Solve the following questions

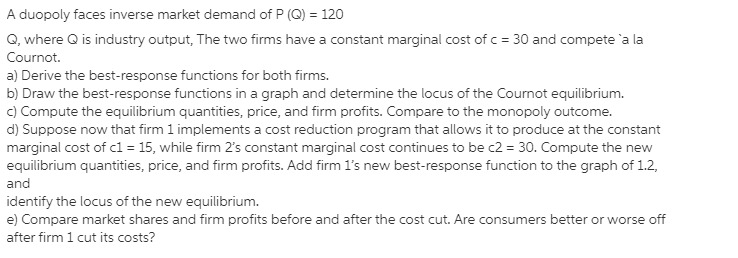

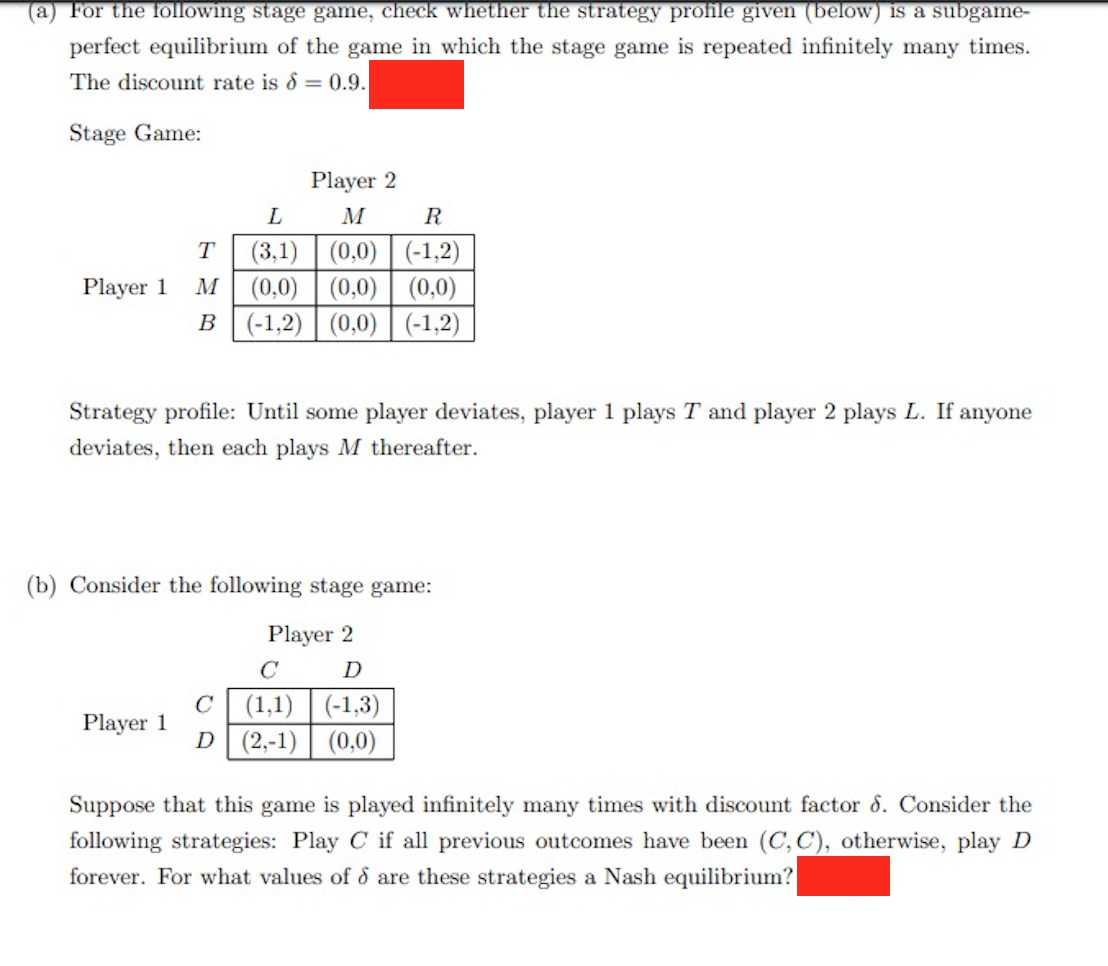

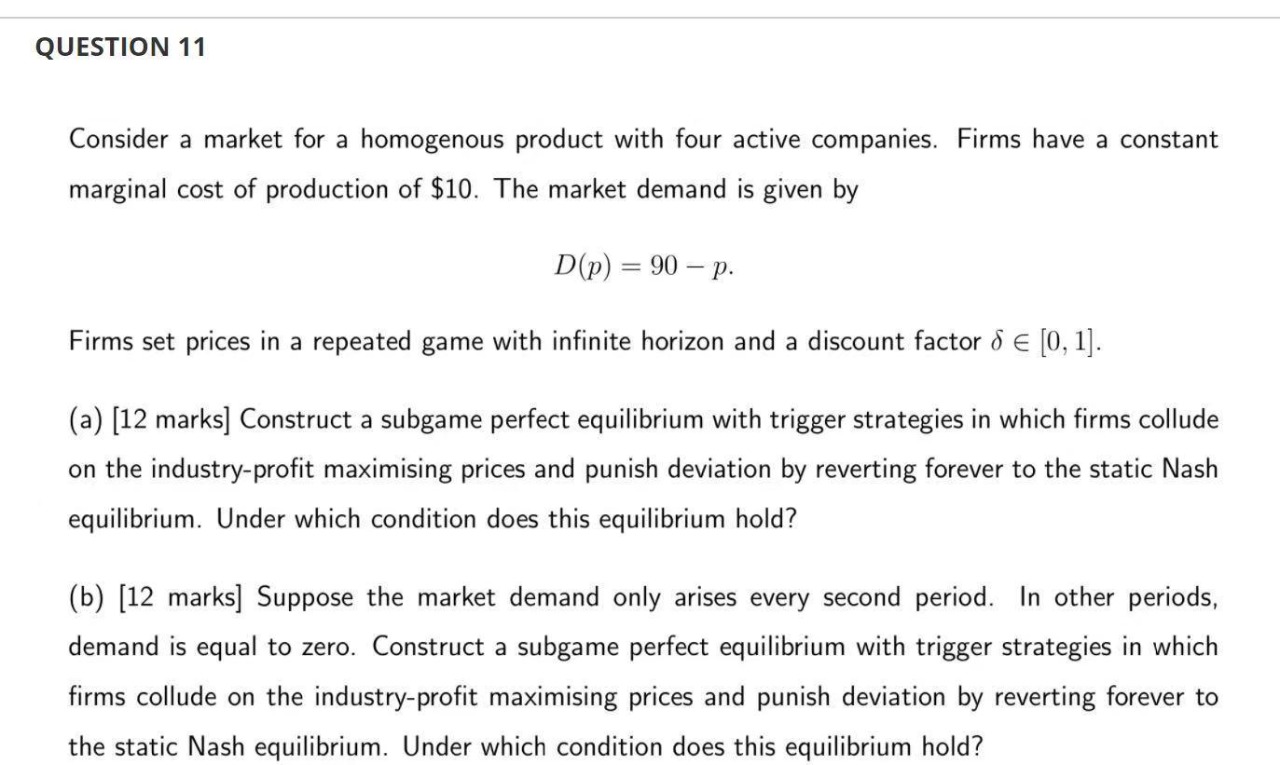

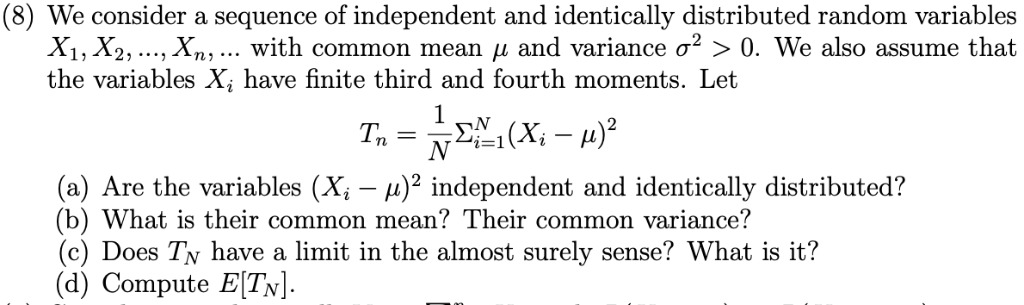

A duopoly faces inverse market demand of P (Q) = 120 Q, where Q is industry output, The two firms have a constant marginal cost of c = 30 and compete 'a la Cournot. a) Derive the best-response functions for both firms. b) Draw the best-response functions in a graph and determine the locus of the Cournot equilibrium. c) Compute the equilibrium quantities, price, and firm profits. Compare to the monopoly outcome. d) Suppose now that firm 1 implements a cost reduction program that allows it to produce at the constant marginal cost of cl = 15, while firm 2's constant marginal cost continues to be c2 = 30. Compute the new equilibrium quantities, price, and firm profits. Add firm 1's new best-response function to the graph of 1.2, and identify the locus of the new equilibrium. e) Compare market shares and firm profits before and after the cost cut. Are consumers better or worse off after firm 1 cut its costs?(a) For the following stage game, check whether the strategy profile given (below) is a subgame- perfect equilibrium of the game in which the stage game is repeated infinitely many times. The discount rate is 6 = 0.9. Stage Game: Player 2 M R T (3,1) (0,0 (-1,2 Player 1 M (0,0) (0,0) (0,0) B (-1,2) (0,0) (-1,2) Strategy profile: Until some player deviates, player 1 plays T and player 2 plays L. If anyone deviates, then each plays M thereafter. (b) Consider the following stage game: Player 2 C D (1,1) (-1,3) Player 1 C D (2,-1) (0,0) Suppose that this game is played infinitely many times with discount factor 6. Consider the following strategies: Play C if all previous outcomes have been (C, C), otherwise, play D forever. For what values of o are these strategies a Nash equilibrium?QUESTION 11 Consider a market for a homogenous product with four active companies. Firms have a constant marginal cost of production of $10. The market demand is given by D(p) =90p. Firms set prices in a repeated game with infinite horizon and a discount factor 6 6 [0,1]. (3) [12 marks] Construct a subgame perfect equilibrium with trigger strategies in which firms collude on the industry-profit maximising prices and punish deviation by reverting forever to the static Nash equilibrium. Under which condition doe this equilibrium hold? (b) [12 marks] Suppose the market demand only arises every second period. In other periods, demand is equal to zero. Construct a subgame perfect equilibrium with trigger strategies in which firms collude on the industryprofit maximising prices and punish deviation by reverting forever to the static Nash equilibrium. Under which condition does this equilibrium hold? (8) We consider a sequence of independent and identically distributed random variables X1,X2, ...,Xm with common mean u and variance 02 > 0. We also assume that the variables X;- have nite third and fourth moments. Let 1 Tn = ziixi _ W2 (a) Are the variables (X1: 11.)2 independent and identically distributed? (b) What is their common mean? Their common variance? (c) Does TN have a limit in the almost surely sense? What is it? ((1) Compute E[TN]. _ _. . m