Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve question with data provided. b. What is the minimum $ of annual salary you expect to earn from this job? (if you don't know,

Solve question with data provided.

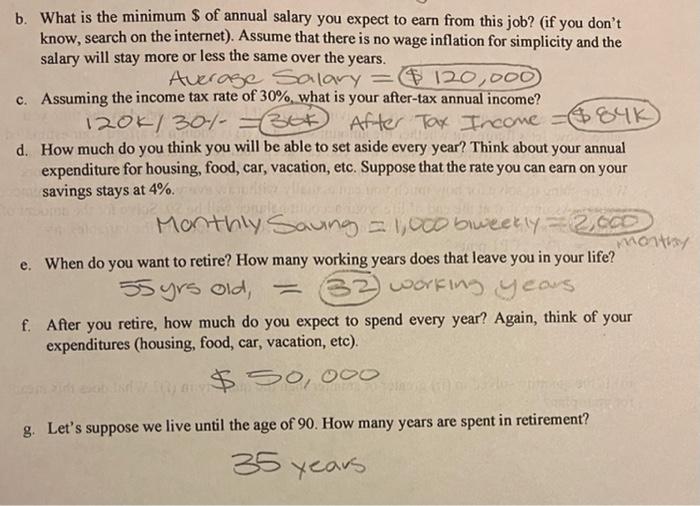

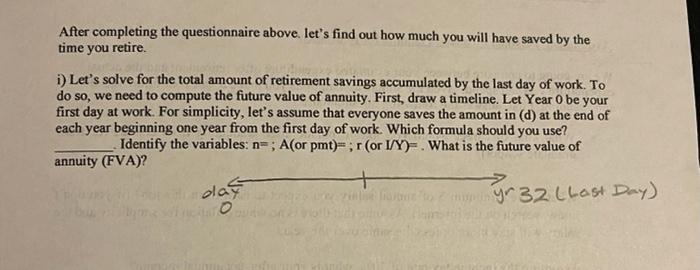

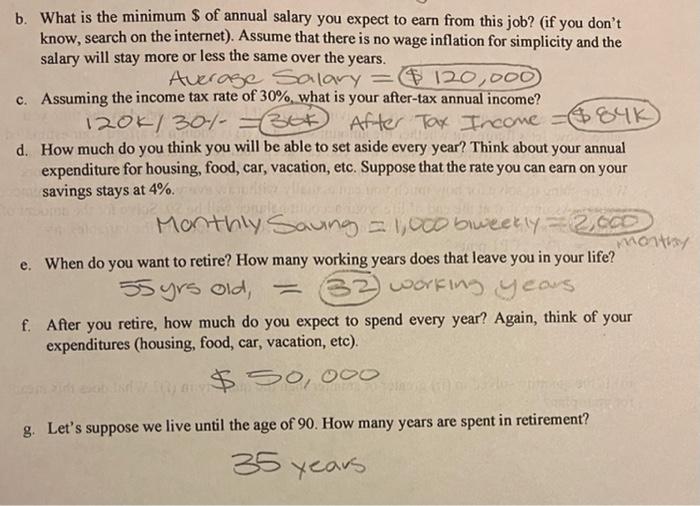

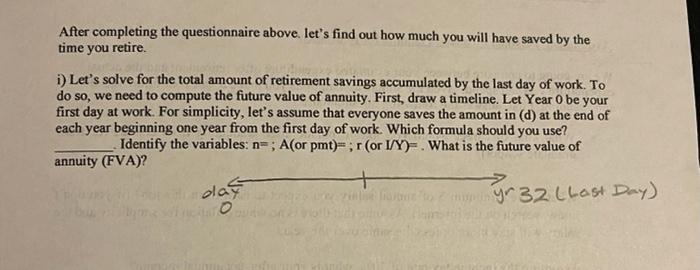

b. What is the minimum $ of annual salary you expect to earn from this job? (if you don't know, search on the internet). Assume that there is no wage inflation for simplicity and the salary will stay more or less the same over the years. Average Salary = $ 120,000 c. Assuming the income tax rate of 30%, what is your after-tax annual income? After Tax Income. 120k/30/- =(30+ $84k GAINUYORU d. How much do you think you will be able to set aside every year? Think about your annual expenditure for housing, food, car, vacation, etc. Suppose that the rate you can earn on your savings stays at 4%. Monthly Saung = 1,000 biweekly = 2,000 e. When do you want to retire? How many working years does that leave you in your life? (32) working years. 55 yrs old, f. After you retire, how much do you expect to spend every year? Again, think of your expenditures (housing, food, car, vacation, etc). sen sich von dir y $50,000 g. Let's suppose we live until the age of 90. How many years are spent in retirement? 35 years monthy After completing the questionnaire above. let's find out how much you will have saved by the time you retire. i) Let's solve for the total amount of retirement savings accumulated by the last day of work. To do so, we need to compute the future value of annuity. First, draw a timeline. Let Year 0 be your first day at work. For simplicity, let's assume that everyone saves the amount in (d) at the end of each year beginning one year from the first day of work. Which formula should you use? Identify the variables: n=; A(or pmt); r (or I/Y). What is the future value of annuity (FVA)? day yr 32 (Last Day) rommers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started