solve the question

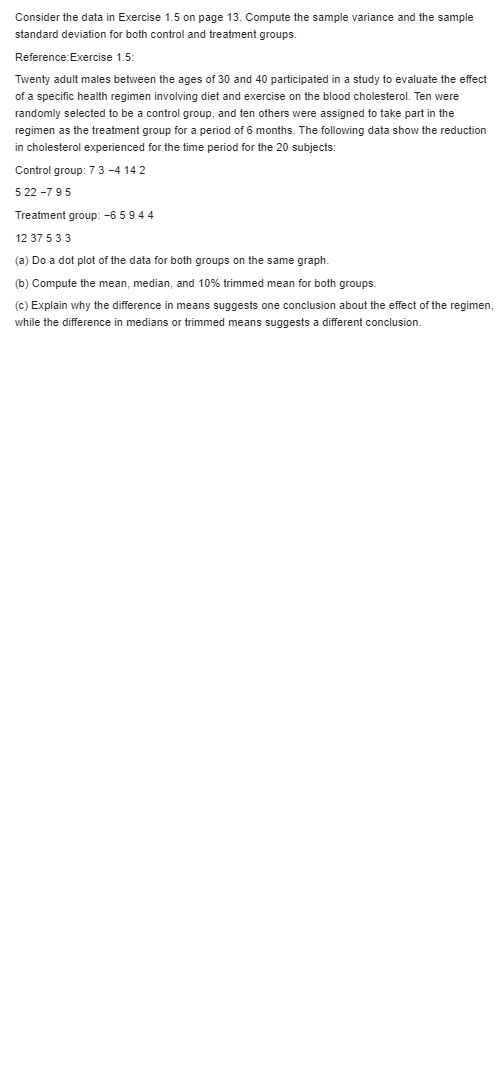

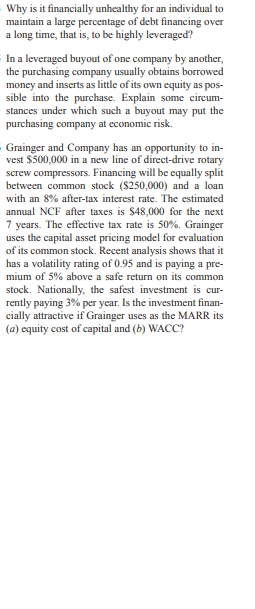

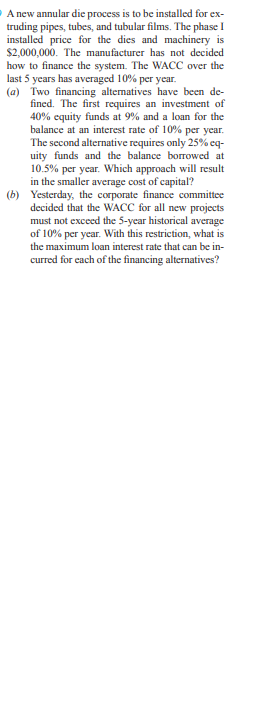

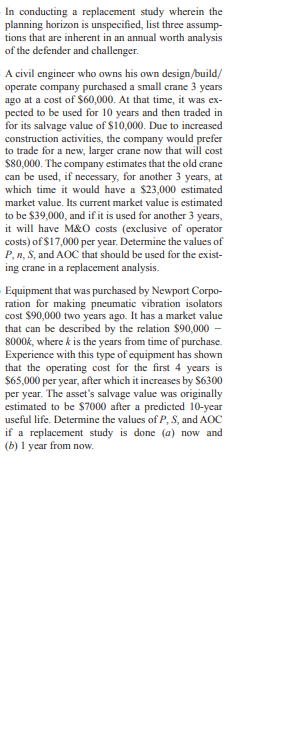

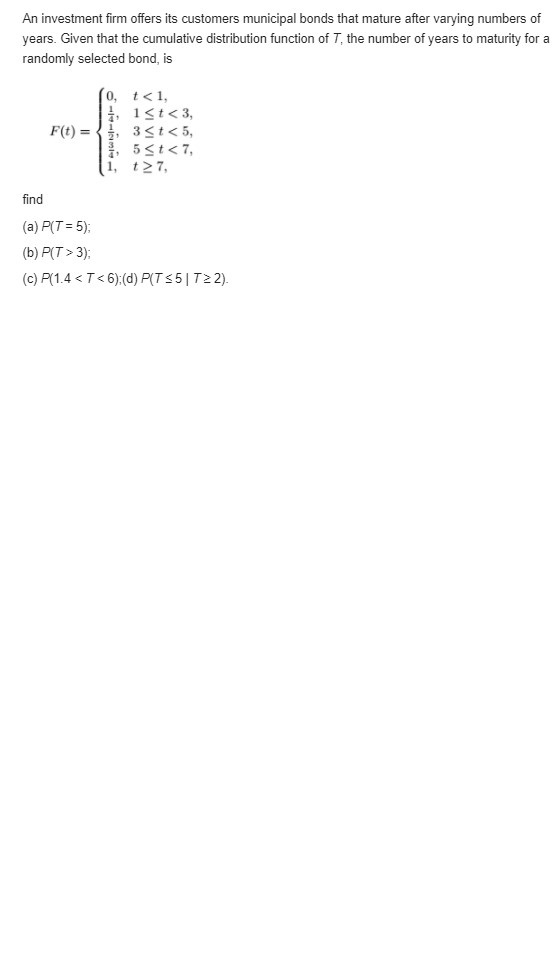

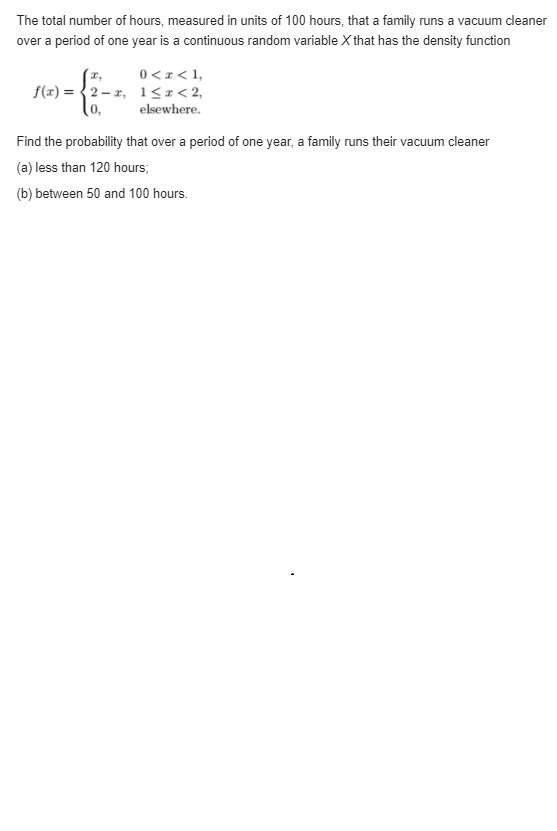

Consider the data in Exercise 1.5 on page 13. Compute the sample variance and the sample standard deviation for both control and treatment groups. Reference Exercise 1.5: Twenty adult males between the ages of 30 and 40 participated in a study to evaluate the effect of a specific health regimen involving diet and exercise on the blood cholesterol. Ten were randomly selected to be a control group, and ten others were assigned to take part in the regimen as the treatment group for a period of 6 months. The following data show the reduction in cholesterol experienced for the time period for the 20 subjects: Control group: 7 3 -4 14 2 522 -7 95 Treatment group: -6 5 9 4 4 12 37 5 3 3 (a) Do a dot plot of the data for both groups on the same graph. (b) Compute the mean, median, and 10% trimmed mean for both groups. (c) Explain why the difference in means suggests one conclusion about the effect of the regimen, while the difference in medians or trimmed means suggests a different conclusion.Why is it financially unhealthy for an individual to maintain a large percentage of debt financing over a long time, that is, to be highly leveraged? In a leveraged buyout of one company by another, the purchasing company usually obtains borrowed money and inserts as little of its own equity as pos- sible into the purchase. Explain some circum- stances under which such a buyout may put the purchasing company at economic risk. Grainger and Company has an opportunity to in- vest $500,000 in a new line of direct-drive rotary screw compressors. Financing will be equally split between common stock ($250,000) and a loan with an 8% after-tax interest rate. The estimated annual NCF after taxes is $48,000 for the next 7 years. The effective tax rate is 50%. Grainger uses the capital asset pricing model for evaluation of its common stock. Recent analysis shows that it has a volatility rating of 0.95 and is paying a pre- mium of 5% above a safe return on its common stock. Nationally, the safest investment is cur- rently paying 3% per year. Is the investment finan- cially attractive if Grainger uses as the MARR its (a) equity cost of capital and (b) WACC?A new annular die process is to be installed for ex- truding pipes, tubes, and tubular films. The phase I installed price for the dies and machinery is $2,000,000. The manufacturer has not decided how to finance the system. The WACC over the last 5 years has averaged 10% per year. (a) Two financing alternatives have been de- fined. The first requires an investment of 40% equity funds at 9% and a loan for the balance at an interest rate of 10% per year. The second alternative requires only 25% cq- uity funds and the balance borrowed at 10.5% per year. Which approach will result in the smaller average cost of capital? (b) Yesterday, the corporate finance committee decided that the WACC for all new projects must not exceed the 5-year historical average of 10% per year. With this restriction, what is the maximum loan interest rate that can be in- curred for each of the financing alternatives?In conducting a replacement study wherein the planning horizon is unspecified, list three assump- tions that are inherent in an annual worth analysis of the defender and challenger. A civil engineer who owns his own design/build/ operate company purchased a small crane 3 years ago at a cost of $60,000. At that time, it was ex- pected to be used for 10 years and then traded in for its salvage value of $10,000. Due to increased construction activities, the company would prefer to trade for a new, larger crane now that will cost $80,000. The company estimates that the old crane can be used, if necessary, for another 3 years, at which time it would have a $23,000 estimated market value. Its current market value is estimated to be $39,000, and if it is used for another 3 years, it will have M&O costs (exclusive of operator costs) of $17,000 per year. Determine the values of P, n, S, and AOC that should be used for the exist- ing crane in a replacement analysis. Equipment that was purchased by Newport Corpo- ration for making pneumatic vibration isolators cost $90,000 two years ago. It has a market value that can be described by the relation $90,000 - 8000k, where & is the years from time of purchase. Experience with this type of equipment has shown that the operating cost for the first 4 years is $65,000 per year, after which it increases by $6300 per year. The asset's salvage value was originally estimated to be $7000 after a predicted 10-year useful life. Determine the values of P, S, and AOC if a replacement study is done (a) now and (b) 1 year from now.Construct a graph of the cumulative distribution function of Exercise 3. 15. Reference: Exercise 3. 15: Find the cumulative distribution function of the random variable X representing the number of defectives in Exercise 3.11. Then using F(x), find (a) P(X = 1); (b) P(0 3); (c) P(1.4 2).The total number of hours, measured in units of 100 hours, that a family runs a vacuum cleaner over a period of one year is a continuous random variable X that has the density function 0<: f o elsewhere. find the probability that over a period of one year family runs their vacuum cleaner less than hours between and hours.an alternative with an infinite life has b ratio benefits per annual maintenance costs year. first cost at interest rate is closest to: cost-effectiveness analysis differs from cost-benefit in that: cea cannot handle multiple alternatives. expresses outcomes natural units rather currency units. independent more time-consuming resource- intensive. several private colleges claim to have programs are very effective teaching enrollees how become entrepreneurs. two identi- fied as program x y produced persons respectively who were recognized if total respec- tively incremental>