Solve question #5-6

Learning Objectives & Instructions

For this case you will analyze the proposed levered-recapitalization of UST Inc. using an APV type model.The case is set around December 1998. During this time period USTs board of directors is consideringborrowing up to $1 billion through a bond issuance in order to repurchase shares. You will examinewhether this transaction will ultimately be to the benefit of USTs shareholders.

All of the information you require to solve this case is provided in the course packet (see syllabus). Please read the entire case study in the course packet carefully and examine the exhibits of the case closely before attempting to answer the questions below. Some of the information you require is contained in the text, other information is contained in the exhibits. You might have to read the case study several times to make sure you have all the information that you need.

You may work on this case study independently or in groups of up to five students. If you work in groups, please only hand in one copy of your write-up per group and make sure to list the full names of all your group members. You will hand in a type-written copy of your write-up at the beginning of class on the due date. The first page should have the title FIN 320 UST Case and list your full name(s). I will not acceptlate submissions, hand-written submissions, or submissions by email.

Please follow the following additional instructions when completing the case:

-

- Assume that cash flows occur annually. In other words, you do not need to make a midyear adjustment.

-

- If UST proceeds with the transaction it will issue a 20-year bond with a face value of $1 billion. Interest payments on the bond will be made with annual frequency. UST will not make any principal payments while the bond is outstanding, but will repay the bond in full after 20 years.

-

- Assume a marginal corporate tax rate of 40% for UST.

-

- Assume that Free Operating Cash Flow (in the exhibits) is similar to the definition of free cash flow

that we have been using throughout this course.

-

- Assume that Fund Flow is defined as Funds from Operations in Exhibit 8.

-

- All cash that UST currently has on its balance sheet is excess cash.

-

- Assume that there are no personal taxes for investors and that only corporate taxes matter for

the valuation.

-

- Please make your tables fit on one page. Choosing a slightly smaller font size as well as Words

Auto Fit to Page feature can help you with this. Additionally, you may present the tables in

landscape format if necessary.

-

- If your write-up has several pages, please staple them together.

-

- If you can not make it to class on the due date for some reason you may drop off a copy of your

write-up at my office before the due date.

1

Question 1 General Overview

In class we discussed the trade-off theory of debt financing. Trade-off theory highlights that taking on debt financing can increase firm value through increased tax shields and agency benefits, but that taking on too much debt might decrease firm value because of distress costs or agency costs. Briefly discuss how the proposed transaction might affect the value of UST from the following two perspectives:

-

Present value of tax shields

-

Present value of distress costs

Hint: I am not looking for a valuation here just a brief description of why or why not you believe the transaction will affect the value of UST based on your reading of the case.

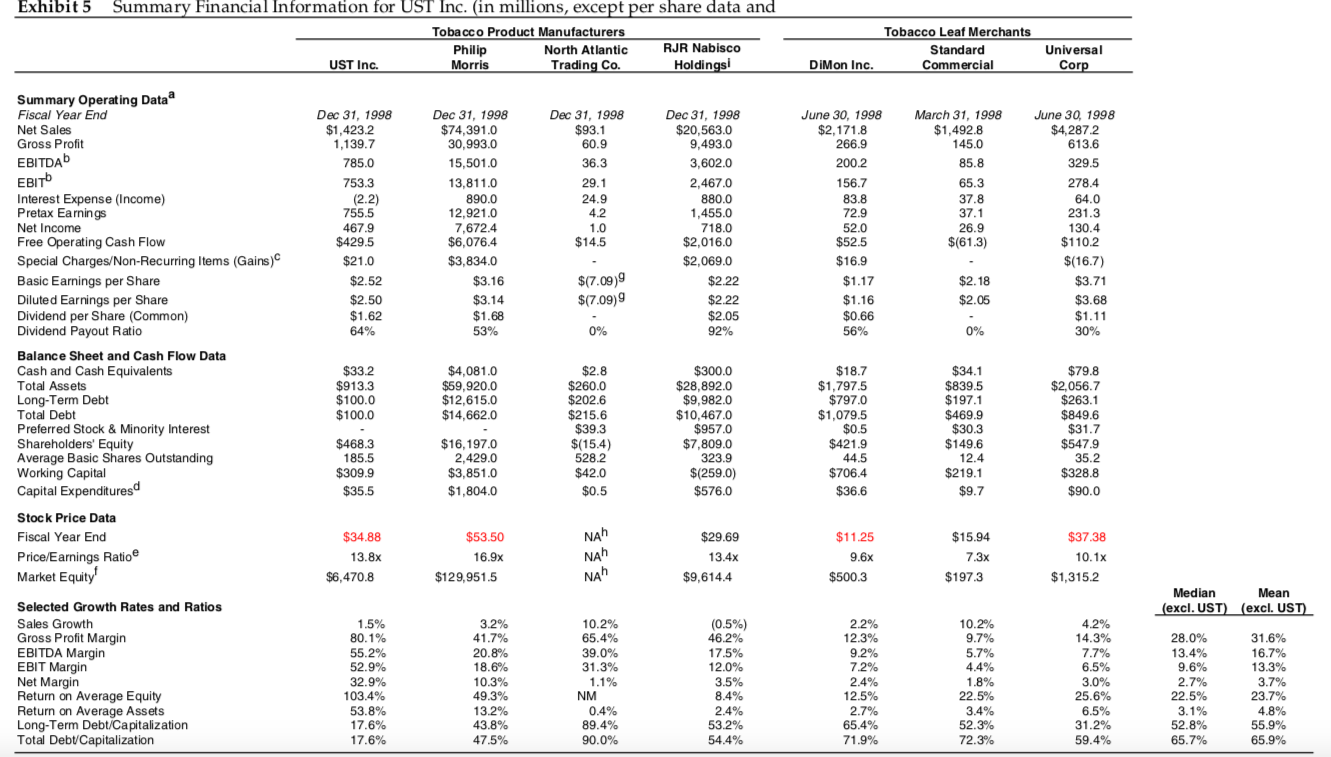

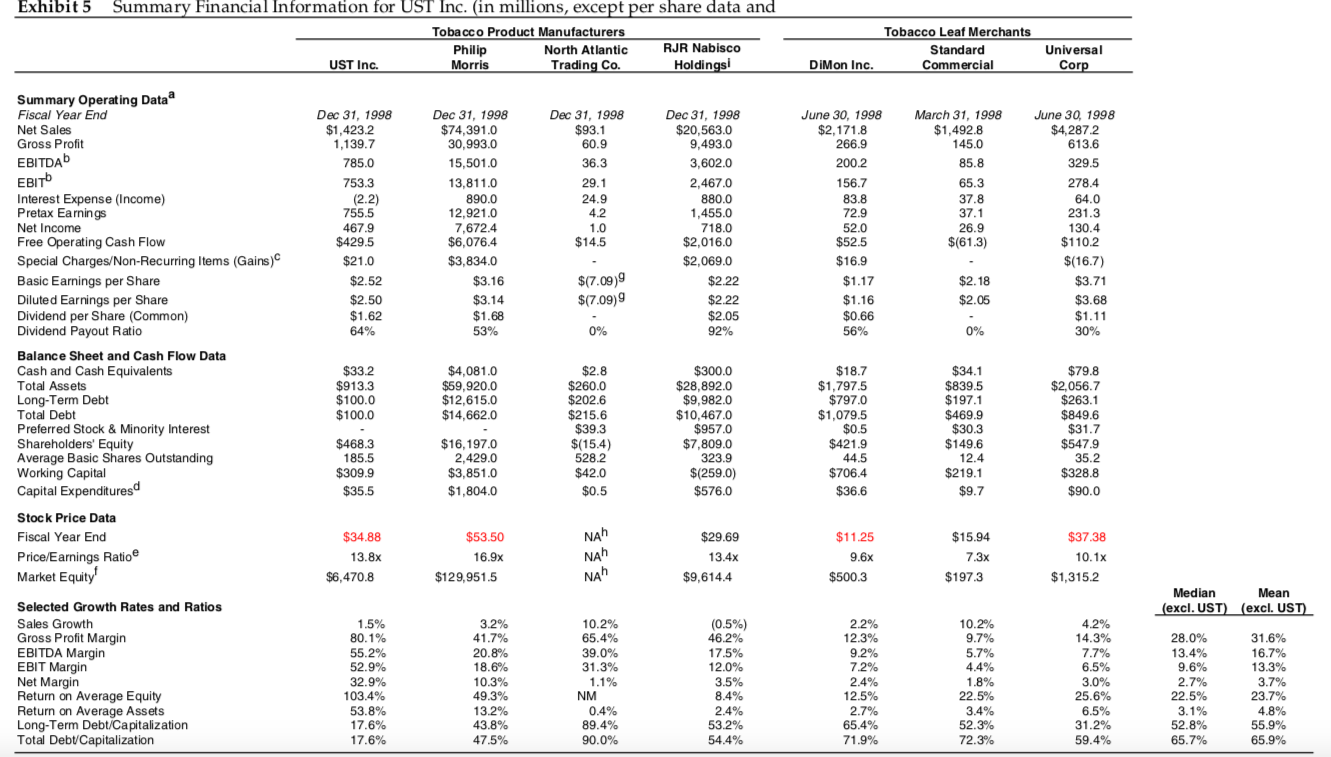

Question 2 Analysis of UST vs. Competition

Using data from Exhibit 5 of the case calculate the Interest Coverage Ratio ( ) for the

following firms as of 1998 by completing a table similar to the one below. Also, add the credit rating for each firm. Does there appear to be a relationship between credit ratings and the interest coverage ratio?

| | EBIT (in $ mn) | Int. Expense (in $ mn) | EBIT/Interest Expense | Credit Rating |

| UST Inc. | | | | |

| Philip Morris | | | | |

| North Atlantic Trading Co. | | | | |

| RJR Nabisco Holdings | | | | |

| DiMon Inc. | | | | |

| Standard Commercial | | | | |

| Universal Corp | | | | |

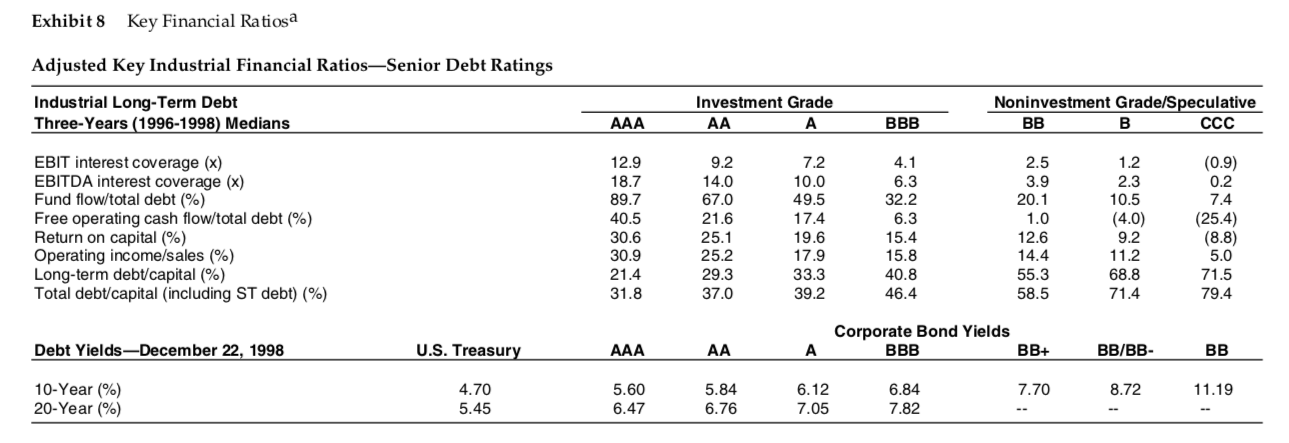

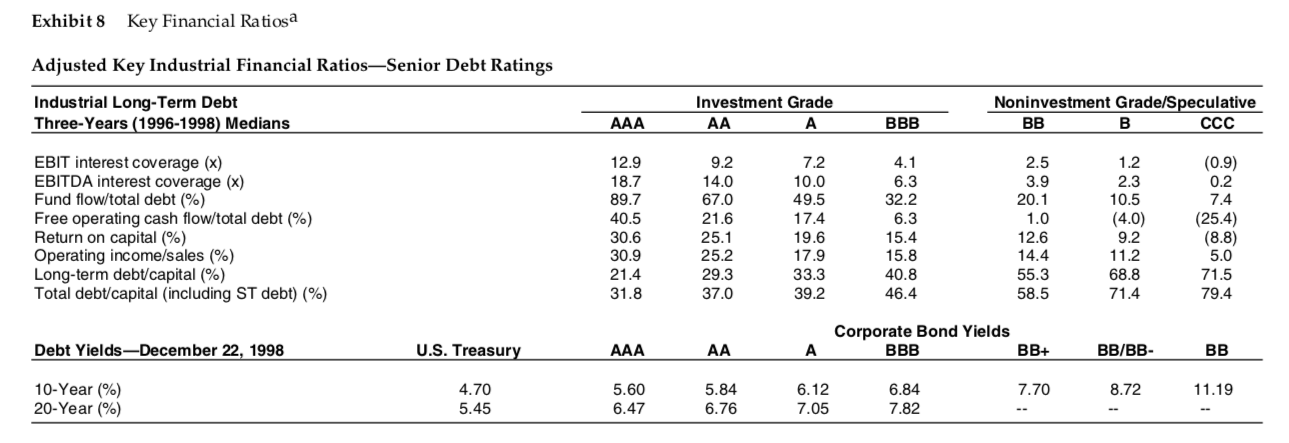

Question 3 Estimate the Credit Rating for UST

In order to apply an APV type model we will need to estimate the interest tax shields that are a result of the new bond issuance. Therefore, we will need to have an estimate of the cost of debt that UST wouldface if it moved forward with this transaction. To estimate the cost of debt, begin by estimating the credit rating UST would get if it moves forward with the transaction. To do this, first calculate the following financial ratios for UST after it issues the new bonds using the data in Exhibits 5 and 8. Then using the data in Exhibit 8 to estimate the bond rating you would give UST based on these three ratios.

Hint: you can use the data for 1998 but you must adjust the ratios for the new amount of debt UST will take on as a result of issuing the new bonds.

| | Financial Ratios | Implied Bond Rating |

| Fund Flow/Total Debt (in %) | | |

| Free operating cash flow/Total Debt (%) | | |

| Operating income/Sales (%) | | |

2

Question 4 Estimate the Cost of Debt for USTs New Bonds

Based on the credit rating that you estimated for UST in question 3, estimate the cost of debt for USTs new bonds using the bond yields for 20-year bonds in Exhibit 8. Be sure to tell me which bond you are picking and why.

Question 5 Estimate the Present Value of Tax Shields Associated with the New Bonds

Estimate the present value of the tax shields associated with issuing the 20-year bonds for this transaction( = 20 ).

0 =1 (1+)

Hint: you can simplify your calculations by using an annuity formula.

Question 6 Estimate the Repurchase Price

Assume that the share price before the transaction is $34.88 and that there are 185.5 million shares outstanding before the transaction. What is the share price at which UST will conduct the share repurchase?

Exhibit 5 Summary Financial Information for UST Inc. (in millions, except per share data and Tobacco Product Manufacturers Philip North Atlantic RJR Nabisco UST Inc. Morris Trading Co. Holdings Tobacco Leaf Merchants Standard Commercial Comme DiMon Inc. Universal Corp Summary Operating Data Fiscal Year End Net Sales Gross Profit EBITDAD June 30, 1998 $2,171.8 266.9 200.2 156.7 6 Dec 31, 1998 $1,423.2 1,139.7 785.0 753.3 (2.2) 755.5 467.9 $429.5 $21.0 $2.52 $2.50 $1.62 64% Dec 31, 1998 $93.1 60.9 36.3 29.1 24.9 4.2 1.0 $14.5 Dec 31, 1998 $74,391.0 30,993.0 15,501.0 13,811.0 890.0 12,921.0 7,672.4 $6,076.4 $3,834.0 $3.16 $3.14 $1.68 53% 83.8 Dec 31, 1998 $20,563.0 9,493.0 3,602.0 2,467.0 880.0 1,455.0 718.0 $2,016.0 $2,069.0 $2.22 $2.22 $2.05 92% March 31, 1998 $1,492.8 145.0 85.8 65.3 37.8 37.1 26.9 $(61.3) June 30, 1998 $4,2872 613.6 329.5 278.4 64.0 231.3 130.4 $110.2 $(16.7) $3.71 $3.68 $1.11 30% 72.9 52.0 $52.5 $16.9 $1.17 $1.16 $0.66 56% $(7.09) $(7.09) 9 $2.18 $2.05 0% 0% Interest Expense (Income) Pretax Earnings Net Income Free Operating Cash Flow Special Charges/Non-Recurring Items (Gains) Basic Earnings per Share Diluted Earnings per Share Dividend per Share (Common) Dividend Payout Ratio Balance Sheet and Cash Flow Data Cash and Cash Equivalents Total Assets Long-Term Debt Total Debt Preferred Stock & Minority Interest Shareholders' Equity Average Basic Shares Outstanding Working Capital Capital Expendituresd $33.2 $913.3 $100.0 $100.0 $4,081.0 $59,920.0 $12,615.0 $14,662.0 $2.8 $260.0 $202.6 $215.6 $39.3 $(15.4) 528.2 $42.0 $0.5 $300.0 $28,892.0 $9,982.0 $10,467.0 $957.0 $7,809.0 323.9 $(259.0) $576.0 $18.7 $1,797.5 $797.0 $1,079.5 $0.5 $421.9 44.5 $706.4 $36.6 $34.1 $839.5 $197.1 $469.9 $30.3 $149.6 12.4 $219.1 $9.7 $79.8 $2,056.7 $263.1 $849.6 $31.7 $547.9 35.2 $328.8 $90.0 $468.3 185.5 $309.9 $35.5 $16,197.0 2,429.0 $3,851.0 $1,804.0 Stock Price Data Fiscal Year End Price/Earnings Ratio Market Equity NAH $34.88 13.8x $6,470.8 $53.50 16.9x $129,951.5 NAH NAh $29.69 13.4x $9,614.4 $11.25 9.6x $500.3 $15.94 7.3x $197.3 $37.38 10.1x $1,315.2 Median Mean (excl. UST) (excl. UST) 3.2% Selected Growth Rates and Ratios Sales Growth Gross Profit Margin EBITDA Margin EBIT Margin Net Margin Return on Average Equity Return on Average Assets Long-Term Debt/Capitalization Total Debt/Capitalization 1.5% 80.1% 55.2% 52.9% 32.9% 103.4% 53.8% 17.6% 17.6% 41.7% 20.8% 18.6% 10.3% 49.3% 13.2% 43.8% 47.5% 10.2% 65.4% 39.0% 31.3% 1.1% NM 0.4% 89.4% 90.0% (0.5%) 46.2% 17.5% 12.0% 3.5% 8.4% 2.4% 53.2% 54.4% 2.2% 12.3% 9.2% 7.2% 2.4% 12.5% 2.7% 65.4% 71.9% 10.2% 9.7% 5.7% 4.4% 1.8% 22.5% 3.4% 52.3% 72.3% 4.2% 14.3% 7.7% 6.5% 3.0% 25.6% 6.5% 31.2% 59.4% 28.0% 13.4% 9.6% 2.7% 22.5% 3.1% 52.8% 65.7% 31.6% 16.7% 13.3% 3.7% 23.7% 4.8% 55.9% 65.9% Exhibit 8 Key Financial Ratiosa Adjusted Key Industrial Financial RatiosSenior Debt Ratings Investment Grade Industrial Long-Term Debt Three-Years (1996-1998) Medians Noninvestment Grade/Speculative BB CCC 4 BBB EBIT interest coverage (x) EBITDA interest coverage (x) Fund flow/total debt (%) Free operating cash flow/total debt (%) Return on capital (%) Operating income/sales (%) Long-term debt/capital (%) Total debt/capital (including ST debt) (%) 12.9 18.7 89.7 40.5 30.6 30.9 21.4 31.8 9.2 14.0 67.0 21.6 25.1 25.2 29.3 37.0 7.2 10.0 49.5 17.4 19.6 17.9 33.3 39.2 4.1 6.3 32.2 6.3 15.4 15.8 40.8 46.4 2.5 3.9 20.1 1.0 12.6 14.4 55.3 58.5 1.2 2.3 10.5 (4.0) 9.2 11.2 68.8 (0.9) 0.2 7.4 (25.4) (8.8) 5.0 71.5 71.4 79.4 Corporate Bond Yields BBB BB+ Debt Yields-December 22, 1998 U.S. Treasury BB/BB- BB 4.70 6.84 10-Year (%) 20-Year (%) 5.60 6.47 8.72 11.19 5.84 6.76 7.70 6.12 7.05 5.45 7.82 Exhibit 5 Summary Financial Information for UST Inc. (in millions, except per share data and Tobacco Product Manufacturers Philip North Atlantic RJR Nabisco UST Inc. Morris Trading Co. Holdings Tobacco Leaf Merchants Standard Commercial Comme DiMon Inc. Universal Corp Summary Operating Data Fiscal Year End Net Sales Gross Profit EBITDAD June 30, 1998 $2,171.8 266.9 200.2 156.7 6 Dec 31, 1998 $1,423.2 1,139.7 785.0 753.3 (2.2) 755.5 467.9 $429.5 $21.0 $2.52 $2.50 $1.62 64% Dec 31, 1998 $93.1 60.9 36.3 29.1 24.9 4.2 1.0 $14.5 Dec 31, 1998 $74,391.0 30,993.0 15,501.0 13,811.0 890.0 12,921.0 7,672.4 $6,076.4 $3,834.0 $3.16 $3.14 $1.68 53% 83.8 Dec 31, 1998 $20,563.0 9,493.0 3,602.0 2,467.0 880.0 1,455.0 718.0 $2,016.0 $2,069.0 $2.22 $2.22 $2.05 92% March 31, 1998 $1,492.8 145.0 85.8 65.3 37.8 37.1 26.9 $(61.3) June 30, 1998 $4,2872 613.6 329.5 278.4 64.0 231.3 130.4 $110.2 $(16.7) $3.71 $3.68 $1.11 30% 72.9 52.0 $52.5 $16.9 $1.17 $1.16 $0.66 56% $(7.09) $(7.09) 9 $2.18 $2.05 0% 0% Interest Expense (Income) Pretax Earnings Net Income Free Operating Cash Flow Special Charges/Non-Recurring Items (Gains) Basic Earnings per Share Diluted Earnings per Share Dividend per Share (Common) Dividend Payout Ratio Balance Sheet and Cash Flow Data Cash and Cash Equivalents Total Assets Long-Term Debt Total Debt Preferred Stock & Minority Interest Shareholders' Equity Average Basic Shares Outstanding Working Capital Capital Expendituresd $33.2 $913.3 $100.0 $100.0 $4,081.0 $59,920.0 $12,615.0 $14,662.0 $2.8 $260.0 $202.6 $215.6 $39.3 $(15.4) 528.2 $42.0 $0.5 $300.0 $28,892.0 $9,982.0 $10,467.0 $957.0 $7,809.0 323.9 $(259.0) $576.0 $18.7 $1,797.5 $797.0 $1,079.5 $0.5 $421.9 44.5 $706.4 $36.6 $34.1 $839.5 $197.1 $469.9 $30.3 $149.6 12.4 $219.1 $9.7 $79.8 $2,056.7 $263.1 $849.6 $31.7 $547.9 35.2 $328.8 $90.0 $468.3 185.5 $309.9 $35.5 $16,197.0 2,429.0 $3,851.0 $1,804.0 Stock Price Data Fiscal Year End Price/Earnings Ratio Market Equity NAH $34.88 13.8x $6,470.8 $53.50 16.9x $129,951.5 NAH NAh $29.69 13.4x $9,614.4 $11.25 9.6x $500.3 $15.94 7.3x $197.3 $37.38 10.1x $1,315.2 Median Mean (excl. UST) (excl. UST) 3.2% Selected Growth Rates and Ratios Sales Growth Gross Profit Margin EBITDA Margin EBIT Margin Net Margin Return on Average Equity Return on Average Assets Long-Term Debt/Capitalization Total Debt/Capitalization 1.5% 80.1% 55.2% 52.9% 32.9% 103.4% 53.8% 17.6% 17.6% 41.7% 20.8% 18.6% 10.3% 49.3% 13.2% 43.8% 47.5% 10.2% 65.4% 39.0% 31.3% 1.1% NM 0.4% 89.4% 90.0% (0.5%) 46.2% 17.5% 12.0% 3.5% 8.4% 2.4% 53.2% 54.4% 2.2% 12.3% 9.2% 7.2% 2.4% 12.5% 2.7% 65.4% 71.9% 10.2% 9.7% 5.7% 4.4% 1.8% 22.5% 3.4% 52.3% 72.3% 4.2% 14.3% 7.7% 6.5% 3.0% 25.6% 6.5% 31.2% 59.4% 28.0% 13.4% 9.6% 2.7% 22.5% 3.1% 52.8% 65.7% 31.6% 16.7% 13.3% 3.7% 23.7% 4.8% 55.9% 65.9% Exhibit 8 Key Financial Ratiosa Adjusted Key Industrial Financial RatiosSenior Debt Ratings Investment Grade Industrial Long-Term Debt Three-Years (1996-1998) Medians Noninvestment Grade/Speculative BB CCC 4 BBB EBIT interest coverage (x) EBITDA interest coverage (x) Fund flow/total debt (%) Free operating cash flow/total debt (%) Return on capital (%) Operating income/sales (%) Long-term debt/capital (%) Total debt/capital (including ST debt) (%) 12.9 18.7 89.7 40.5 30.6 30.9 21.4 31.8 9.2 14.0 67.0 21.6 25.1 25.2 29.3 37.0 7.2 10.0 49.5 17.4 19.6 17.9 33.3 39.2 4.1 6.3 32.2 6.3 15.4 15.8 40.8 46.4 2.5 3.9 20.1 1.0 12.6 14.4 55.3 58.5 1.2 2.3 10.5 (4.0) 9.2 11.2 68.8 (0.9) 0.2 7.4 (25.4) (8.8) 5.0 71.5 71.4 79.4 Corporate Bond Yields BBB BB+ Debt Yields-December 22, 1998 U.S. Treasury BB/BB- BB 4.70 6.84 10-Year (%) 20-Year (%) 5.60 6.47 8.72 11.19 5.84 6.76 7.70 6.12 7.05 5.45 7.82