Answered step by step

Verified Expert Solution

Question

1 Approved Answer

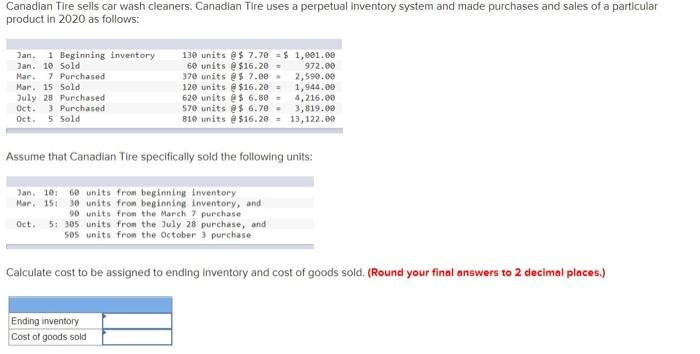

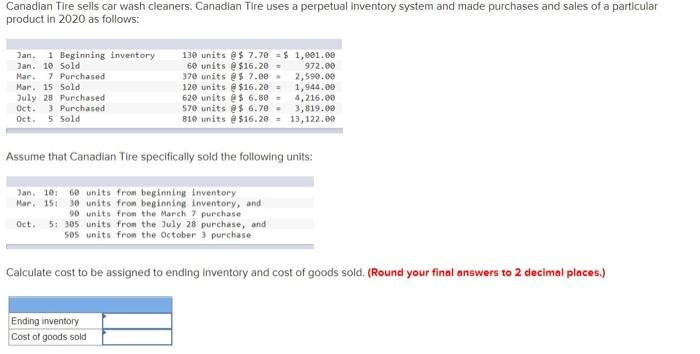

solve seprately all question different question 1 question 2 question 3 question 4 Canadian Tire sells car wash cleaners. Canadian Tire uses a perpetual inventory

solve seprately all question different

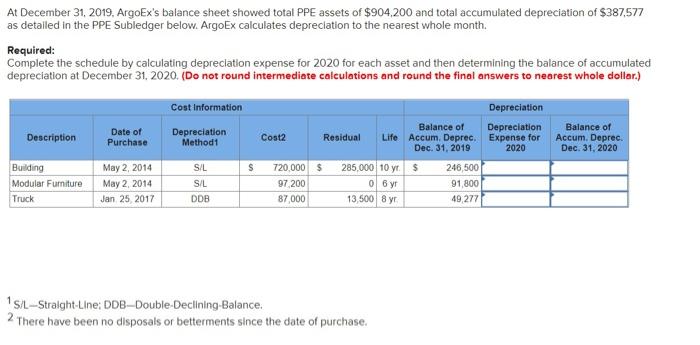

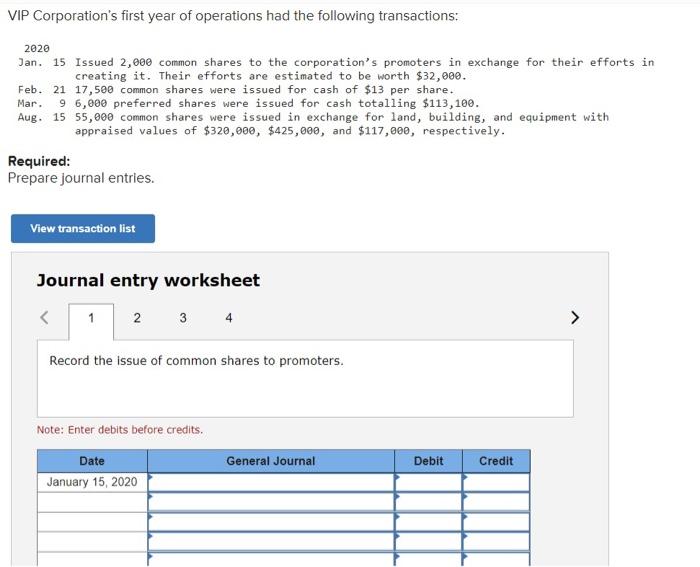

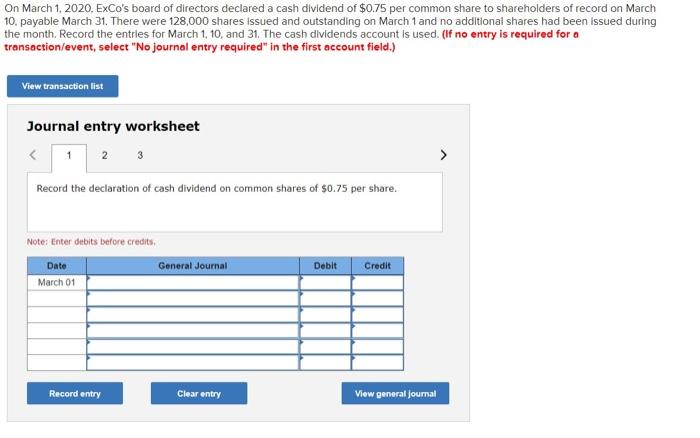

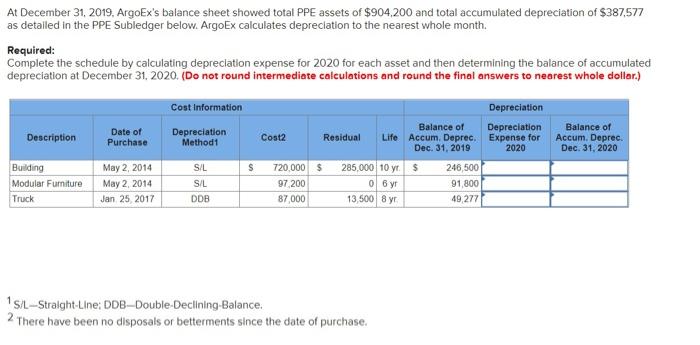

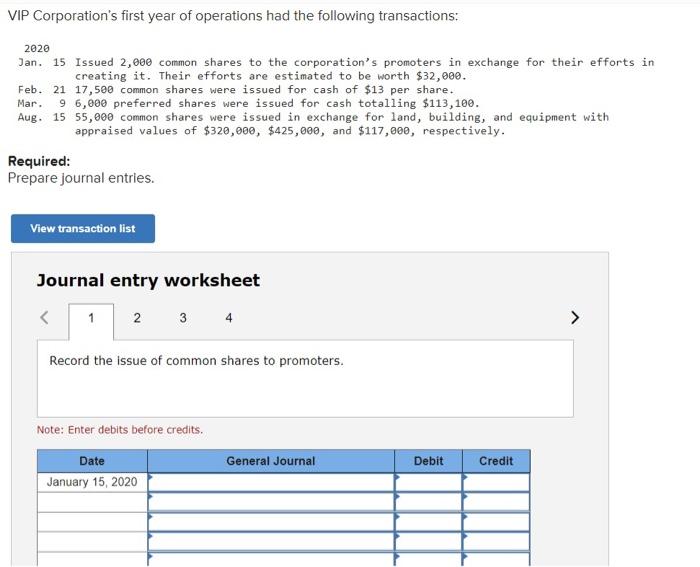

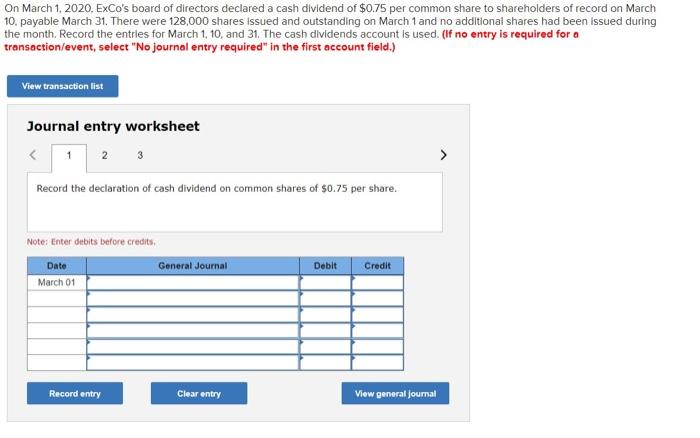

Canadian Tire sells car wash cleaners. Canadian Tire uses a perpetual inventory system and made purchases and sales of a particular product in 2020 as follows: Jan. 1 Beginning inventory Jan. 10 Sold Mar. 7 Purchased Mar. 15 Sold July 28 Purchased Oct. 3 Purchased Oct. 5 sold 130 units $ 7.70 = $ 1,091.00 60 units @ $16.20 - 972.00 370 units $ 7.00 2,590.00 120 units @ $16.20 = 1,944.00 620 units @ $ 6.80 = 4,216.00 570 units $ 6.70 - 3,819.00 810 units @$16.20 = 13, 122.00 Assume that Canadian Tire specifically sold the following units: Jan. 10160 units from beginning inventory Mar. 151 30 units fron beginning inventory, and 90 units from the March purchase Oct. 5: 385 units from the July 28 purchase, and 505 units from the October ) purchase Calculate cost to be assigned to ending inventory and cost of goods sold. (Round your final answers to 2 decimal places.) Ending inventory Cost of goods sold At December 31, 2019, ArgoEx's balance sheet showed total PPE assets of $904,200 and total accumulated depreciation of $387,577 as detailed in the PPE Subledger below. ArgoEx calculates depreciation to the nearest whole month. Required: Complete the schedule by calculating depreciation expense for 2020 for each asset and then determining the balance of accumulated depreciation at December 31, 2020. (Do not round intermediate calculations and round the final answers to nearest whole dollar.) Cost Information Description Date of Purchase Depreciation Methodt Depreciation Balance of Depreciation Balance of Cost2 Residual Life Accum. Deprec. Expense for Accum. Deprec. Dec 31, 2019 2020 Dec 31, 2020 720,000 $ 285,000 10 y $ 246,500 97 200 0 6 yr 91,800 87,000 13,500 8 yr 49,277 $ Building Modular Furniture Truck May 2, 2014 May 2, 2014 Jan 25, 2017 SIL SIL DDB 1S/L-Stralght-Line: DDB-Double-Declining-Balance There have been no disposals or betterments since the date of purchase. 2 VIP Corporation's first year of operations had the following transactions: Mar. 2020 Jan. 15 Issued 2,000 common shares to the corporation's promoters in exchange for their efforts in creating it. Their efforts are estimated to be worth $32,000. Feb. 21 17,500 common shares were issued for cash of $13 per share. 9 6,000 preferred shares were issued for cash totalling $113,100. Aug. 15 55,000 common shares were issued in exchange for land, building, and equipment with appraised values of $320,000, $425,000, and $117,000, respectively. Required: Prepare journal entries. View transaction list Journal entry worksheet 1 2 2 3 4 > Record the issue of common shares to promoters. Note: Enter debits before credits. Date January 15, 2020 General Journal Debit Credit On March 1, 2020. ExCo's board of directors declared a cash dividend of $0.75 per common share to shareholders of record on March 10. payable March 31. There were 128,000 shares issued and outstanding on March 1 and no additional shares had been issued during the month. Record the entries for March 1, 10, and 31. The cash dividends account is used. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 3 > Record the declaration of cash dividend on common shares of $0.75 per share Note: Enter dubits before credits Date March 01 General Journal Debit Credit Record entry Clear entry View general Journal question 1

question 2

question 3

question 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started