Solve the following 2 exercises Exercise 1 Company X, a subsidiary of Q8Global Corporation, operates in Canada. According to the Canadian tax rules the

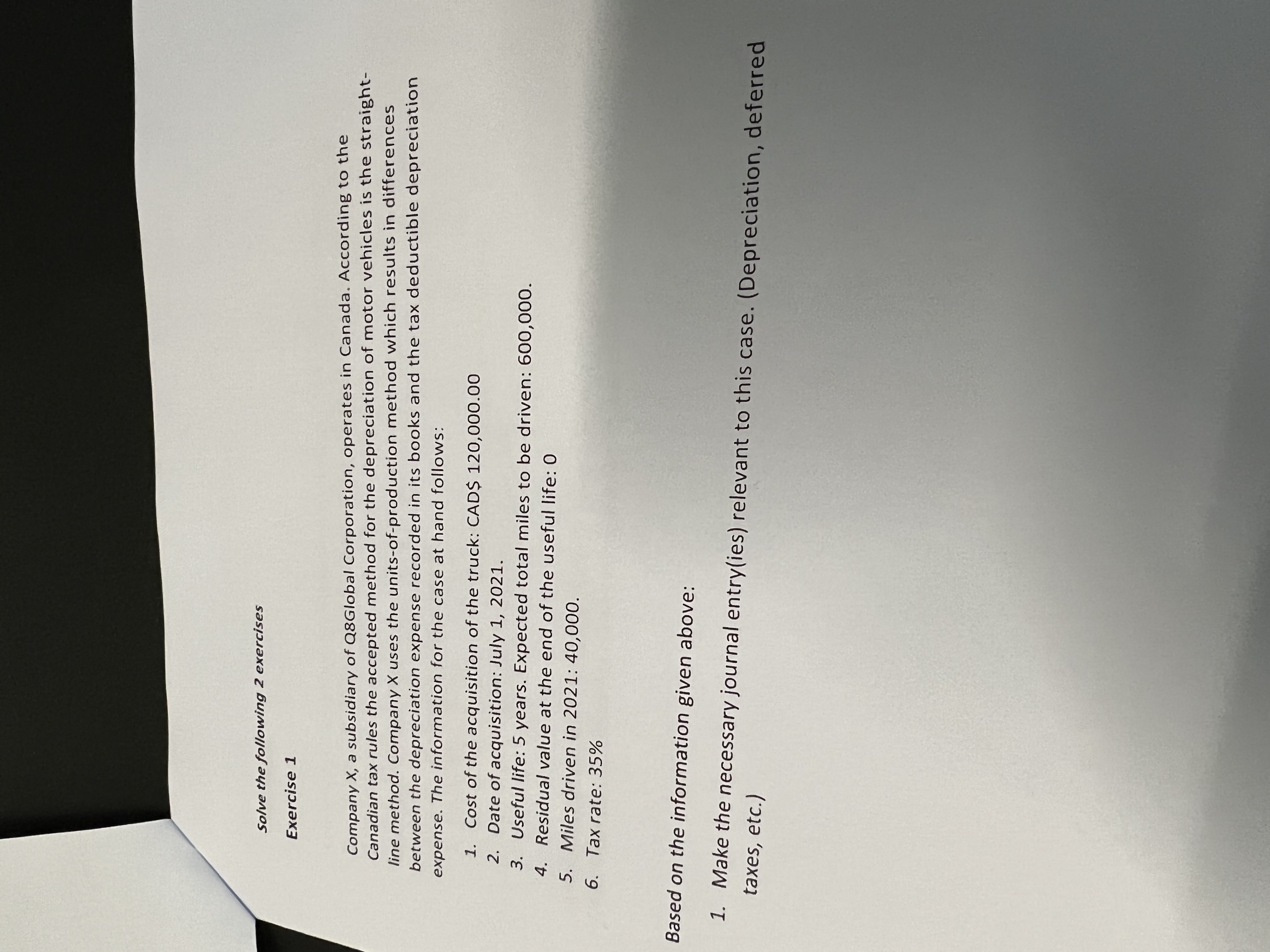

Solve the following 2 exercises Exercise 1 Company X, a subsidiary of Q8Global Corporation, operates in Canada. According to the Canadian tax rules the accepted method for the depreciation of motor vehicles is the straight- line method. Company X uses the units-of-production method which results in differences between the depreciation expense recorded in its books and the tax deductible depreciation expense. The information for the case at hand follows: 1. Cost of the acquisition of the truck: CAD$ 120,000.00 2. Date of acquisition: July 1, 2021. 3. Useful life: 5 years. Expected total miles to be driven: 600,000. 4. Residual value at the end of the useful life: 0 5. Miles driven in 2021: 40,000. 6. Tax rate: 35% Based on the information given above: taxes, etc.) 1. Make the necessary journal entry(ies) relevant to this case. (Depreciation, deferred

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Straightline depreciation Annual depreciation expense under straightline method cost residua...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started