Answered step by step

Verified Expert Solution

Question

1 Approved Answer

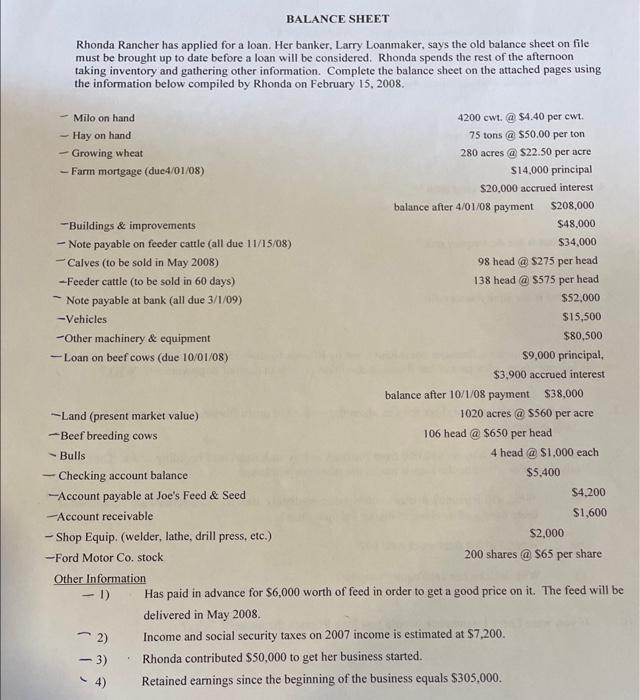

BALANCE SHEET Rhonda Rancher has applied for a loan. Her banker, Larry Loanmaker, says the old balance sheet on file must be brought up

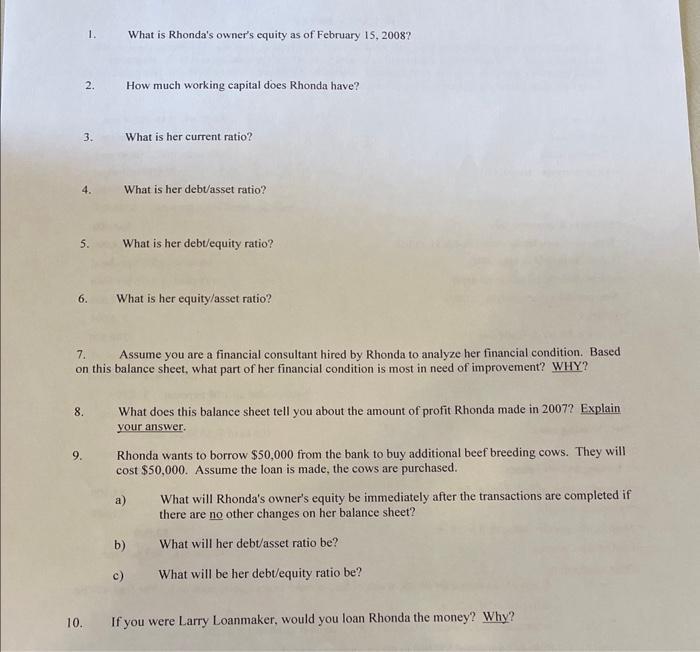

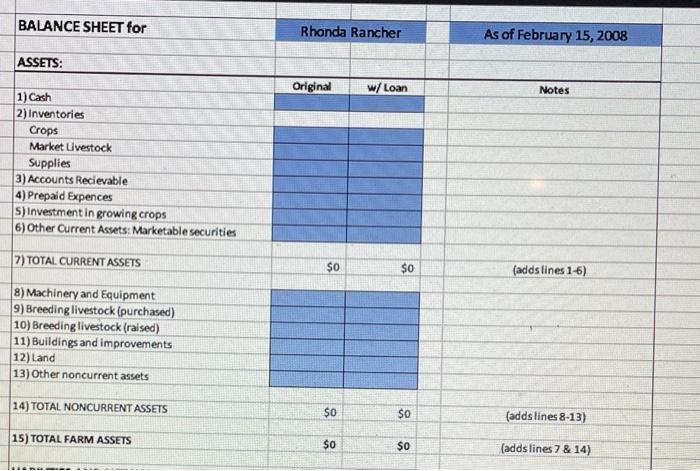

BALANCE SHEET Rhonda Rancher has applied for a loan. Her banker, Larry Loanmaker, says the old balance sheet on file must be brought up to date before a loan will be considered. Rhonda spends the rest of the afternoon taking inventory and gathering other information. Complete the balance sheet on the attached pages using the information below compiled by Rhonda on February 15, 2008. Milo on hand Hay on hand -Growing wheat - Farm mortgage (due4/01/08) -Buildings & improvements - Note payable on feeder cattle (all due 11/15/08) -Calves (to be sold in May 2008) -Feeder cattle (to be sold in 60 days) Note payable at bank (all due 3/1/09) -Vehicles -Other machinery & equipment -Loan on beef cows (due 10/01/08) - -Land (present market value) -Beef breeding cows - Bulls Checking account balance -Account payable at Joe's Feed & Seed -Account receivable -Shop Equip. (welder, lathe, drill press, etc.) -Ford Motor Co. stock Other Information 1. 2. 8. 3. 4. 10. What is Rhonda's owner's equity as of February 15, 2008? How much working capital does Rhonda have? What is her current ratio? What is her debu/asset ratio? What is her debt/equity ratio? 7. Assume you are a financial consultant hired by Rhonda to analyze her financial condition. Based on this balance sheet, what part of her financial condition is most in need of improvement? WHY? What is her equity/asset ratio? What does this balance sheet tell you about the amount of profit Rhonda made in 2007? Explain your answer. c) Rhonda wants to borrow $50,000 from the bank to buy additional beef breeding cows. They will cost $50,000. Assume the loan is made, the cows are purchased. a) b) What will Rhonda's owner's equity be immediately after the transactions are completed if there are no other changes on her balance sheet? What will her debt/asset ratio be? What will be her debt/equity ratio be? If you were Larry Loanmaker, would you loan Rhonda the money? Why? BALANCE SHEET for ASSETS: 1) Cash 2) Inventories Crops Market Livestock Supplies 3) Accounts Recievable 4) Prepaid Expences 5) Investment in growing crops 6) Other Current Assets: Marketable securities 7) TOTAL CURRENT ASSETS 8) Machinery and Equipment 9) Breeding livestock (purchased) 10) Breeding livestock (raised) 11) Buildings and improvements 12) Land 13) Other noncurrent assets 14) TOTAL NONCURRENT ASSETS 15) TOTAL FARM ASSETS Rhonda Rancher Original $0 $0 $0 w/ Loan $0 $0 $0 As of February 15, 2008 Notes (adds lines 1-6) (adds lines 8-13) (adds lines 7 & 14)

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To solve these questions well need to analyze Rhondas financial information provided in the first image and calculate various financial ratios and amo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started