Solve, the following given questions.

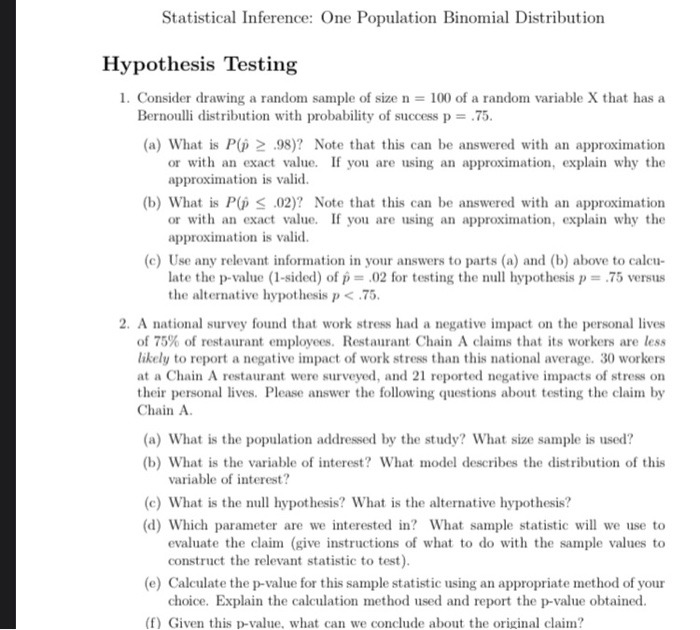

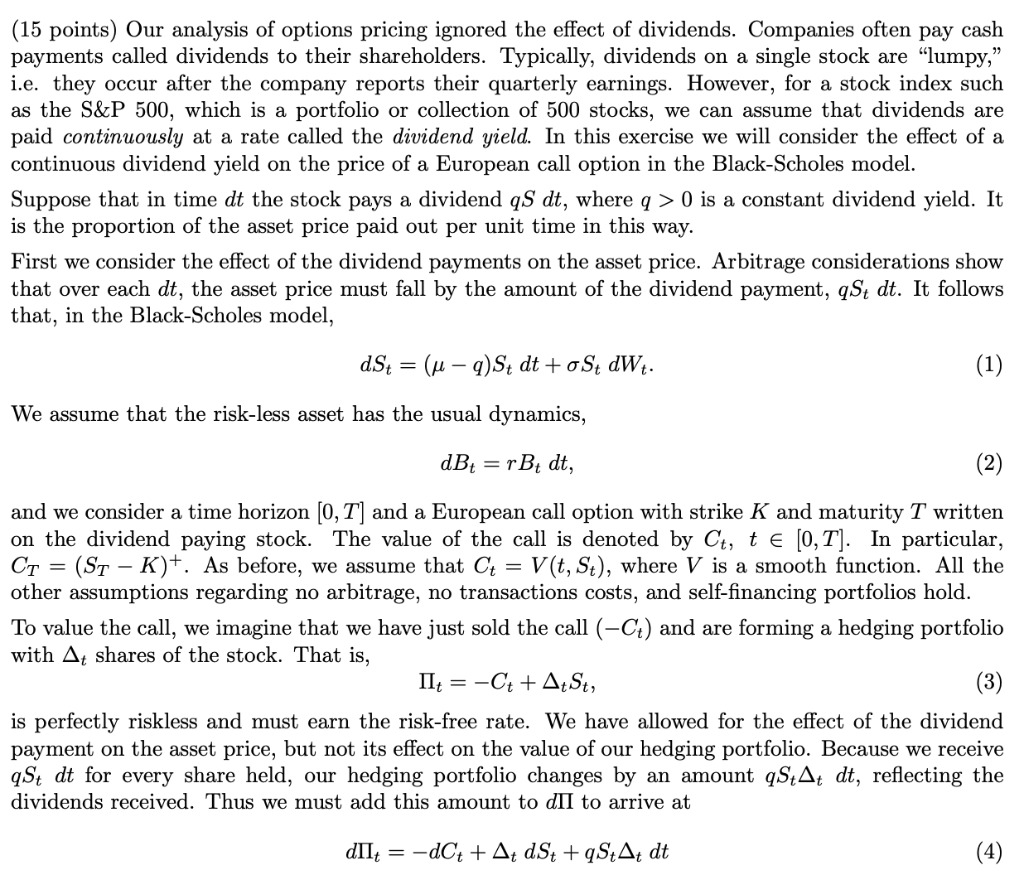

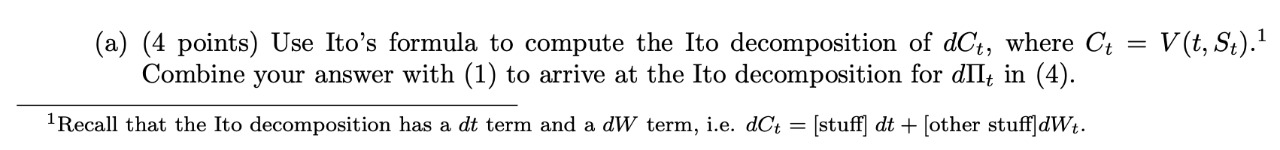

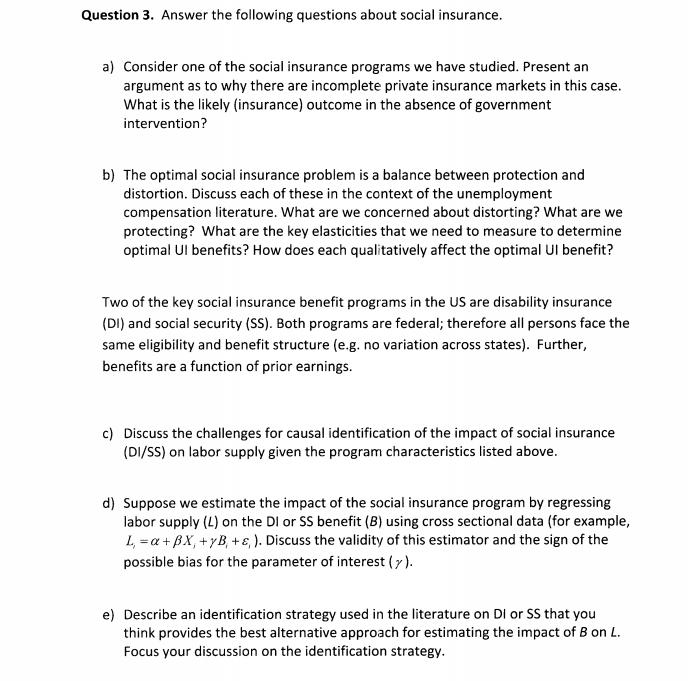

Statistical Inference: One Population Binomial Distribution Hypothesis Testing 1. Consider drawing a random sample of size n = 100 of a random variable X that has a Bernoulli distribution with probability of success p = .75. (a) What is P(p 2 .98)? Note that this can be answered with an approximation or with an exact value. If you are using an approximation, explain why the approximation is valid. (b) What is P(p D is a constant dividend yield. It is the proportion of the asset price paid out per unit time in this way. First we consider the effect of the dividend payments on the asset price. Arbitrage considerations show that over each dt, the asset price must fall by the amount of the dividend payment, qSt dt. It follows that, in the Black-Scholes model, d5; = (a (1)8: dt + OS: diet}. (1) We asswne that the risk-less asset has the usual dynamics, as, = r3, dt, (2) and we consider a time horizon [0, T] and a European call option with strike K and maturity T written 0n the dividend paying stock. The value of the call is denoted by Cg, t E [0, T]. In particular, CT 2 (ST K)+. As before, we assume that C; = V(t,S;), where V is a smooth function. All the other assumptions regarding no arbitrage, no transactions costs, and self-nancing portfolios hold. To value the call, we imagine that we have just sold the call (00 and are forming a hedging portfolio with A, shares of the stock. That is, I1 11, c.t + Ava, (3) is perfectly riskless and must earn the risk-free rate. We have allowed for the effect of the dividend payment on the asset price, but not its e'ect on the value of our hedging portfolio. Because we receive ng sit for every share held, our hedging portfolio changes by an amount qS'tAg dt, reecting the dividends received. Thus we must add this amount to (11 to arrive at (in; 2 do: + A; (is; + QStAt {it (4) (a) (4 points) Use Ito's formula to compute the Ito decomposition of dCt, where Ct = V(t, St).1 Combine your answer with (1) to arrive at the Ito decomposition for dlIt in (4). Recall that the Ito decomposition has a dt term and a dW term, i.e. dCt = [stuff] dt + [other stuff]dWt.Question 3. Answer the following questions about social insurance. a) Consider one of the social insurance programs we have studied. Present an argument as to why there are incomplete private insurance markets in this case. What is the likely (insurance) outcome in the absence of government intervention? b) The optimal social insurance problem is a balance between protection and distortion. Discuss each of these in the context of the unemployment compensation literature. What are we concerned about distorting? What are we protecting? What are the key elasticities that we need to measure to determine optimal UI benefits? How does each qualitatively affect the optimal UI benefit? Two of the key social insurance benefit programs in the US are disability insurance (DI) and social security (SS). Both programs are federal; therefore all persons face the same eligibility and benefit structure (e.g. no variation across states). Further, benefits are a function of prior earnings. c) Discuss the challenges for causal identification of the impact of social insurance (DI/SS) on labor supply given the program characteristics listed above. d) Suppose we estimate the impact of the social insurance program by regressing labor supply (4) on the DI or SS benefit (B) using cross sectional data (for example, I, = a + BX, + >B, + 8, ). Discuss the validity of this estimator and the sign of the possible bias for the parameter of interest (7 ). e) Describe an identification strategy used in the literature on DI or SS that you think provides the best alternative approach for estimating the impact of B on L. Focus your discussion on the identification strategy