Answered step by step

Verified Expert Solution

Question

1 Approved Answer

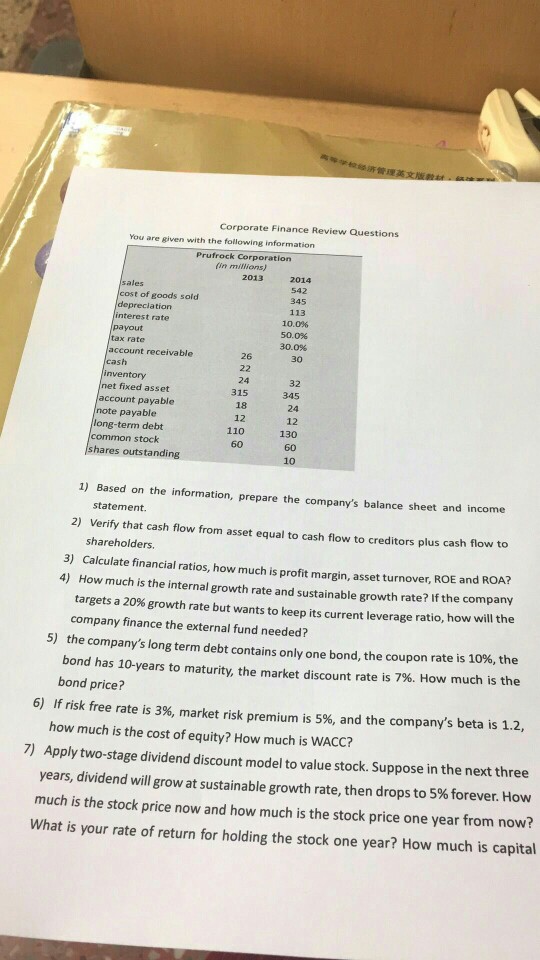

solve the following questions Corporate Finance Review Questions You are given with the following information Prufrock Corporation fin millions) 20132014 tof goods sold 345 113

solve the following questions

Corporate Finance Review Questions You are given with the following information Prufrock Corporation fin millions) 20132014 tof goods sold 345 113 10.0% 50.0% 30.0% 30 t rate 26 sh 32 net fixed asset 315 18 12 110 60 t payable payable 24 12 130 60 long-term debt stock shares outstanding 1) Based on the information, prepare the company's balance sheet and income statement. 2) Verify that cash flow from asset equal to cash flow to creditors plus cash flow to shareholders. Calculate financial ratios, how much is profit margin, asset turnover, ROE and ROA? How much is the internal growth rate and sustainable growth rate? If the company targets a 20% growth rate but wants to keep its current leverage ratio, how will the 3) 4) company finance the external fund needed? 5) the company's long term debt contains only one bond, the coupon rate is 10%, the bond has 10-years to maturity, the market discount rate is 7%. How much is the bond pricei 6) If risk free rate is 3%, market risk premium is 5%, and the company's beta is 1.2, how much is the cost of equity? How much is WACC? 7) Apply two-stage dividend discount model to value stock. Suppose in the next three years, dividend will grow at sustainable growth rate, then drops to 5% forever. How much is the stock price now and how much is the stock price one year from now? What is your rate of return for holding the stock one year? How much is capitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started