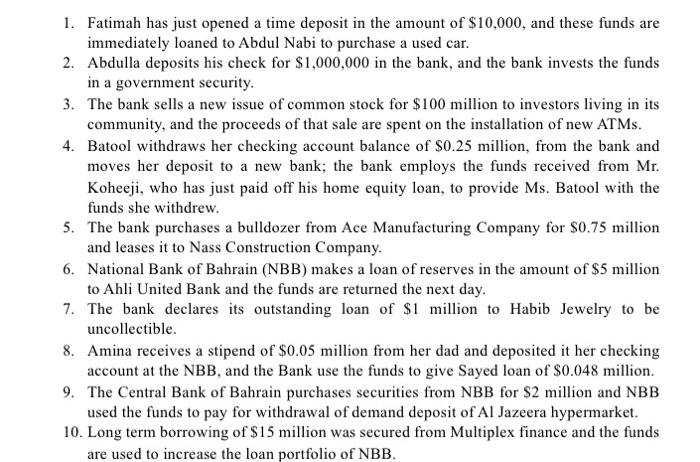

solve quetion 6,7,8

Objective Your study of Chapter five of this course reveal that commercial bank performance can summarized into two main reports (financial statements) known as Report of Condition -Balance Sheet and Report of Income - Income Statement. Our focus for this project would be on the Report of Condition. The Report of Condition shows the amount and composition of funds sources (financial inputs) drawn upon to finance lending and investing activities and how much has been allocated to loans, securities, and other funds uses (financial outputs) at any given point in time. For banks and other depository institutions the assets on the balance sheet are of four major types: cash in the vault and deposits held at other depository institutions (C), government and private interest-bearing securities purchased in the open market ( S ), loans and lease financings made available to customers (L), and miscellaneous assets (MA). Liabilities fall into two principal categories: deposits made by and owed to various customers (D) and nondeposit borrowings of funds in the money and capital markets (NDB). Finally, equity capital represents long-term funds the owners contribute (EC). Therefore, the balance sheet identity for a depository institution can be written: C+S+L+MA=D+NDB+EC As students of Commercial Banking, it is imperative to understand the bank transactions that affect the items under the Report of Condition and Report of Income. This project is therefore designed to give you the opportunity to work with the different transactions that come under the commercial banks operations by making entries to the items that are affected by the transactions below. Requirement: (A). You are required to form groups of 6 members and do the following: 1. For each of the transactions described here, which of at least two accounts on a bank's balance sheet (Report of Condition) would be affected by each transaction? 2. For each of the entries in (1) above, explain why each entry is positive or negative. 3. Your entries should centre around the items of the Report of Condition in the following blocks: Assets Cash and due from depository institutions Securities Federal funds sold and reverse repurchase agreements Gross loans and leases Loan loss allowance Net loans and leases Trading account assets Bank premises and fixed assets Other real estate owned Goodwill and other intangibles All other assets Liabilities Total deposits Federal funds purchased and repurchase agreements Trading liabilities Other borrowed funds Subordinated debt All other liabilities Common stock 1. Fatimah has just opened a time deposit in the amount of $10,000, and these funds are immediately loaned to Abdul Nabi to purchase a used car. 2. Abdulla deposits his check for $1,000,000 in the bank, and the bank invests the funds in a government security. 3. The bank sells a new issue of common stock for $100 million to investors living in its community, and the proceeds of that sale are spent on the installation of new ATMs. 4. Batool withdraws her checking account balance of $0.25 million, from the bank and moves her deposit to a new bank; the bank employs the funds received from Mr. Koheeji, who has just paid off his home equity loan, to provide Ms. Batool with the funds she withdrew. 5. The bank purchases a bulldozer from Ace Manufacturing Company for $0.75 million and leases it to Nass Construction Company. 6. National Bank of Bahrain (NBB) makes a loan of reserves in the amount of $5 million to Ahli United Bank and the funds are returned the next day. 7. The bank declares its outstanding loan of $1 million to Habib Jewelry to be uncollectible. 8. Amina receives a stipend of $0.05 million from her dad and deposited it her checking account at the NBB, and the Bank use the funds to give Sayed loan of $0.048 million. 9. The Central Bank of Bahrain purchases securities from NBB for \$2 million and NBB used the funds to pay for withdrawal of demand deposit of Al Jazeera hypermarket. 10. Long term borrowing of $15 million was secured from Multiplex finance and the funds are used to increase the loan portfolio of NBB