Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve the above problems using MILP and Gurobi. Provide Gurobipy code separately for each problem. 1.1. ABC Wholesales stores FMCG products and supplies them to

Solve the above problems using MILP and Gurobi.

Solve the above problems using MILP and Gurobi.Provide Gurobipy code separately for each problem.

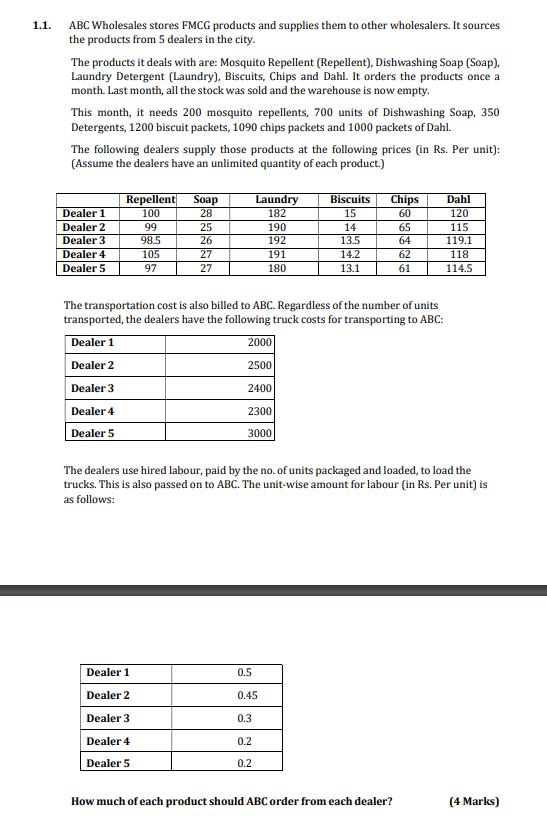

1.1. ABC Wholesales stores FMCG products and supplies them to other wholesalers. It sources the products from 5 dealers in the city. The products it deals with are: Mosquito Repellent (Repellent), Dishwashing Soap (Soap). Laundry Detergent (Laundry), Biscuits, Chips and Dahl. It orders the products once a month. Last month, all the stock was sold and the warehouse is now empty. This month, it needs 200 mosquito repellents, 700 units of Dishwashing Soap, 350 Detergents, 1200 biscuit packets, 1090 chips packets and 1000 packets of Dahl. The following dealers supply those products at the following prices (in Rs. Per unit): (Assume the dealers have an unlimited quantity of each product.) Repellent Soap Laundry Biscuits Chips Dahl Dealer 1 100 28 182 15 60 120 Dealer 2 99 25 190 14 65 115 Dealer 3 98.5 26 192 13.5 64 119.1 Dealer 4 105 27 191 14.2 62 118 Dealer 5 97 27 180 13.1 61 114.5 The transportation cost is also billed to ABC. Regardless of the number of units transported, the dealers have the following truck costs for transporting to ABC: Dealer 1 Dealer 2 Dealer 3 Dealer 4 Dealer 5 2000 2500 2400 2300 3000 The dealers use hired labour, paid by the no. of units packaged and loaded, to load the trucks. This is also passed on to ABC. The unit-wise amount for labour (in Rs. Per unit) is as follows: Dealer 1 0.5 Dealer 2 0.45 Dealer 3 0.3 Dealer 4 0.2 Dealer 5 0.2 How much of each product should ABC order from each dealer? (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started