solve question 5 please

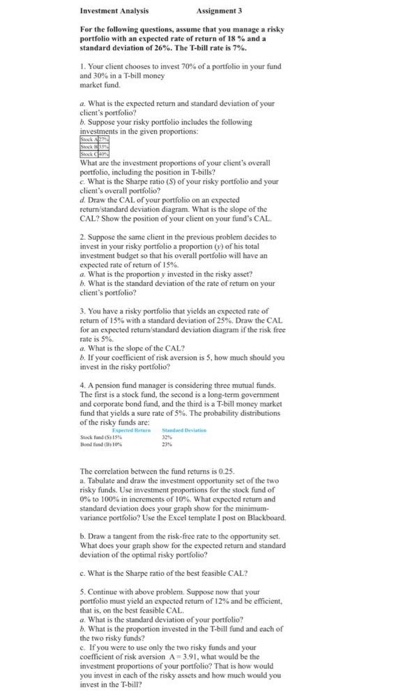

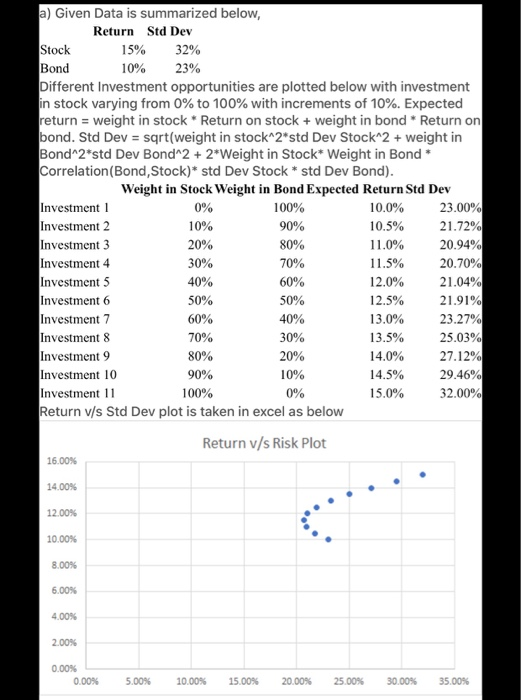

Investment Analysis Assignment 3 For the following questions, assume that you manage a risky portfolio with an expected rate of return of 18% and a standard deviation of 26%. The T-bill rate is 7% 1. Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund What is the expected return and standard deviation of your client's profolio Suppose your risky portfolio includes the following investments in the given proportions: What are the investment proportions of your client's overall portfolio, including the position in T-bills? What is the Sharpe ratio (S) of your risky portfolio and your client's overall portfolio? . Draw the CAL of your portfolio on an expected retur standard deviation diagram. What is the slope of the CAL? Show the position of your client on your fund's CAL 2. Suppose the same client in the previous problem decides to invest in your risky portfolio a proportion of his total investment budget so that his overall portfolio will have an expected rate of return of 15% What is the proportion y invested in the risky asset? h. What is the standard deviation of the rate of retum on your client's portfolio? 3. You have a risky portfolio that yields an d rate of return of 15% with a standard deviation of 25% Draw the CAL for an expected return standard deviation diagram of the risk free rate is 5% What is the slope of the CAL? If your coefficient of risk aversion is 5. how much should you invest in the risky portfolio? 4. A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-ball money market fund that yields a sure rate of 5%. The probability distributions of the risky funds are: The correlation between the fund returns is 0.25 a. Tabulate and draw the investment opportunity set of the two risky funds. Use investment proportions for the stock fund of 0% to 100% in increments of 10% What expected return and standard deviation does your graph show for the minimum variance portfolio? Use the Excel template post on Blackboard b. Draw a tangent from the risk-free rate to the opportunity set What does your graph show for the expected return and standard deviation of the optimal risky portfolio c. What is the Sharpe ratio of the best feasible CAL? 5Continue with above problem. Support now that you portfolio must yield an expected return of 12% and be efficient, that is on the best feasible CAL a. What is the standard deviation of your portfolio h What is the proportion invested in the ball fund and each of the two risky funds? e. If you were to use only the two risky funds and your coeficient of risk anversion - 1.91, what would be the investment proportions of your portfolio? That is how would you invest in each of the risky assets and how much would you invest in the T-bill? a) Given Data is summarized below, Return Std Dev Stock 15% 32% Bond 10% 23% Different Investment opportunities are plotted below with investment in stock varying from 0% to 100% with increments of 10%. Expected return = weight in stock Return on stock + weight in bond Return on bond. Std Dev = sqrt(weight in stock^2*std Dev Stock^2 + weight in Bond^2*std Dev Bond^2 + 2*Weight in Stock* Weight in Bond Correlation(Bond, Stock)* std Dev Stock * std Dev Bond). Weight in Stock Weight in Bond Expected Return Std Dev Investment ! 0% 100% 10.0% 23.00% Investment 2 10% 90% 10.5% 21.72% Investment 3 20% 80% 11.0% 20.94% Investment 4 30% 70% 11.5% 20.70% Investment 5 60% 12.0% 21.04% Investment 6 50% 50% 12.5% 21.91% Investment 7 60% 40% 13.0% 23.27% Investment 8 30% 13.5% 25.03% Investment 9 80% 20% 14.0% 27.12% Investment 10 90% 10% 14.5% 29.46% Investment 11 15.0% 32.00% Return v/s Std Dev plot is taken in excel as below 40% 70% 0% Return v/s Risk Plot 16.00% 14.00% 12.00% 10.00% 8.00% 6.00% 2.00% 0.00% 0.00% 5.00% 10.00% 5.00% 20.00% 25.00% 30.00% 35.00% b) Tangent was drawn from Risk-Free rate to the investment opportunity set. This meets the opportunity set at point 7 (60%- Stock; 40% - Bond). Hence, this is the optimal risky portfolio. Expected return for the portfolio = 13%. Std Dev = 23.27%. Return v/s Risk Plot 16.00% 14.00% 12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% 35.00% c) Sharpe ratio for the best feasible CAL is the slope of the tangent drawn to the investment set i.e. Sharpe Ratio = (E(Rp)-Rf)/std dev(Rp) = 34.38%. Investment Analysis Assignment 3 For the following questions, assume that you manage a risky portfolio with an expected rate of return of 18% and a standard deviation of 26%. The T-bill rate is 7% 1. Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund What is the expected return and standard deviation of your client's profolio Suppose your risky portfolio includes the following investments in the given proportions: What are the investment proportions of your client's overall portfolio, including the position in T-bills? What is the Sharpe ratio (S) of your risky portfolio and your client's overall portfolio? . Draw the CAL of your portfolio on an expected retur standard deviation diagram. What is the slope of the CAL? Show the position of your client on your fund's CAL 2. Suppose the same client in the previous problem decides to invest in your risky portfolio a proportion of his total investment budget so that his overall portfolio will have an expected rate of return of 15% What is the proportion y invested in the risky asset? h. What is the standard deviation of the rate of retum on your client's portfolio? 3. You have a risky portfolio that yields an d rate of return of 15% with a standard deviation of 25% Draw the CAL for an expected return standard deviation diagram of the risk free rate is 5% What is the slope of the CAL? If your coefficient of risk aversion is 5. how much should you invest in the risky portfolio? 4. A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-ball money market fund that yields a sure rate of 5%. The probability distributions of the risky funds are: The correlation between the fund returns is 0.25 a. Tabulate and draw the investment opportunity set of the two risky funds. Use investment proportions for the stock fund of 0% to 100% in increments of 10% What expected return and standard deviation does your graph show for the minimum variance portfolio? Use the Excel template post on Blackboard b. Draw a tangent from the risk-free rate to the opportunity set What does your graph show for the expected return and standard deviation of the optimal risky portfolio c. What is the Sharpe ratio of the best feasible CAL? 5Continue with above problem. Support now that you portfolio must yield an expected return of 12% and be efficient, that is on the best feasible CAL a. What is the standard deviation of your portfolio h What is the proportion invested in the ball fund and each of the two risky funds? e. If you were to use only the two risky funds and your coeficient of risk anversion - 1.91, what would be the investment proportions of your portfolio? That is how would you invest in each of the risky assets and how much would you invest in the T-bill? a) Given Data is summarized below, Return Std Dev Stock 15% 32% Bond 10% 23% Different Investment opportunities are plotted below with investment in stock varying from 0% to 100% with increments of 10%. Expected return = weight in stock Return on stock + weight in bond Return on bond. Std Dev = sqrt(weight in stock^2*std Dev Stock^2 + weight in Bond^2*std Dev Bond^2 + 2*Weight in Stock* Weight in Bond Correlation(Bond, Stock)* std Dev Stock * std Dev Bond). Weight in Stock Weight in Bond Expected Return Std Dev Investment ! 0% 100% 10.0% 23.00% Investment 2 10% 90% 10.5% 21.72% Investment 3 20% 80% 11.0% 20.94% Investment 4 30% 70% 11.5% 20.70% Investment 5 60% 12.0% 21.04% Investment 6 50% 50% 12.5% 21.91% Investment 7 60% 40% 13.0% 23.27% Investment 8 30% 13.5% 25.03% Investment 9 80% 20% 14.0% 27.12% Investment 10 90% 10% 14.5% 29.46% Investment 11 15.0% 32.00% Return v/s Std Dev plot is taken in excel as below 40% 70% 0% Return v/s Risk Plot 16.00% 14.00% 12.00% 10.00% 8.00% 6.00% 2.00% 0.00% 0.00% 5.00% 10.00% 5.00% 20.00% 25.00% 30.00% 35.00% b) Tangent was drawn from Risk-Free rate to the investment opportunity set. This meets the opportunity set at point 7 (60%- Stock; 40% - Bond). Hence, this is the optimal risky portfolio. Expected return for the portfolio = 13%. Std Dev = 23.27%. Return v/s Risk Plot 16.00% 14.00% 12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% 35.00% c) Sharpe ratio for the best feasible CAL is the slope of the tangent drawn to the investment set i.e. Sharpe Ratio = (E(Rp)-Rf)/std dev(Rp) = 34.38%