solve the question

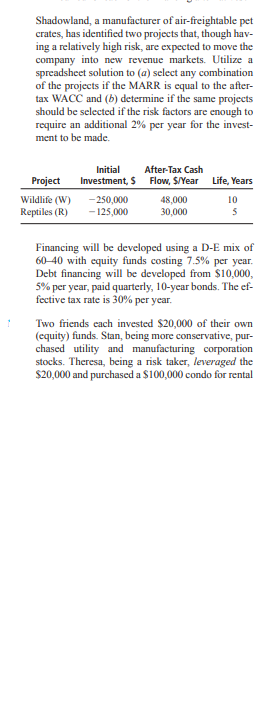

If an alternative has a salvage value, how is it han- dled in the calculation of a B/C ratio relative to benefits, disbenefits, costs, or savings? The cost of grading and spreading gravel on a short rural road is expected to be $300,000. The road will have to be maintained at a cost of $25,000 per year. Even though the new road is not very smooth, it allows access to an area that previously could only be reached with off-road vehicles. The improved accessibility has led to a 150% increase in the property values along the road. If the previ- ous market value of a property was $900,000, calculate the B/C ratio using an interest rate of 6% per year and a 20-year study period. Arsenic enters drinking water supplies from natu- ral deposits in the earth or from agricultural and industrial practices. Since it has been linked to cancer of the bladder, kidney, and other internal organs, the EPA has lowered the arsenic standard for drinking water from 0.050 parts per million to 0.010 parts per million (10 parts per billion). The annual cost to public water utilities to meet the new standard is estimated to be $200 per house- hold. If it is estimated that there are 90 million households in the United States and that the lower standard can save 50 lives per year valued at $4,000,000 per life, what is the benefit/cost ratio of the regulation?Twenty adult males between the ages of 30 and 40 participated in a study to evaluate the effect of a specific health regimen involving diet and exercise on the blood cholesterol. Ten were randomly selected to be a control group, and ten others were assigned to take part in the regimen as the treatment group for a period of 6 months. The following data show the reduction in cholesterol experienced for the time period for the 20 subjects: Control group: 7 3 -4 14 2 522 -795 Treatment group: -6 5 9 4 4 12 37 5 3 3 (a) Do a dot plot of the data for both groups on the same graph. (b) Compute the mean, median, and 10% trimmed mean for both groups. (c) Explain why the difference in means suggests one conclusion about the effect of the regimen while the difference in medians or trimmed means suggests a different conclusion.A project to extend irrigation canals into an area that was recently cleared of mesquite trees (a nui- sance tree in Texas) and large weeds is projected to have a capital cost of $2,000,000. Annual mainte- nance and operation costs will be $100,000 per year. Annual favorable consequences to the gen- cral public of $820,000 per year will be offset to some extent by annual adverse consequences of $400,000 to a portion of the general public. If the project is assumed to have a 20-year life, what is the B/C ratio at an interest rate of 8% per year? Calculate the B/C ratio for the following cash flow estimates at a discount rate of 7% per year. tem Cash Flow FW of benefits, $ 30,800,000 AW of disbenefits, $ per year 105,000 First cost, $ 1,200,000 M&O costs, $ per year 400,000 Life of project, years 20 The benefits associated with a nuclear power plant cooling water filtration project located on the Ohio River are $10,000 per year forever, starting in year 1. The costs are $50,000 in year 0 and $50,000 at the end of year 2. Calculate the B/C ratio at i = 10% per year.Shadowland, a manufacturer of air-freightable pet crates, has identified two projects that, though hav- ing a relatively high risk, are expected to move the company into new revenue markets. Utilize a spreadsheet solution to (a) select any combination of the projects if the MARR is equal to the after- tax WACC and (b) determine if the same projects should be selected if the risk factors are enough to require an additional 2% per year for the invest- ment to be made. Initial After-Tax Cash Project Investment, $ Flow, $/Year Life, Years Wildlife (W) -250,000 48,000 10 Reptiles (R) -125,000 30,000 Financing will be developed using a D-E mix of 60-40 with equity funds costing 7.5% per year. Debt financing will be developed from $10,000, 5% per year, paid quarterly, 10-year bonds. The ef- fective tax rate is 30% per year. Two friends each invested $20,000 of their own (equity) funds. Stan, being more conservative, pur- chased utility and manufacturing corporation stocks. Theresa, being a risk taker, leveraged the $20,000 and purchased a $100,000 condo for rentalIn conducting a replacement study wherein the planning horizon is unspecified, list three assump- tions that are inherent in an annual worth analysis of the defender and challenger. A civil engineer who owns his own design/build/ operate company purchased a small crane 3 years ago at a cost of $60,000. At that time, it was ex- pected to be used for 10 years and then traded in for its salvage value of $10,000. Due to increased construction activities, the company would prefer to trade for a new, larger crane now that will cost $80,000. The company estimates that the old crane can be used, if necessary, for another 3 years, at which time it would have a $23,000 estimated market value. Its current market value is estimated to be $39,000, and if it is used for another 3 years, it will have M&O costs (exclusive of operator costs) of $17,000 per year. Determine the values of P, n, S, and AOC that should be used for the exist- ing crane in a replacement analysis. Equipment that was purchased by Newport Corpo- ration for making pneumatic vibration isolators cost $90,000 two years ago. It has a market value that can be described by the relation $90,000 - 8000k, where & is the years from time of purchase. Experience with this type of equipment has shown that the operating cost for the first 4 years is $65,000 per year, after which it increases by $6300 per year. The asset's salvage value was originally estimated to be $7000 after a predicted 10-year useful life. Determine the values of P, S, and AOC if a replacement study is done (a) now and (b) 1 year from now.For the density function of Exercise 3.18, find F(x), and use it to evaluate P(3 s X