Solve the following attachments

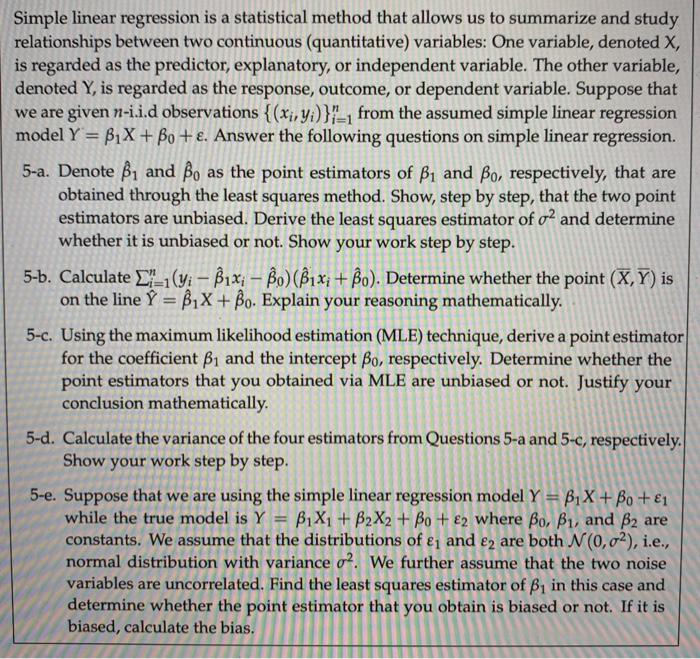

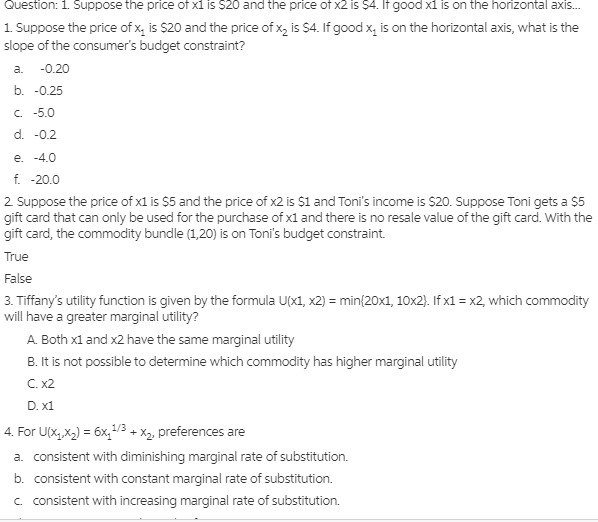

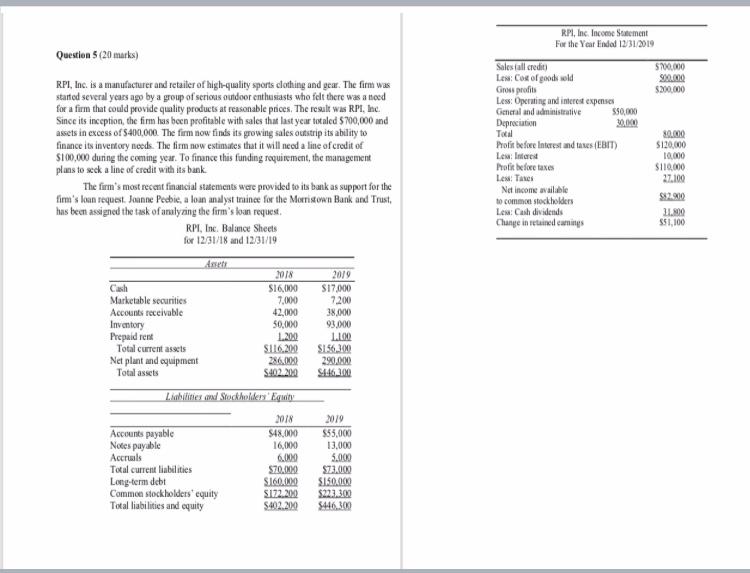

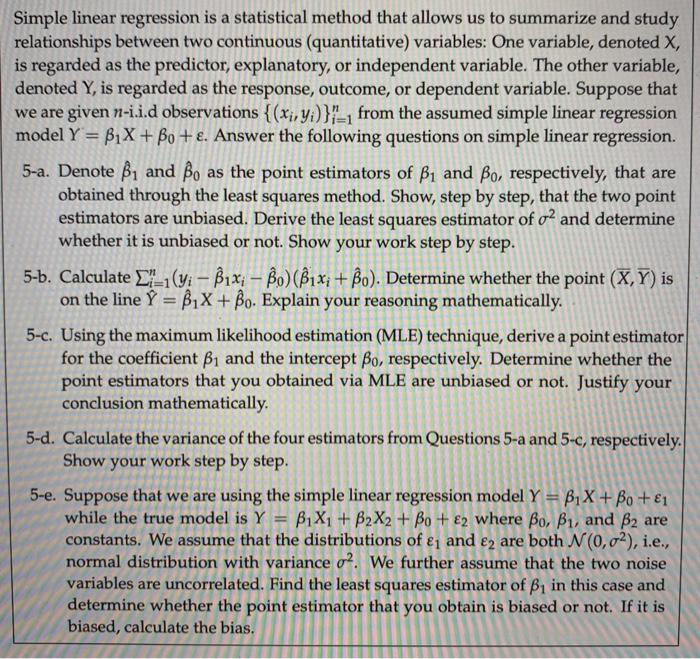

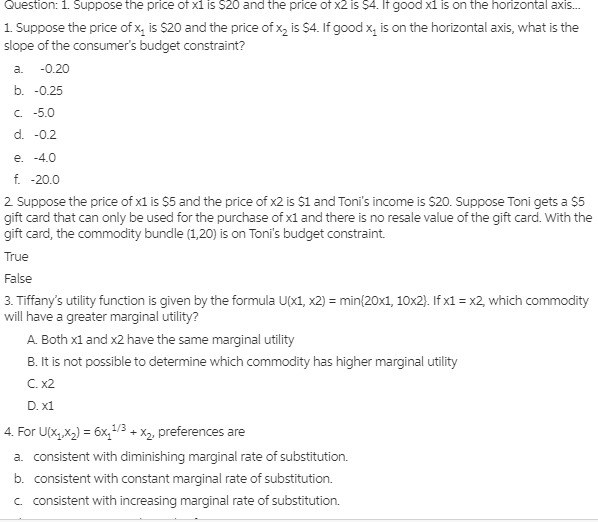

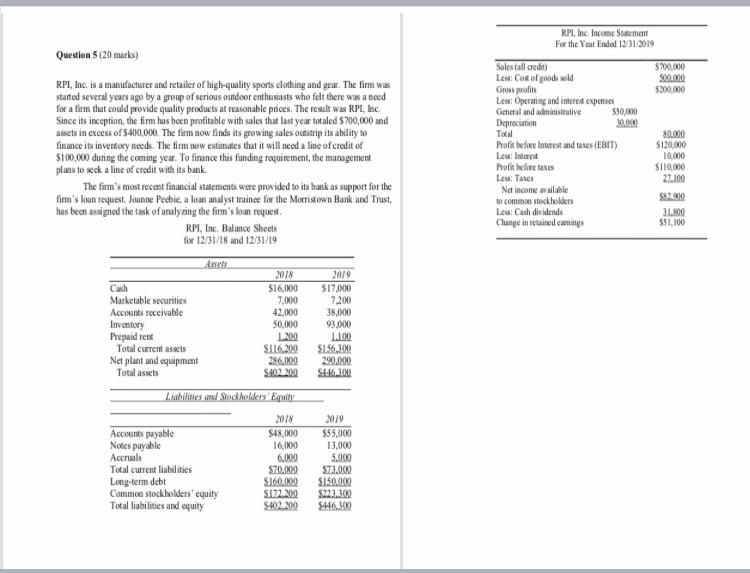

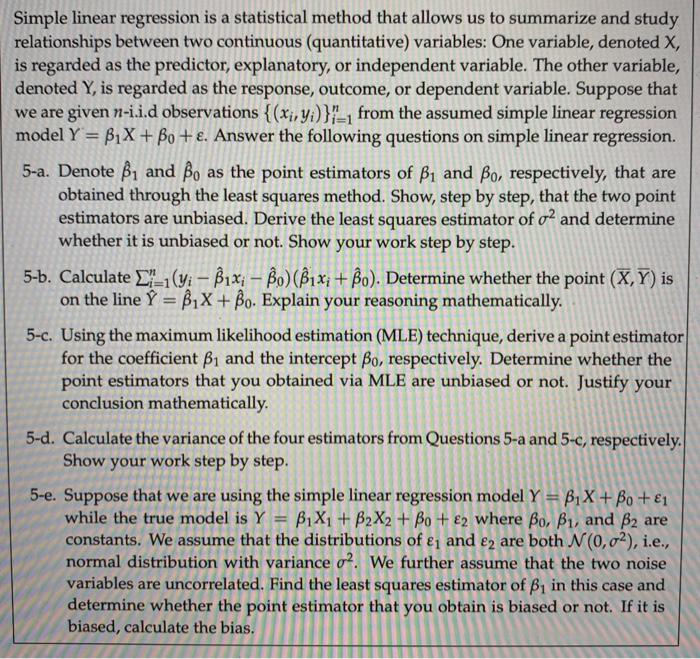

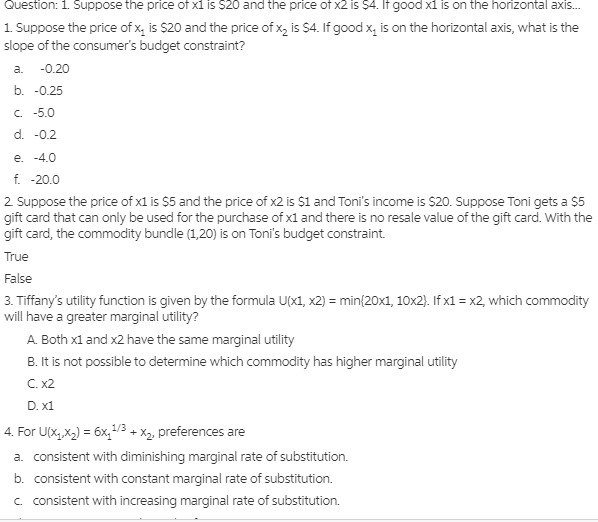

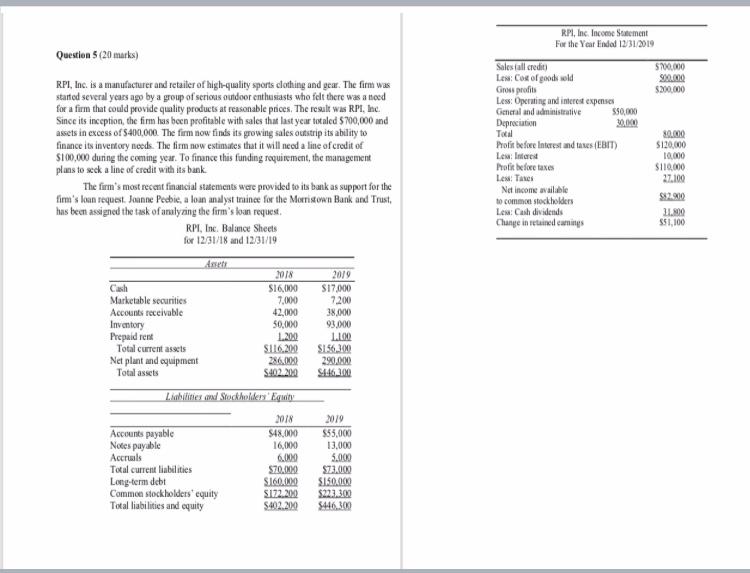

Simple linear regression is a statistical method that allows us to summarize and study relationships between two continuous (quantitative) variables: One variable, denoted X, is regarded as the predictor, explanatory, or independent variable. The other variable, denoted Y, is regarded as the response, outcome, or dependent variable. Suppose that we are given n-i.i.d observations { (x;, y;)}"_, from the assumed simple linear regression model Y = BIX + Bo + . Answer the following questions on simple linear regression. 5-a. Denote 1 and Bo as the point estimators of B, and Bo, respectively, that are obtained through the least squares method. Show, step by step, that the two point estimators are unbiased. Derive the least squares estimator of of and determine whether it is unbiased or not. Show your work step by step. 5-b. Calculate _'_1(yi - Bix; - Bo) (Bix, + Bo). Determine whether the point (X, Y) is on the line Y = 1X + Bo. Explain your reasoning mathematically. 5-c. Using the maximum likelihood estimation (MLE) technique, derive a point estimator for the coefficient B1 and the intercept Bo, respectively. Determine whether the point estimators that you obtained via MLE are unbiased or not. Justify your conclusion mathematically. 5-d. Calculate the variance of the four estimators from Questions 5-a and 5-c, respectively. Show your work step by step. 5-e. Suppose that we are using the simple linear regression model Y = B1 X + Bo + 1 while the true model is Y = 1X1 + B2X2 + Bo + 82 where Bo, B1, and B2 are constants. We assume that the distributions of &, and e2 are both N(0,02), i.e., normal distribution with variance o?. We further assume that the two noise variables are uncorrelated. Find the least squares estimator of B, in this case and determine whether the point estimator that you obtain is biased or not. If it is biased, calculate the bias.Question: 1. Suppose the price of x1 is $20 and the price of x2 is $4. If good x1 is on the horizontal axis... 1. Suppose the price of x, is $20 and the price of xz is $4. If good x, is on the horizontal axis, what is the slope of the consumer's budget constraint? a. -0.20 b. -0.25 C -5.0 d. -0.2 e. -4.0 f. -20.0 2. Suppose the price of x1 is $5 and the price of x2 is $1 and Toni's income is $20. Suppose Toni gets a $5 gift card that can only be used for the purchase of x1 and there is no resale value of the gift card. With the gift card, the commodity bundle (1,20) is on Toni's budget constraint. True False 3. Tiffany's utility function is given by the formula U(x1, x2) = min(20x1, 10x2). If x1 = x2, which commodity will have a greater marginal utility? A. Both x1 and x2 have the same marginal utility B. It is not possible to determine which commodity has higher marginal utility C. x2 D. x1 4. For U(X X2) = 6x,1/8 + X2, preferences are a. consistent with diminishing marginal rate of substitution. b. consistent with constant marginal rate of substitution. C consistent with increasing marginal rate of substitution.R.PI, Inc. Income Statement For the Year Endal 1231/2019 Question 5 (20 marks) Sales fall credit 5740.030 Los: Cost of goods cold RPI, Inc. is a manufacturer and retailer of high-quality sports clothing and gear. The firm was Gross profits started several years ago by a group of serious outdoor enthusiasts who fell there was a need Less: Operating and intered expenses for a firm that could provide quality products at reasonable prices, The result was RPI. Inc. General and administrative Since its inception, the firm has been profitable with sales that last year totaled $700,000 and Depreciation assets in excess of 5400,000. The firm now finds its growing sales outstrip its ability to Total finance its inventory needs. The firm now estimates that it will need a line of credit of Profit before Interest and taxes (EBIT) $100,000 during the coming year. To finance this funding requirement, the management Lew: Inand plans to seek a line of credit with its bank. Profit before taxes $110,100 Lew: Taxes 27.100 The firm's most recent financial statements were provided to its bank as support for the Net income available firm's loan request. Joanne Peebie, a loan analyst traince for the Morristown Bank and Trust, to common stockholders 5:2 900 has been assigned the task of analyzing the firm's loan request. Lew: Cash dividenda RPI, Inc. Balance Sheets Change in retained earnings $51,100 for 12/31/18 and 12/31/19 JO18 2019 Cash $16.030 $17,000 Marketable securities 7.00.0 7,200 Accounts receivable 42,000 38,000 Inventory 50.000 93.000 Prepaid rent 1.20:0 L.LOO Total current assets $116.200 $156 300 Net plant and equipment 286.000 290.0.00 Total assets $402 20 0 Limbifities ood Stockholders Equity Accounts payable $48.000 $55.000 Notes payable 16.000 13,000 Accruals 6.004 5.000 Total current liabilities $70.00-0 $73.0100 Long-term debt $160.000 $1502000 Common stockholders* equity $ 172. 20.0 $221300 Total liabilities and equity 5402.200 $463m