $360.00. i. On August 2 a bill for materials (e.g., nails, hardware, and small tools) in the amount of $3,846 was entered into the accounting system. A bill for the forklift rental in the amount of $6,720 was also entered. j. On August 3 the employees were paid for the time entered into the accounting system on August 1 k. On August 5 the general contractor was billed $45,000 for July's work 1. On August 8 the time cards were entered into the accounting system. The following costs were recorded: wages due to employees, $5,374.40 social security, $753.60; Medicare, $177.60; SUTA gen- Balance Sheet Job Cost Income Statement 430 Current Period Net 120 Accounts 340 Accrued 342 Accrued Income/ 310 Accounts 343 Accrued 640 620 Labor 1005.0611L 110 Cash Receivable Payable Payroll Profit 500 Revenue 610 Materials 1005.0611E 2 Date xes Insurance Equipment 1005.0611M 4 6 7 10 11 12