Solve. the following attachments.

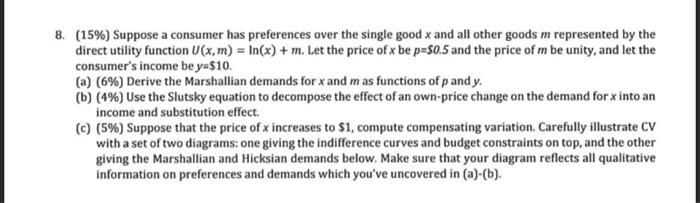

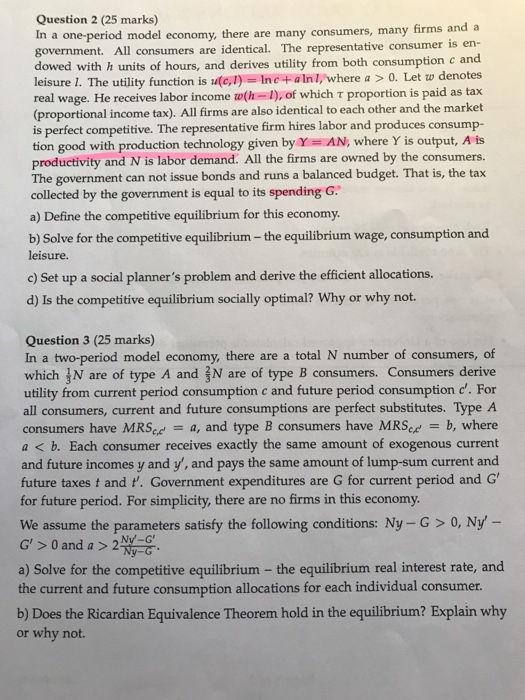

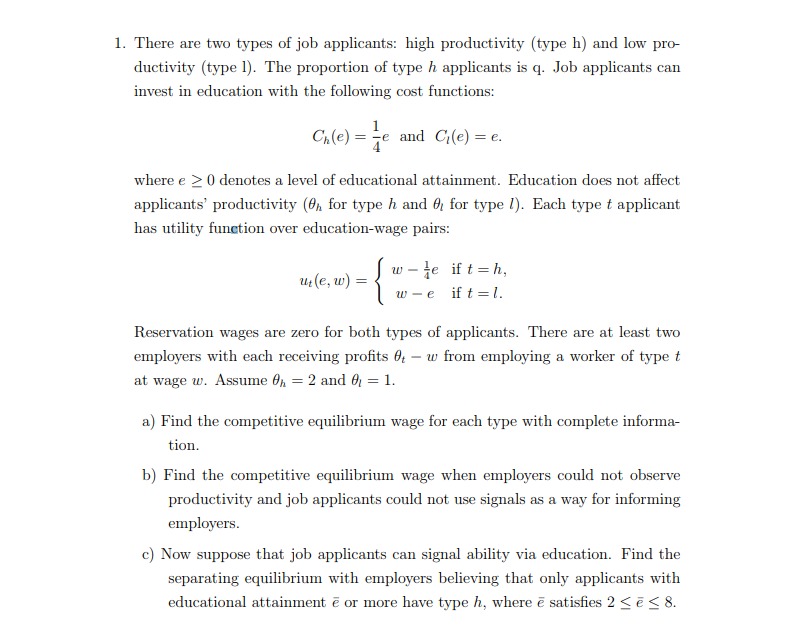

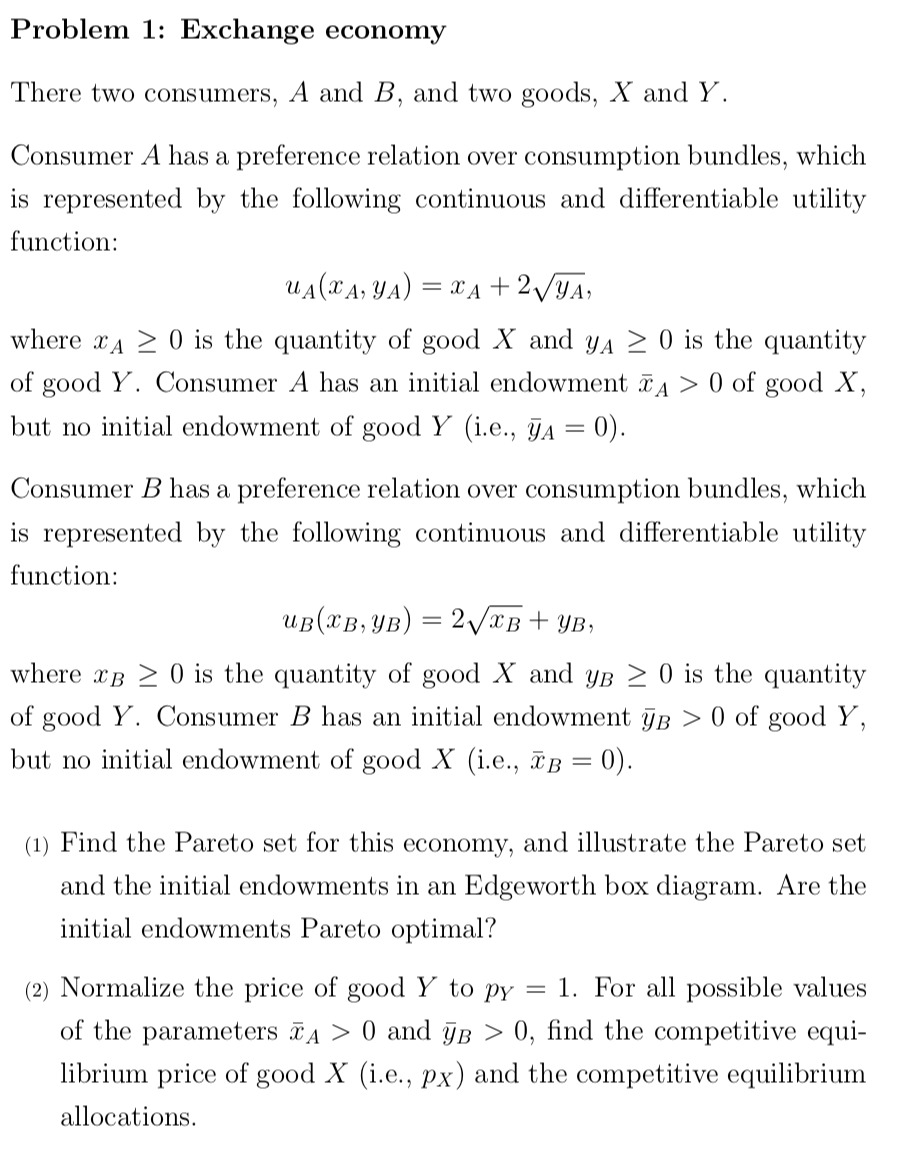

8. (15%) Suppose a consumer has preferences over the single good x and all other goods m represented by the direct utility function U(x, m) = In(x) + m. Let the price of x be p=$0.5 and the price of m be unity, and let the consumer's income bey=$10. (a) (6%) Derive the Marshallian demands for x and m as functions of p and y. (b) (4%) Use the Slutsky equation to decompose the effect of an own-price change on the demand for x into an income and substitution effect. (c) (5%) Suppose that the price of x increases to $1, compute compensating variation. Carefully illustrate CV with a set of two diagrams: one giving the indifference curves and budget constraints on top, and the other giving the Marshallian and Hicksian demands below. Make sure that your diagram reflects all qualitative information on preferences and demands which you've uncovered in (a)-(b).Question 2 (25 marks) In a one-period model economy, there are many consumers, many firms and a government. All consumers are identical. The representative consumer is en- dowed with h units of hours, and derives utility from both consumption c and leisure 1. The utility function is w(c,!) = Inc + all, where a > 0. Let w denotes real wage. He receives labor income w(h = 1), of which T proportion is paid as tax (proportional income tax). All firms are also identical to each other and the market is perfect competitive. The representative firm hires labor and produces consump- tion good with production technology given by Y = AN, where Y is output, A is productivity and N is labor demand. All the firms are owned by the consumers. The government can not issue bonds and runs a balanced budget. That is, the tax collected by the government is equal to its spending G. a) Define the competitive equilibrium for this economy. b) Solve for the competitive equilibrium - the equilibrium wage, consumption and leisure. c) Set up a social planner's problem and derive the efficient allocations. d) Is the competitive equilibrium socially optimal? Why or why not. Question 3 (25 marks) In a two-period model economy, there are a total N number of consumers, of which N are of type A and N are of type B consumers. Consumers derive utility from current period consumption c and future period consumption c'. For all consumers, current and future consumptions are perfect substitutes. Type A consumers have MRS. = a, and type B consumers have MRScp = b, where a 0, Ny' - G' > 0 and a > 2 Ny-G a) Solve for the competitive equilibrium - the equilibrium real interest rate, and the current and future consumption allocations for each individual consumer. b) Does the Ricardian Equivalence Theorem hold in the equilibrium? Explain why or why not.1. There are two types of job applicants: high productivity [type h} and low pro ductivity [type I]. The proportion of type It applicants is :1. Job applicants can invest in education with the following cost functions: one}: 31.: and c.(e}=e. where e E {1 denotes a level of educational attainment. Education does not affect applicantsT productivity [3:1 for type it and It]; for type 1'}. Each type t applicant has utity funltion over educationwage pairs: wle ift=h, u[e,w}={ \"Ludc ift=l Reservation wages are zero for both types of applicants. There are at least two employers with each receiving prots E: - w from employing a worker of type t at wage to. assume Eh = 2 and Hg = 1. a} Find the competitive equilibrium wage for each type with complete informa tion. b} Find the competitive equilibrium wage when employers could not observe productivity and job applicants could not use signals as a way for informing employers. c} Now suppose that job applicants can signal ability via education. Find the separating equilibrium with employers believing that only applicants with educational attainment E or more have type 31, where E satises 2 E E E 3. Problem 1: Exchange economy There two consumers, A and B, and two goods, X and Y. Consumer A has a preference relation over consumption bundles, which is represented by the following continuous and differentiable utility function: H.4(3'3A: 9A) = 56.4 + 2x/1UA, where 31,4 2 0 is the quantity of good X and 3m 2 0 is the quantity of good Y. Consumer A has an initial endowment EA 2: 0 of good X, but no initial endowment of good Y (i.e., 5,4, = 0). Consumer B has a preference relation over consumption bundles, which is represented by the following continuous and differentiable utility function: Ramsay's) = QWEB + ye, where :33 2 0 is the quantity of good X and ya 2 0 is the quantity of good Y. Consumer B has an initial endowment g > 0 of good Y, but no initial endowment of good X (i.e., 3 = 0). {1) Find the Pareto set for this economy, and illustrate the Pareto set and the initial endowments in an Edgeworth box diagram. Are the initial endowments Pareto optimal? {2) Normalize the price of good Y to 15* = 1. For all possible values of the parameters 33.4 > 0 and 373 > 0, nd the competitive equi- librium price of good X (i.e., px) and the competitive equilibrium allocations