Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve the following application problems. 3. Judy Martinez is paid $34.060 annually. Find the equivalent earnings if this amount is paid (a) weekly, (b)

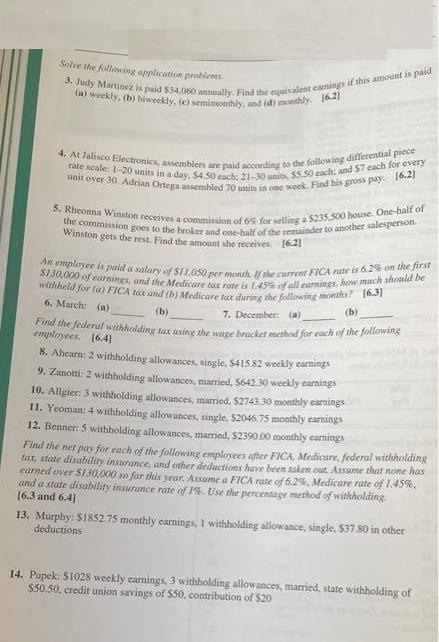

Solve the following application problems. 3. Judy Martinez is paid $34.060 annually. Find the equivalent earnings if this amount is paid (a) weekly, (b) biweekly, (c) semimonthly, and (d) moothly. 16.21 4. At Jalisco Electronics, assemblers are paid according to the following differential piece rate scale: 1-20 units in a day, $4.50 each; 21-30 units, 55.50 each; and $7 each for every unit over 30. Adrian Ortega assembled 70 units in one week. Find his gross pay. 16.2) 5. Rheonna Winston receives a commission of 6% for selling a $235.500 house. One-half of the commission goes to the broker and one-half of the remainder to another salesperson. Winston gets the rest. Find the amount she receives [62] An employee is paid a salary of $11.050 per month. If the current FICA rate is 6.2% on the first $130,000 of earnings, and the Medicare tax rate is 1.45% of all earnings, how much should be withheld for (a) FICA tax and (b) Medicare tax during the following months? [6.3] 6. March: (a) (b) (b) 7. December: (a) Find the federal withholding tax using the wage bracket method for each of the following employees. [64] 8. Ahearn: 2 withholding allowances, single, $415.82 weekly earnings 9. Zanotti: 2 withholding allowances, married, $642.30 weekly earnings 10. Allgier: 3 withholding allowances, married, $2743.30 monthly earnings 11. Yeoman: 4 withholding allowances, single, $2046.75 monthly earnings 12. Benner: 5 withholding allowances, married, $2390.00 monthly earnings Find the net pay for each of the following employees after FICA, Medicare, federal withholding tax, state disability insurance, and other deductions have been taken out. Assume that none has earned over $130,000 so far this year. Assume a FICA rate of 6.2%, Medicare rate of 1.45%, and a state disability insurance rate of 1%. Use the percentage method of withholding. [6.3 and 6.4] 13. Murphy: $1852.75 monthly earnings, I withholding allowance, single, $37.80 in other deductions 14. Pupek: $1028 weekly earnings, 3 withholding allowances, married, state withholding of $50.50, credit union savings of $50, contribution of $20

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

QUESTION 3 The following conversion factors may be used to determine the comparable earnings if Judy Martinezs 34060 annual income were paid weekly biweekly semimonthly and monthly Number of weeks in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started