Answered step by step

Verified Expert Solution

Question

1 Approved Answer

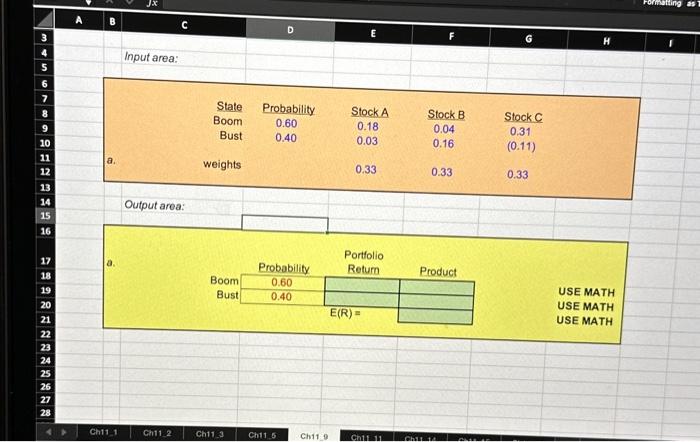

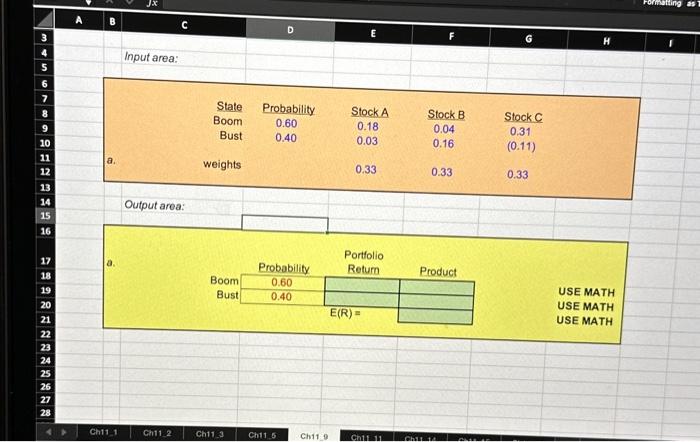

solve the following using excel (please include formulas) Output area: USE MATH USE MATH USE MATH Question (9 a). Returns and Standard Deviations (only a)

solve the following using excel (please include formulas)

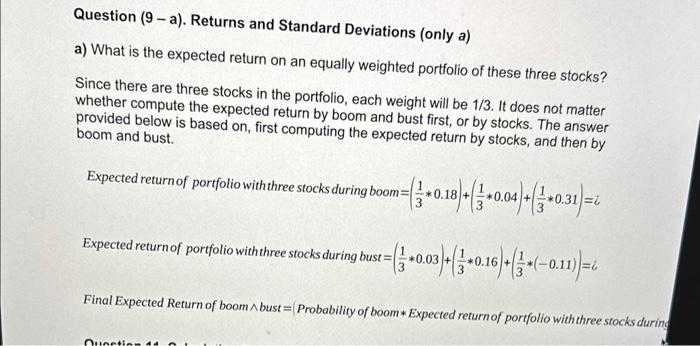

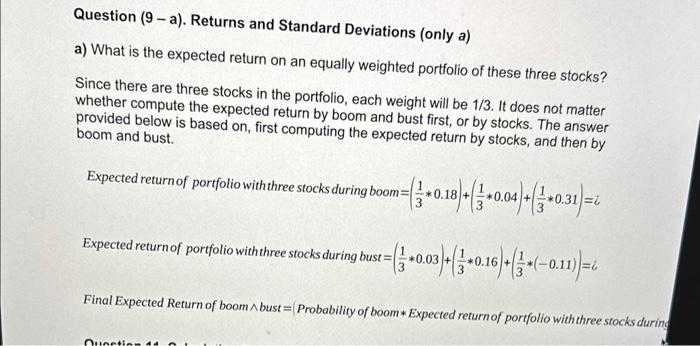

Output area: USE MATH USE MATH USE MATH Question (9 a). Returns and Standard Deviations (only a) a) What is the expected return on an equally weighted portfolio of these three stocks? Since there are three stocks in the portfolio, each weight will be 1/3. It does not matter whether compute the expected return by boom and bust first, or by stocks. The answer provided below is based on, first computing the expected return by stocks, and then by boom and bust. Expected return of portfolio with three stocks during boom =(310.18)+(310.04)+(310.31)=i Expected return of portfolio with three stocks during bust =(310.03)+(310.16)+(31(0.11))=i Final Expected Return of boom bust = Probability of boom Expected return of portfolio with three stocks during

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started