Question: solve the following question The cash flow plan associated with a debt finance ing transaction allowed a company to receive $2,800,000 now in lieu of

solve the following question

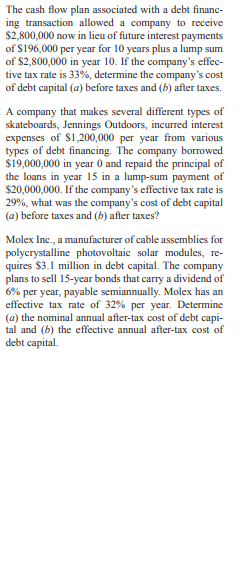

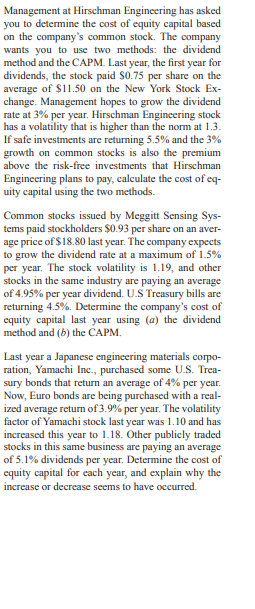

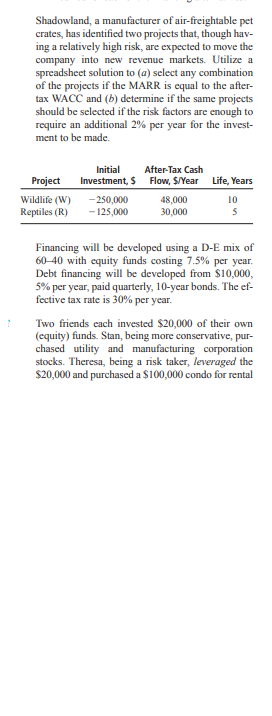

The cash flow plan associated with a debt finance ing transaction allowed a company to receive $2,800,000 now in lieu of future interest payments of $196,000 per year for 10 years plus a lump sum of $2,800,000 in year 10. If the company's effect live tax rate is 33%, determine the company's cost of debt capital (a) before taxes and (b) after taxes. A company that makes several different types of skateboards, Jennings Outdoors, incurred interest expenses of $1,200,000 per year from various types of debt financing. The company borrowed $19,000,000 in year 0 and repaid the principal of the loans in year 15 in a lump-sum payment of $20,000,000. If the company's effective tax rate is 29%, what was the company's cost of debt capital (a) before taxes and (b) after taxes? Molex Inc., a manufacturer of cable assemblies for polycrystalline photovoltaic solar modules, re- quires $3.1 million in debt capital. The company plans to sell 15-year bonds that carry a dividend of 6% per year, payable semiannually. Molex has an effective tax rate of 32% per year. Determine (a) the nominal annual after-tax cost of debt capi- tal and (b) the effective annual after-tax cost of debt capital.Management at Hirschman Engineering has asked you to determine the cost of equity capital based on the company's common stock. The company wants you to use two methods: the dividend method and the CAPM. Last year, the first year for dividends, the stock paid $0.75 per share on the average of $11.50 on the New York Stock Ex- change. Management hopes to grow the dividend rate at 3% per year. Hirschman Engineering stock has a volatility that is higher than the norm at 1.3. If safe investments are returning 5.5% and the 3% growth on common stocks is also the premium above the risk-free investments that Hirschman Engineering plans to pay, calculate the cost of cq- uity capital using the two methods. Common stocks issued by Meggitt Sensing Sys- tems paid stockholders $0.93 per share on an aver- age price of $18.80 last year. The company expects to grow the dividend rate at a maximum of 1.5% per year. The stock volatility is 1.19, and other stocks in the same industry are paying an average of 4.95% per year dividend. U.S Treasury bills are returning 4.5%. Determine the company's cost of equity capital last year using (a) the dividend method and (b) the CAPM. Last year a Japanese engineering materials corpo- ration, Yamachi Inc., purchased some U.S. Trea- sury bonds that return an average of 4% per year. Now, Euro bonds are being purchased with a real- ized average return of 3.9% per year. The volatility factor of Yamachi stock last year was 1. 10 and has increased this year to 1.18. Other publicly traded stocks in this same business are paying an average of 5.1% dividends per year. Determine the cost of equity capital for each year, and explain why the increase or decrease seems to have occurred.A project to extend irrigation canals into an area that was recently cleared of mesquite trees (a nui- sance tree in Texas) and large weeds is projected to have a capital cost of $2,000,000. Annual mainte- nance and operation costs will be $100,000 per year. Annual favorable consequences to the gen- cral public of $820,000 per year will be offset to some extent by annual adverse consequences of $400,000 to a portion of the general public. If the project is assumed to have a 20-year life, what is the B/C ratio at an interest rate of 8% per year? Calculate the B/C ratio for the following cash flow estimates at a discount rate of 7% per year. tem Cash Flow FW of benefits, $ 30,800,000 AW of disbenefits, $ per year 105,000 First cost, $ 1,200,000 M&O costs, $ per year 400,000 Life of project, years 20 The benefits associated with a nuclear power plant cooling water filtration project located on the Ohio River are $10,000 per year forever, starting in year 1. The costs are $50,000 in year 0 and $50,000 at the end of year 2. Calculate the B/C ratio at i = 10% per year.Shadowland, a manufacturer of air-freightable pet crates, has identified two projects that, though hav- ing a relatively high risk, are expected to move the company into new revenue markets. Utilize a spreadsheet solution to (a) select any combination of the projects if the MARR is equal to the after- tax WACC and (b) determine if the same projects should be selected if the risk factors are enough to require an additional 2% per year for the invest- ment to be made. Initial After-Tax Cash Project Investment, $ Flow, $/Year Life, Years Wildlife (W) -250,000 48,000 10 Reptiles (R) -125,000 30,000 Financing will be developed using a D-E mix of 60-40 with equity funds costing 7.5% per year. Debt financing will be developed from $10,000, 5% per year, paid quarterly, 10-year bonds. The ef- fective tax rate is 30% per year. Two friends each invested $20,000 of their own (equity) funds. Stan, being more conservative, pur- chased utility and manufacturing corporation stocks. Theresa, being a risk taker, leveraged the $20,000 and purchased a $100,000 condo for rentalMedzyme Pharmaceuticals has maintained a 50-50 D-E mix for capital investments. Equity capital has cost 11%; however, debt capital that histori- cally cost 9% has now increased by 20% per year. If Medzyme does not want to exceed its historical weighted average cost of capital (WACC), and it is forced to go to a D-E mix of 75-25, the maximum acceptable cost of equity capital is closest to: (a) 7.6% (6) 9.2% (c) 9.8% (d) 10.9% The importance values (0 to 100) for five attributes are shown below. The weight to assign to attribute 1 is: (a) 0.16 (6) 0.20 (c) 0.22 (d) 0.25 Attribute Importance Score 55 45 85 30 60Find the cumulative distribution function of the random variable Win Exercise 3.8. Using A(w), find (@) P(W = 0); (b) P(-1 s W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts